Your mortgage website isn’t just an online brochure; it’s your 24/7 digital loan officer. When built correctly, it educates borrowers, builds trust, captures leads, and encourages prospects to take action even while you’re asleep.

Yet many mortgage professionals struggle with websites that look decent but don’t convert.

In this guide, we’ll break down exactly how to develop mortgage website platforms that are purpose-built for conversions, not just aesthetics. Whether you’re a loan officer, broker, or mortgage company owner, this article will show you how to turn traffic into applications

Key Takeaways

- Why conversion-focused design matters more than visual appeal alone

- The essential elements every high-converting mortgage website must include

- How trust, speed, and mobile optimization impact borrower decisions

- Step-by-step guidance to develop a mortgage website that generates leads

- Common mistakes that quietly kill conversions (and how to fix them)

Why Conversion-Focused Mortgage Websites Matter

Borrowers today are more informed, cautious, and impatient than ever. Before filling out a form or booking a call, they research:

- Your credibility

- Your loan programs

- Your reviews

- Your responsiveness

If your website doesn’t answer questions quickly or feel trustworthy, visitors leave—and they rarely come back.

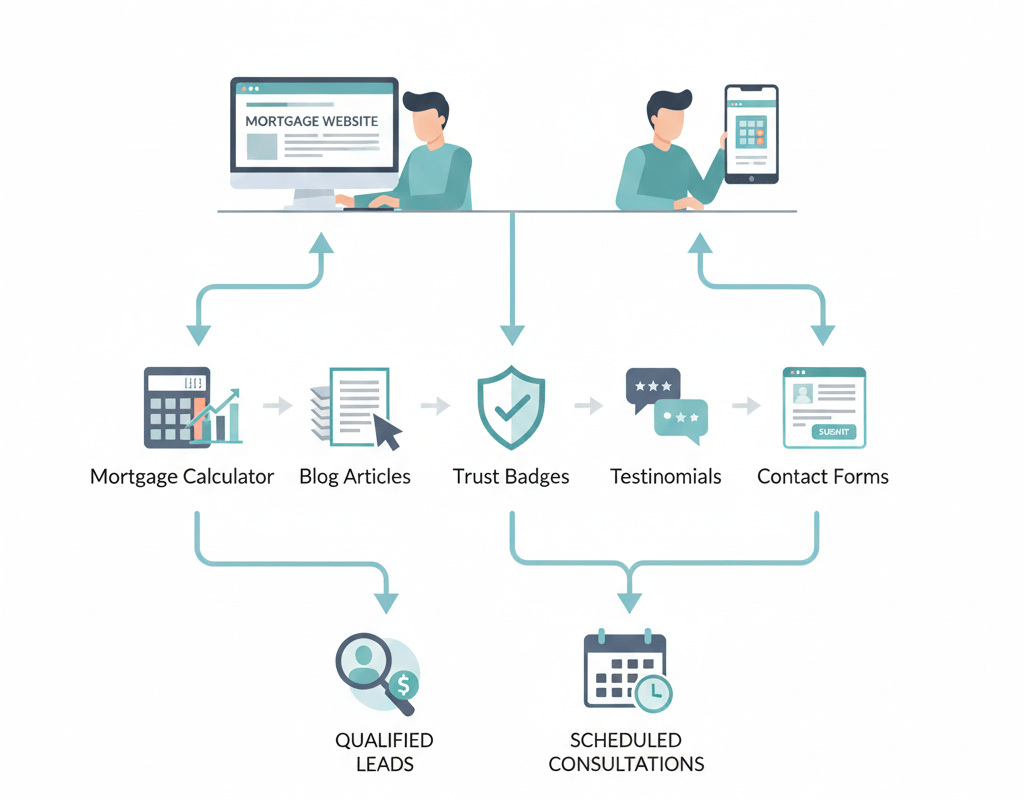

A conversion-focused mortgage website bridges the gap between interest and action by:

- Guiding users clearly

- Reducing friction

- Providing reassurance at every step

This is why modern lenders no longer ask, “Does my website look good?”

They ask, “Does my website convert?”

Develop Mortgage Website With Conversion Strategy First

When you Develop Mortgage Website projects, conversion should guide every decision—from layout to copy to integrations.

Start With Clear Goals

Before design begins, define your website’s primary objectives:

- Capture leads

- Book appointments

- Drive loan applications

- Educate borrowers

- Build referral partner trust

Every page should support at least one of these goals. Anything else is noise.

Design for User Flow, Not Just Beauty

High-converting mortgage websites follow intentional user paths:

- Homepage → Loan Program Page → Calculator → Lead Form

- Blog Article → Education Center → Consultation Booking

- Landing Page → Short Form → Automated Follow-Up

When users are unsure of what to do next, they often do nothing.

Essential Elements of a High-Converting Mortgage Website

Let’s break down the non-negotiables.

Clear Value Proposition Above the Fold

Within 5 seconds, visitors should understand:

- Who you help

- What you offer

- Why you different

This includes:

- A strong headline

- A short supporting statement

- One primary call-to-action

Avoid vague messaging. Be specific, borrower-focused, and confident.

Trust Signals That Remove Doubt

Mortgage decisions involve fear, risk, and long-term commitment. Your website must constantly reinforce trust.

Effective trust elements include:

- Client testimonials

- Google and Zillow review feeds

- Licensing and NMLS information

- Professional photos

- Secure SSL indicators

Trust isn’t built in one place—it’s built everywhere.

Mobile-First Design Is No Longer Optional

Over 70% of mortgage website traffic comes from mobile devices.

A conversion-ready mobile experience includes:

- Fast load speeds

- Thumb-friendly buttons

- Short, readable sections

- Click-to-call functionality

If users struggle to navigate or read on mobile, conversions collapse.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

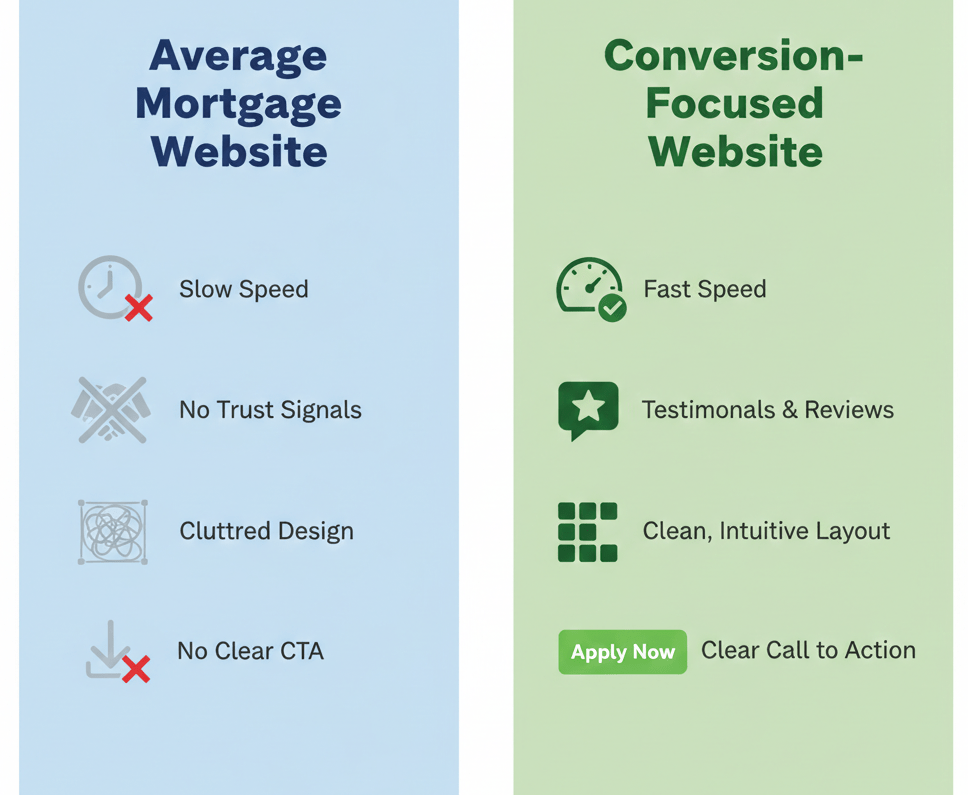

The Role of Speed and Performance in Conversions

Website speed directly impacts lead generation.

Slow websites cause:

- Higher bounce rates

- Lower form completions

- Reduced Google rankings

When you develop mortgage website platforms, performance optimization should include:

- Lightweight design

- Optimized images

- Clean code

- Reliable hosting

Even a 1-second delay can reduce conversions by double digits.

Forms That Convert Without Overwhelming

One of the biggest mistakes mortgage websites make is asking for too much, too soon.

Best Practices for Mortgage Lead Forms

- Start with short forms

- Ask only essential questions

- Use multi-step forms for longer data

- Clearly explain what happens next

Examples of high-converting form offers:

- Free mortgage consultation

- Payment estimate review

- First-time buyer guide

- Pre-qualification checklist

The goal is momentum—not interrogation.

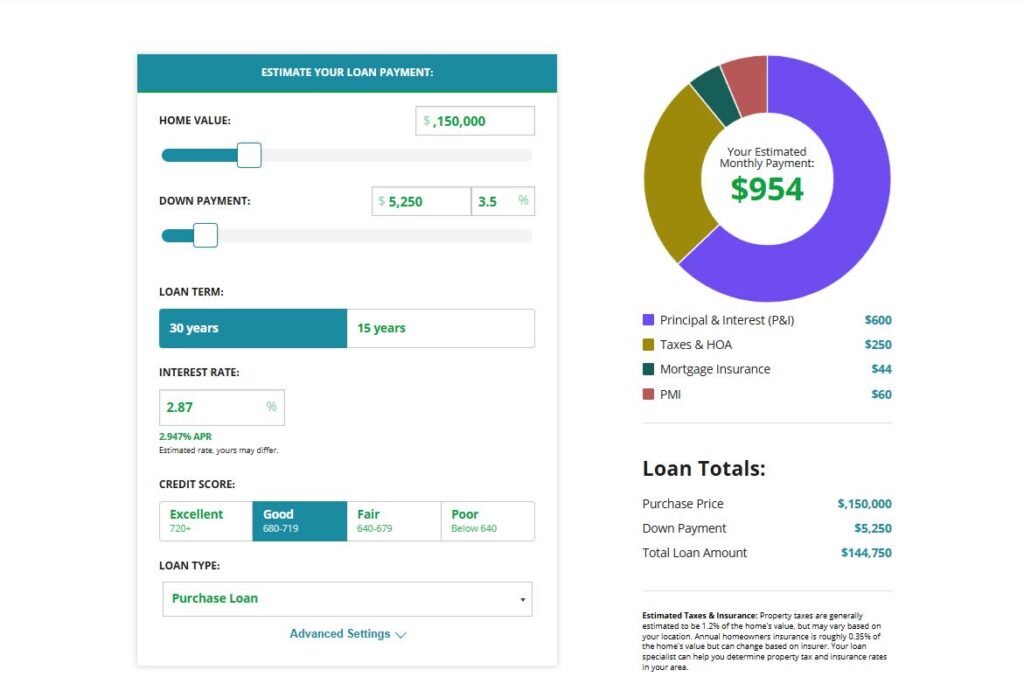

Mortgage Calculators as Conversion Tools

Mortgage calculators aren’t just helpful—they’re powerful conversion assets.

When used correctly, calculators:

- Increase time on site

- Build trust through transparency

- Encourage form submissions

High-performing mortgage websites include calculators such as:

- Affordability calculator

- Refinance calculator

- FHA, VA, USDA tools

- Monthly payment estimators

Always pair calculators with contextual CTAs like “Want a personalized estimate?”

Content That Educates and Converts

Borrowers don’t just want answers; they want clarity.

Blog and Education Centers

When you develop a mortgage website content strategy, include:

- First-time homebuyer guides

- Loan program breakdowns

- Market insights

- FAQ-style articles

Educational content builds authority while quietly moving users closer to conversion.

Automation That Captures Leads Instantly

Speed matters after the form submission, too.

High-converting mortgage websites integrate with automation systems that:

- Send instant confirmation emails

- Trigger SMS follow-ups

- Notify your team

- The route leads into CRM pipelines

The faster you respond, the higher the conversion rate.

Step-by-Step Guide to Develop Mortgage Website Built for Conversions

Here’s a simplified roadmap:

Step 1: Define Your Ideal Borrower

Know their fears, goals, and objections.

Step 2: Choose Conversion-Focused Layouts

Avoid clutter. Prioritize clarity.

Step 3: Build Trust Everywhere

Reviews, credentials, testimonials, consistency.

Step 4: Optimize for Mobile and Speed

Test across devices. Fix friction points.

Step 5: Integrate Forms, Calculators, and CRM

Everything should connect seamlessly.

Step 6: Track and Improve

Use analytics to monitor performance and refine.

Conversion optimization is not a one-time task—it’s ongoing.

Common Mistakes That Hurt Mortgage Website Conversions

Avoid these silent killers:

- Overloaded pages

- Generic messaging

- No clear CTAs

- Slow load times

- Lack of trust indicators

- Complex navigation

Fixing just one of these can dramatically improve results.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

How long does it take to develop a mortgage website?

Most professional mortgage websites can be developed within a few days to a few weeks, depending on customization and content requirements.

Do I need a CRM for my mortgage website?

While not mandatory, CRM integration significantly improves follow-up speed, lead organization, and conversion tracking.

How often should I update my mortgage website?

Core pages should remain stable, but blogs, testimonials, and educational content should be updated regularly.

Are mortgage calculators really necessary?

Can I edit my mortgage website myself?

Modern platforms allow easy updates without technical knowledge, especially for content and images.

Is my website data secure?

Quality mortgage website providers include SSL certificates, secure hosting, and daily backups as standard features. Always verify that your provider takes security seriously—it’s essential for protecting both your business and your clients’ information.

What pages should every mortgage site have?

Home, About, Loan Programs, Blog, Reviews, Contact, and a clear Apply or Book CTA.

Are these platforms suitable for teams?

Most mortgage website builders support multiple users, pipelines, and team workflows.

Conclusion

To succeed in today’s digital-first lending environment, you must develop mortgage website platforms that do more than look good; they must perform.

A conversion-focused mortgage website builds trust, removes friction, educates borrowers, and captures leads consistently. When strategy, design, speed, and automation work together, your website becomes one of your most powerful business assets.

If your current site isn’t converting, it’s not failing; it’s just unfinished. And now, you know exactly how to fix it.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators