If you’re a loan officer, mortgage broker, or lender in North Carolina, your website is no longer just an online business card; it’s your 24/7 digital loan officer. Borrowers today research lenders online long before they ever pick up the phone. That means your website must establish trust instantly, clearly explain its value, and make it easy for prospects to take the next step.

In this guide, we’ll break down what truly makes the best mortgage website design in North Carolina, what features matter most, how pricing works, and how to choose a platform that actually helps you close more loans, not just look good.

Key Takeaways

- Your mortgage website should be mobile-first, fast, and trust-focused

- Borrowers in North Carolina expect online applications and calculators

- SEO and local visibility are essential to compete in crowded markets

- Done-for-you mortgage websites often outperform DIY builders

- Clear pricing and fast setup can save weeks of frustration

Why Mortgage Website Design Matters in North Carolina

North Carolina is one of the fastest-growing states in the U.S. With population growth comes more lenders, more competition, and more informed borrowers. Whether you’re serving Charlotte, Raleigh, Durham, Greensboro, or smaller local markets, your website must stand out immediately.

Here’s what North Carolina borrowers expect:

- A professional, modern design

- Easy access to loan programs and calculators

- Mobile-friendly browsing on phones and tablets

- Fast load times and secure browsing (SSL)

- Clear ways to apply, call, text, or book appointments

- If your site feels outdated or confusing, visitors won’t wait—they’ll move on to the next lender.

Mortgage Website Design in North Carolina Generates Leads

A high-performing mortgage website design in North Carolina isn’t about flashy graphics—it’s about clarity, trust, and usability.

Essential Design Elements

- Clean layouts with clear messaging

- Simple navigation for loan programs and resources

- Strong call-to-action buttons (Apply Now, Get Pre-Approved, Schedule a Call)

- Local branding that feels relevant and personal

Mobile-First Is Non-Negotiable

Over 70% of mortgage website traffic now comes from mobile devices. A mobile-first design ensures:

- Buttons are easy to tap

- Forms are short and readable

- Pages load quickly even on slower connections

Google also ranks mobile-optimized sites higher, making this critical for SEO.

Ready to grow your mortgage business online?

Stop losing leads to competitors with better websites

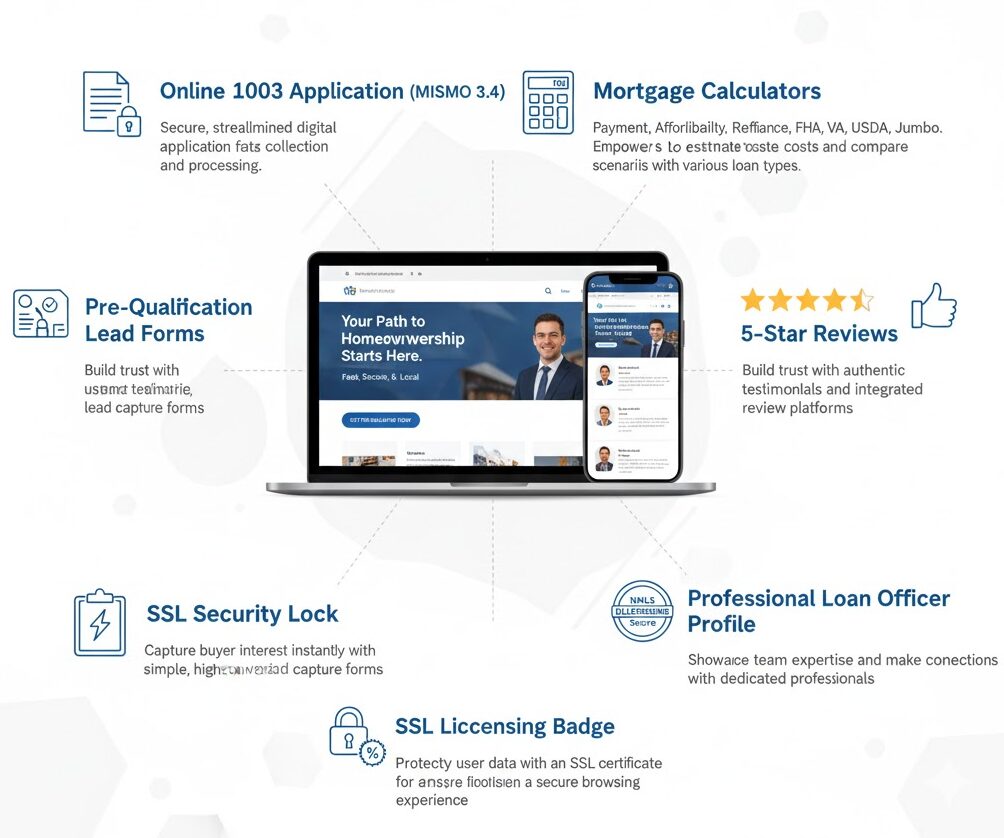

Must-Have Features for Mortgage Websites in North Carolina

Online Applications and Lead Capture

Your site should include:

- Online 1003 (MISMO 3.4) application forms

- Custom lead capture forms for different loan types

- Thank-you pages with booking or follow-up options

This allows borrowers to take action immediately, even outside business hours.

Mortgage Calculators

Borrowers love calculators. The most effective sites include:

- Mortgage payment calculator

- Affordability calculator

- Refinance calculator

- FHA, VA, USDA, and Jumbo calculators

These tools help keep visitors engaged for longer periods and increase conversion rates.

Reviews and Trust Signals

Trust is everything in mortgage lending. Your site should display:

- Google and Facebook reviews

- Licensing information

- Professional photos and bios

- SSL security indicators

Real Mortgage Website Examples

Example 1 Miami Mortgage Pros

Example 2

Focused on mobile-first design, this site loads in under 2 seconds and includes 7 mortgage calculators, blog updates, and a multilingual interface for Florida’s diverse audience.

How to Choose the Right Mortgage Website Partner

Before committing, ask:

Is the platform built specifically for mortgage professionals?

Does it include calculators and online applications?

Can it scale as my business grows?

Is SEO built into the structure?

How fast can my website go live?

The right partner saves you months of trial and error.

Launch Your Website in Days, Not Months

Get a mortgage site built for California professionals, live in just 3–5 business days.

Frequently Asked Questions

How long does it take to launch a mortgage website?

Most professional platforms launch within 3–5 business days after onboarding is completed.

Can I use my existing domain?

Yes, most platforms allow you to connect your current domain easily.

Do I need separate hosting?

No. Hosting, SSL, and backups are typically included.

Can I use my existing CRM?

Yes, most platforms integrate with top CRM tools like Salesforce, Jungo, or have built-in CRM systems.

How long does it take to launch?

You can have your site live in as little as 5 business days.

Can I customize the design?

Absolutely! Choose from prebuilt sections or build your own layout.

What integrations are available?

Calculators, email tools, review platforms, social media, and more.

What if I need support after launch?

An in-house support team is available to help with updates, edits, and guidance whenever you need it.

Conclusion

Your website is one of the most valuable assets in your mortgage business. A well-executed mortgage website design in North Carolina helps you build credibility, attract local borrowers, and convert visitors into qualified leads—around the clock.

Instead of struggling with generic website builders or outdated designs, investing in a modern, mortgage-specific website positions you as a trusted professional in a competitive market. When your website works for you 24/7, growth becomes far more predictable—and far less stressful.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators