Let’s be real for a second: picking how to build your mortgage website can feel weirdly high-stakes. You don’t want to waste money. You don’t want something that looks cookie-cutter. And you definitely don’t want a site that loads slowly, feels outdated, or makes borrowers bounce before they ever talk to you.

So the big question is, should you use mortgage website templates or go fully custom?

Good news: there isn’t one “right” answer. There’s a right answer for you. Let’s find it.

Key Takeaways

- 🚀 Templates are faster to launch and easier on the budget.

- 🎨 Custom design is best when brand uniqueness and advanced features matter.

- 📱 Mobile speed and trust signals beat fancy design every time.

- 🔁 A hybrid approach is often the smartest long-term play.

- ✅ Your best choice depends on your business stage and goals.

What Mortgage Website Templates

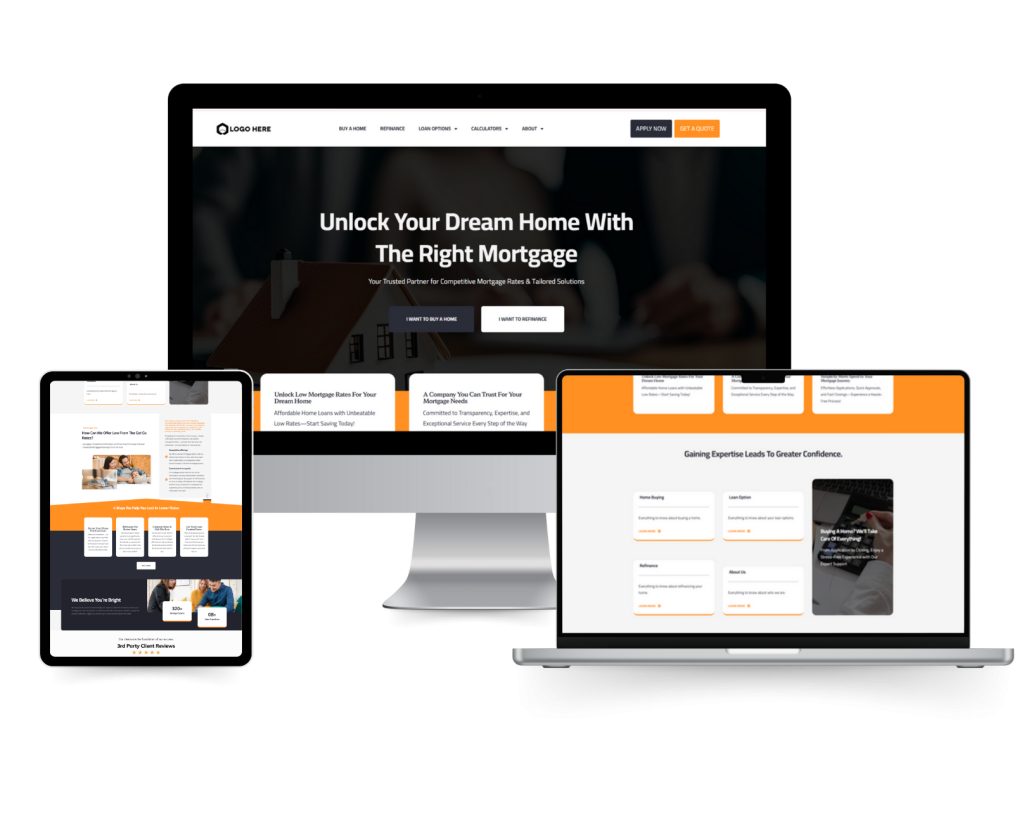

Mortgage website templates are pre-built website designs made for mortgage pros. You pick a layout, add your logo, colors, bio, and loan programs, and you’re live.

Think of templates like moving into a well-designed model home 🏡.

You can decorate, rearrange, and make it yours but the structure is already built.

What good mortgage templates usually include

- Clean homepage with strong CTAs

- Loan program pages (FHA, VA, Conventional, Jumbo, etc.)

- Lead capture forms

- Mortgage calculators

- Blog or news section

- Reviews/testimonials area

- Team or About pages

- Mobile-first design and fast loading

Why templates are so popular

Speed and simplicity.

You can go live in days instead of waiting months. For most loan officers and brokers, that’s a huge win.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

What custom mortgage websites

A custom site starts from scratch. Your designer and developer build everything around your exact brand, your audience, and your business workflow. Think of this like building your dream home from the ground up 🛠️. Unlimited freedom but it takes more time, planning, and budget.

What good mortgage templates usually include

- One-of-a-kind branding

- Unique layout and features

- Advanced integrations

- More control over the user journey

- Custom SEO structure for multiple markets

mortgage website development and why it matters more than looks

Here’s the part most people miss:

Mortgage website development isn’t about “pretty pages.”

It’s about building a website that works like a lead-generating machine.

No matter which route you choose, mortgage website development should include:

- Fast mobile performance 📱

Borrowers are on phones. If your site lags, they leave. - Clear loan program content 🧾

People want to understand options fast. - Trust signals everywhere ⭐

Reviews, NMLS info, photos, and real explanations. - Simple conversion paths 🧭

Every page should make the next step obvious: call, apply, or book. - Built-in lead capture 📨

Forms, calendars, chat, and automated follow-ups.

Which one is best for your situation

Most clients won’t need a new mortgage right away but they will still need mortgage-related insights, market updates, and homeowner advice.

Ideas for post-closing value:

- If you’re a newer LO or broker

Templates are usually best: you need trust fast, your niche may still change, and your budget is better spent on leads. A strong template site beats a slow custom build. - If you’re established and rebranding

Choose based on goal: templates for a quick modern refresh, custom if you want a bold, luxury or niche brand. - If you’re an IMB or scaling multi-branch

Custom makes sense for multi-location hubs, complex funnels, and advanced workflows — but many IMBs start with high-end templates and customize as they grow.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Are Mortgage Website Templates good for SEO?

Yes, especially if they’re mortgage-specific, fast, and structured well.

Will a template site look generic?

Only if you don’t customize it. With proper branding and content, templates look premium.

When should I choose custom design?

When you need deep uniqueness, advanced integrations, or multi-market scaling.

Can templates handle online applications?

Most mortgage platforms support 1003/MISMO integrations or strong pre-qual funnels.

What matters more design or speed?

Speed. Borrowers leave slow sites quickly, especially on mobile.

Can I start with a template and switch later?

Yes, and it’s a very smart growth strategy.

What pages should every mortgage site have?

Home, About, Loan Programs, Blog, Reviews, Contact, and a clear Apply or Book CTA.

How often should I update my site?

At least monthly with fresh content, reviews, or program updates.

Conclusion

In the end, it’s not about templates being “better” than custom or vice-versa; it’s about what fits your business right now. If you need a professional site to live quickly, with mortgage features already built in, templates are the smart, low-stress choice. If your brand depends on standing out in a big way or you’re scaling across multiple markets with complex needs, custom design can be worth the investment. And if you’re unsure, start with a strong template and grow into custom later. The real win is a fast, trustworthy, lead-generating website that makes borrowers feel confident choosing you.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators