If your mortgage website is getting traffic but not enough conversations, leads, or applications, you’re not alone. Today’s borrowers expect instant answers, quick responses, and a smooth online experience—and waiting for a callback just doesn’t cut it anymore.

That’s exactly where AI chatbots come in.

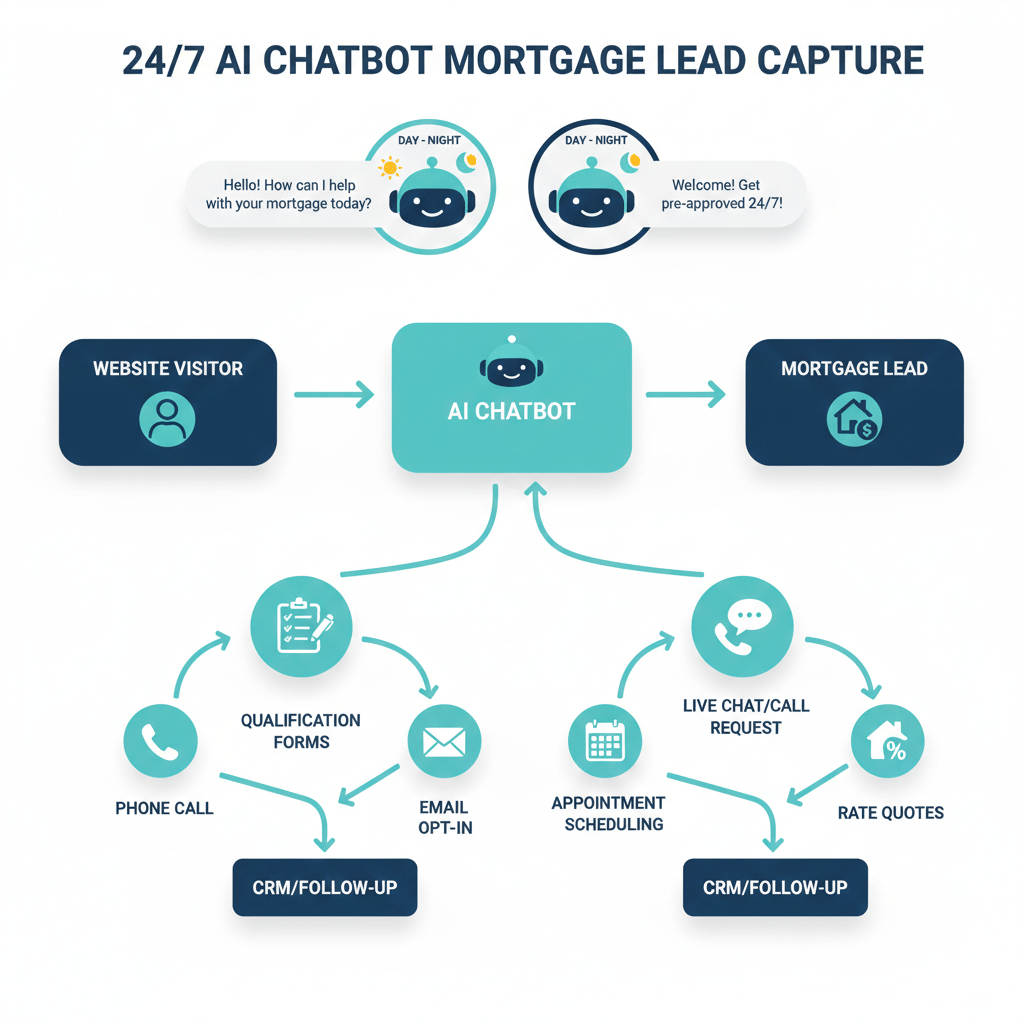

AI chatbots on mortgage websites act like a digital loan assistant that never sleeps. They greet visitors, answer common questions, pre-qualify prospects, and route serious leads directly to you — automatically. Instead of losing potential borrowers after business hours, you turn your website into a 24/7 lead conversion machine.

In this guide, we’ll break down how AI chatbots work, why they matter, and how mortgage professionals can use them to grow smarter.

Key Takeaways

- AI chatbots help mortgage websites capture and qualify leads 24/7

- Borrowers get instant answers without waiting on emails or calls

- Loan officers save time by focusing only on high-intent prospects

- Chatbots improve conversion rates and user experience

- Setup is easier than most lenders expect

What Is an AI Chatbot for Mortgage Websites

An AI chatbot is a conversational tool powered by artificial intelligence that lives on your website and interacts with visitors in real time. Unlike basic chat widgets, modern AI chatbots understand intent, ask smart follow-up questions, and guide users through a logical conversation.

On mortgage websites, chatbots are commonly used to:

- Answer loan-related questions

- Ask pre-qualification questions

- Collect contact details

- Book appointments

- Route leads into a CRM automatically

Think of it as a friendly digital loan assistant that works alongside you.

Why AI Chatbots Matter for Mortgage Websites

Mortgage decisions are emotional, time-sensitive, and information-heavy. When a borrower visits your site, they’re often researching late at night, comparing options, or feeling overwhelmed.

If your website doesn’t respond instantly, they bounce.

Here’s why AI chatbots have become essential for modern mortgage websites.

Borrowers Expect Immediate Responses

Today’s consumers are used to instant gratification. If they can get answers from Amazon or their bank in seconds, they expect the same from a mortgage professional.

AI chatbots provide:

- Immediate replies to common questions

- Clear next steps without confusion

- A stress-free experience for first-time buyers

You Stop Losing After-Hours Leads

Many mortgage website visits happen outside business hours. Without a chatbot, those visitors leave without taking action.

With a chatbot:

- Every visitor is greeted

- Every lead is captured

- Every opportunity is logged automatically

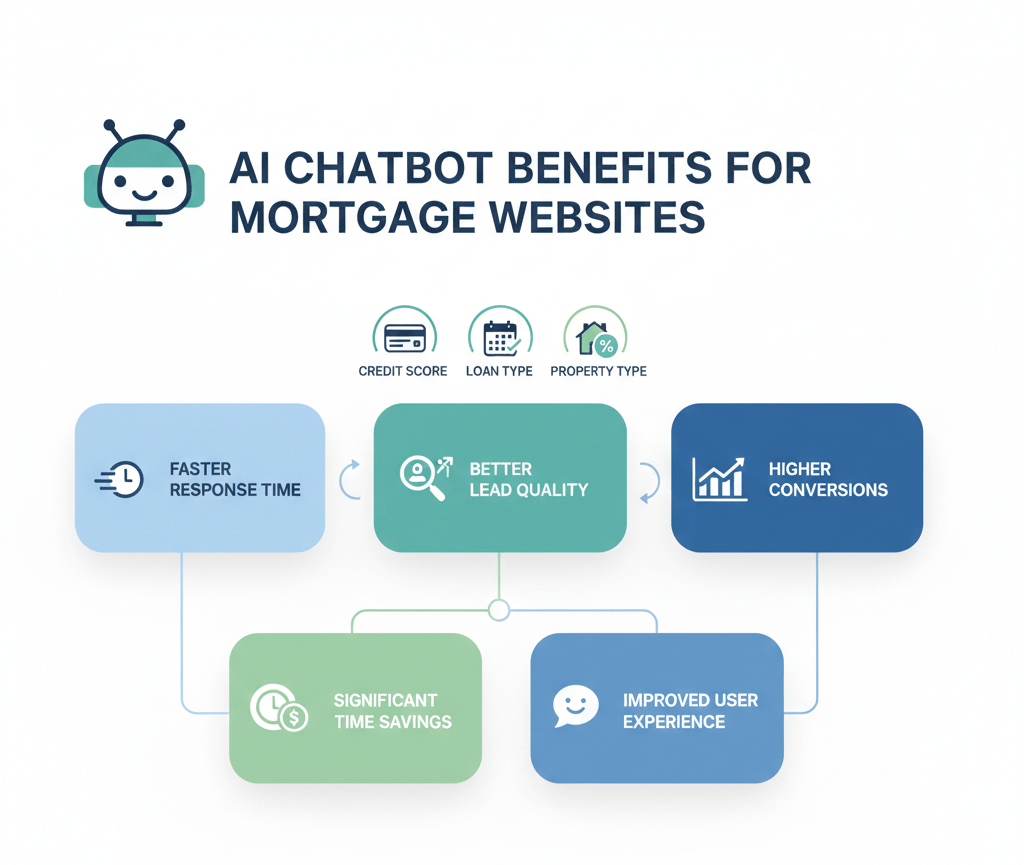

Better Lead Quality, Not Just More Leads

Instead of dumping raw leads into your inbox, chatbots pre-qualify prospects by asking smart questions like

- Are you looking to buy or refinance

- What’s your estimated credit range

- How soon are you planning to move

This means fewer tire-kickers and more serious conversations.

How AI Chatbots Improve Mortgage Websites User Experience

User experience is one of the biggest ranking and conversion factors for mortgage websites. A chatbot improves UX in subtle but powerful ways.

Personalized Conversations

AI chatbots can adapt based on user responses. A first-time homebuyer gets different guidance than an investor or refinance prospect.

This personalization builds trust fast.

Reduced Friction

Instead of forcing users to hunt through menus or fill out long forms, chatbots guide them step by step.

Simple questions feel easier than complex forms.

Clear Calls to Action

Chatbots naturally lead users toward:

- Booking a consultation

- Starting an application

- Downloading a guide

- Requesting a rate quote

No pressure, just helpful direction.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

Step-by-Step How AI Chatbots Work on Mortgage Websites

If you’re wondering how this actually works behind the scenes, here’s a simple breakdown.

Step 1: Greeting the Visitor

The chatbot welcomes the visitor with a friendly message like:

“Hi! Looking to buy, refinance, or just exploring your options?”

This instantly invites interaction.

Step 2: Asking Smart Questions

Based on the response, the chatbot asks relevant follow-up questions such as:

- Purchase price range

- Timeframe to buy

- Loan type interest

- Credit range

The questions feel conversational, not robotic.

Step 3: Capturing Contact Information

Once the user is engaged, the chatbot collects:

- Name

- Phone number

This happens naturally after a value is provided.

Step 4: Routing the Lead

The lead is sent directly to your CRM, tagged, and assigned based on rules you set.

Some systems can even trigger automated follow-ups instantly.

Step 5: Booking Appointments Automatically

High-intent leads can be sent straight to your calendar to book a call no back-and-forth emails required.

AI Chatbots and Mortgage Websites Lead Conversion Benefits

Adding an AI chatbot isn’t just about convenience. It directly impacts your bottom line.

Higher Conversion Rates

Websites with conversational tools consistently convert better than static pages because visitors feel supported, not sold to.

Faster Response Time

Speed matters in mortgage sales. Chatbots respond instantly, beating competitors who rely on manual follow-up.

Less Manual Work

Instead of answering the same questions repeatedly, your chatbot handles the basics while you focus on closing deals.

Scalable Growth

Whether you get 10 visitors a day or 1,000, the chatbot performs the same without burnout.

Common Use Cases for AI Chatbots on Mortgage Websites

- Lead Qualification: Automatically filter leads based on criteria like credit score, timeline, and loan type

- First-Time Homebuyer Education: Guide nervous buyers through the basics without overwhelming them

- Refinance Screening: Identify homeowners who are likely to benefit from refinancing

- Appointment Booking: Eliminate scheduling friction with built-in calendar integration

- Support and FAQs: Answer common questions about rates, documents, and process steps instantly

Best Practices for Using AI Chatbots on Mortgage Websites

To maximize value, follow these best practices.

- Keep conversations short and friendly

- Avoid overwhelming users with too many questions

- Focus on helping, not selling

- Customize scripts for your ideal borrower

- Regularly review chatbot conversations for improvements

A chatbot should feel like a helpful assistant, not a pushy salesperson.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Are AI chatbots compliant for mortgage use?

Yes, when configured properly. They collect basic information and route users to licensed professionals for advice and disclosures.

Will an AI chatbot replace loan officers?

No. Chatbots assist loan officers by handling initial conversations, not replacing human expertise.

Do chatbots hurt website SEO?

No. In fact, better engagement and lower bounce rates can improve SEO performance.

Can AI chatbots integrate with my CRM?

Most modern mortgage chatbot systems integrate seamlessly with CRMs for automation and follow-up.

Do borrowers actually like using chatbots?

Yes. Many borrowers prefer quick, private answers over calling or filling long forms.

Is an AI chatbot expensive?

Costs vary, but most lenders see ROI quickly through higher conversions and time savings.

Can Mortgage Website Templates be customized for my business?

Yes. Most modern Mortgage Website Templates allow you to customize branding, content, layouts, and calls to action so your website reflects your unique business while remaining optimized for mobile and SEO.

Are these platforms suitable for teams?

Most mortgage website builders support multiple users, pipelines, and team workflows.

Conclusion

Mortgage websites are no longer just digital brochures. They are interactive platforms designed to guide, educate, and convert visitors in real time.

AI chatbots transform your website into a living, breathing assistant that works around the clock—answering questions, qualifying leads, and helping borrowers take the next step with confidence.

For mortgage professionals seeking more leads, more effective conversations, and less manual work, AI chatbots aren’t a trend; they’re a competitive advantage.

If your website isn’t talking to visitors yet, now might be the perfect time to start.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators