In today’s digital mortgage landscape, a website that doesn’t engage is a website that loses leads. One of the most effective engagement tools is a mortgage calculator—but not just any calculator. The best mortgage calculators are purpose-built to help specific client types understand their financing options and take immediate action.

At GetMortgageWebsite.com, we design calculators that not only compute accurate results but also capture leads, educate borrowers, and build trust instantly.

From first-time homebuyers to high-net-worth clients, our seven calculators speak directly to your audience’s needs—helping you close more deals faster.

Key Takeaways

- Each calculator is targeted for a specific borrower group, increasing conversion rates.

- All calculators integrate seamlessly with your CRM and lead forms.

- Built-in automation ensures every lead gets followed up quickly.

- Using calculators can boost website conversions by up to 40%.

- Fully responsive, secure, and optimized for search engines.

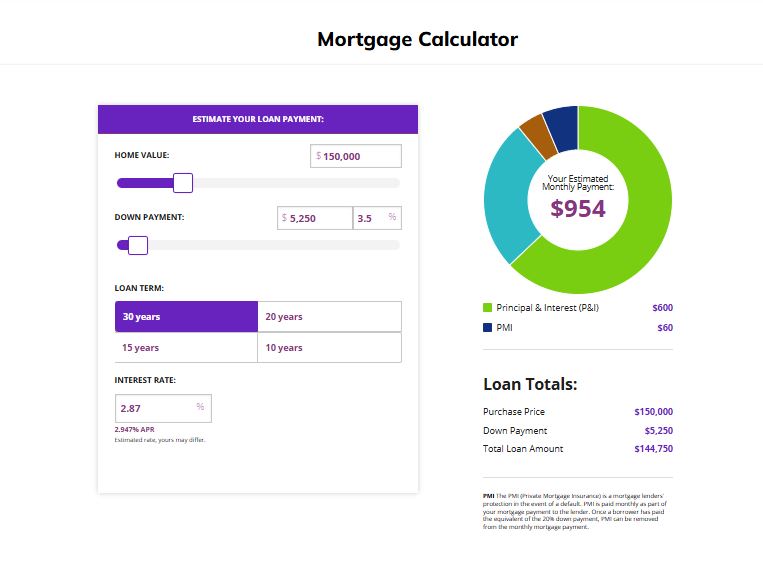

Conventional Loan Calculator

Designed For: Borrowers with good credit and a stable income who prefer traditional financing.

The Conventional Loan Calculator is ideal for clients who want predictable payments and flexible terms without government-backed restrictions. It’s a universal calculator for most buyers and refinancers.

Key Features:

- Customizable down payment, term, and rate inputs.

- Instant monthly payment results.

- Clear amortization charts and payoff timeline.

- Post-calculation lead capture option.

Why It Converts:

These are qualified, ready-to-act borrowers seeking clear loan estimates. By using the calculator, they signal genuine purchase intent.

VA Home Loan Calculator

Designed For: U.S veterans, active-duty service members, and eligible spouses.

Key Features:

- Automatically applies VA loan parameters.

- Calculates with or without funding fees.

- Option to include property tax and insurance.

- Veteran-specific eligibility messages.

Statistic: Over 2 million VA loans were issued in 2024 — a massive audience for loan officers specializing in veteran lending.

Why It Converts:

FHA Home Loan Calculator

Designed For:First-time homebuyers, lower-credit applicants, or clients with limited down payments.

The FHA Calculator is built for accessibility and confidence. It automatically includes MIP (Mortgage Insurance Premium) and lets users explore affordable loan options with smaller down payments.

Key Features:

- MIP and upfront insurance are included.

- Real-time affordability adjustments.

- Interactive payment comparison charts.

- Lead capture form for prequalification.

Why It Converts:

The FHA Calculator is built for accessibility and confidence. It automatically includes MIP (Mortgage Insurance Premium) and lets users explore affordable loan options with smaller down payments.

Ready to Capture, Educate, and Convert?

Get a fully branded, high-performing mortgage website with all seven calculators built-in. No plugins. No coding. Just results.

USDA Loan Home Calculator

Designed For:Rural and suburban homebuyers seeking zero-down loans under the USDA program.

Key Features:

- Location-based eligibility check.

- Built-in USDA Guarantee Fee calculation.

- Income verification tool.

- Simple, step-by-step user flow.

Why It Converts:

This calculator appeals to budget-conscious borrowers and first-time rural buyers, helping you reach untapped markets.

Affordability Calculator

Designed For: Early-stage homebuyers figuring out what they can afford.

Key Features:

- Real-time affordability insights.

- Income and expense sliders for ease of use.

- Lead form after results: “Want to see homes in your range?”

- Integrated with CRM for instant follow-up.

📈 Statistic: Websites featuring affordability tools see 50% higher engagement than those without.

Why It Converts:

Launch Your Website in Days, Not Months

Get a mortgage site built for California professionals, live in just 3–5 business days.

Jumbo Calculator

Designed For: General homebuyers and high-net-worth borrowers purchasing above conforming loan limits.

Key Features:

- Handles large loan amounts above FHFA limits.

- Adjustable-rate and interest-only support.

- Personalized messaging for high-income clie

Why It Converts:

Refinance Calculator

Designed For: Existing homeowners exploring lower rates or cash-out options.

Key Features:

- Side-by-side comparison of current vs. new payments.

- Visual savings graph and break-even analysis.

- Optional email capture to deliver results summary.

- Auto follow-up workflow via CRM.

Why It Converts:

Why These Are the Best Mortgage Calculators

- Audience-Specific: Each calculator serves a defined borrower segment for precision targeting.

- CRM-Integrated: Leads are captured, scored, and followed up automatically.

- Fast & Reliable: 90+ Google performance score ensures optimal UX.

- Fully Customizable: Match your brand, content, and workflow.

- All-Inclusive Platform: Hosting, SSL, updates, and daily backups included.

Frequently Asked Questions

How long does it take to build a mortgage website?

Typically, 3–5 business days with a professional platform.

Are these calculators for specific borrower types?

Yes. Each calculator serves a defined audience (e.g., VA for veterans, FHA for first-time buyers).

Do these calculators work on mobile?

Yes—they’re fully responsive and optimized for any screen.

Can I use my own domain and branding?

Yes. Your calculators are fully branded under your domain.

Do calculators integrate with CRM tools?

Yes—automatic lead capture and follow-up are included.

Are updates and support included?

Yes — 24/7 support and regular feature updates are standard.

What integrations are available?

Calculators, email tools, review platforms, social media, and more.

Can I test a demo before purchasing?

Definitely. Schedule a Live Demo to experience the tools in action.

Conclusion

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators