Imagine waking up to find your inbox full of inquiries from potential homebuyers and refinance prospects.

That’s what happens when you give people real value upfront without asking them to commit right away. Free resources like PDF guides, mortgage calculators, and webinars work like magnets to pull in the right audience, turning visitors into loyal clients over time.

In this guide, we’ll show you exactly how to use these tools to attract more mortgage leads, grow your email list, and build authority in your market.

📈 Did you know? Businesses that use lead magnets see a 67% higher conversion rate than those without them.

Key Takeaways

✅ Free PDFs position you as the local mortgage expert

✅ Mortgage calculators engage visitors and encourage action

✅ Webinars establish authority and nurture prospects at scale

✅ Automation ensures no lead slips through the cracks

✅ These tools build trust and work for you 24/7

Why Free Resources Are Your Secret Weapon for Mortgage Leads

Imagine someone searching for mortgage advice in your area. They land on your site and see a free “First-Time Homebuyer Checklist”, try a payment calculator, and register for a live webinar on the mortgage process.

By the end of their visit, you have their email, they see you as a trusted professional, and they’re one step closer to becoming your client.

This is not a fantasy it’s how successful mortgage pros are thriving in the digital age.

📊 Did you know? Businesses using lead magnets generate 54% more leads than those who don’t

Free resources help you:

- Build credibility in your local market

- Provide answers to urgent questions

- Keep your brand top-of-mind until prospects are ready to act

Create Free PDFs That Educate and Inspire

📘 Free PDFs offer a powerful way to showcase your expertise while collecting contact information.

Why PDFs Are Effective

- Portable and easy to download

- Offer detailed insights that position you as an authority

- Perfect for sharing on social media and in email campaigns

Ideas for PDF Topics

✔ First-Time Homebuyer Guides

✔ Refinance Readiness Checklists

✔ Mortgage Process Roadmaps

✔ Local Housing Market Trends

Steps to Craft a High-Converting PDF

Creating a PDF that actually attracts and converts mortgage leads isn’t about slapping your logo on a Word doc and calling it a day. It’s about building something so helpful, so relevant, and so easy to digest that your prospects can’t help but exchange their email to get it.

Here’s how you do it step by step:

🕵️ Identify Client Pain Points

Start with your audience’s biggest questions and worries. What keeps them up at night? Are they confused about the mortgage process? Unsure if they’re financially ready? Nervous about refinancing?

Turn those pain points into helpful topics.

✨ Examples:

“The First-Time Homebuyer’s Survival Guide”

“Psychology of Mortgage Website”

“Your Step-by-Step Mortgage Process Checklist”

The key? Give them information they can actually use—not just generic fluff.

✍️Write in Plain English

Avoid jargon. Speak like you’re explaining things to a friend.

🎨Design for Engagement

Looks matter. A boring wall of text isn’t going to cut it.

Here’s how to make your PDF visually engaging:

✅ Use clean layouts with plenty of white space

✅ Break up text with bullet points, checklists, and icons

✅ Include high-quality images (think: happy families in homes, local neighborhood shots, etc.)

✅ Add pull quotes or stats to catch the eye

✨ Example: Instead of a long paragraph about first-time buyer fears, create a “Quick Checklist: 5 Signs You’re Ready to Buy” with icons next to each point.

📢 Add a Clear Call-to-Action (CTA)

Every great PDF needs a next step. After giving your readers value, guide them towards taking action with a friendly, non pushy CTA.

🎯 Examples of CTAs:

1: Want to know exactly how much home you can afford? Click here to schedule your free consultation.

2: Have questions about your unique situation? Let’s chat—book a call today.

3: Download our full Homebuyer Readiness Checklist for even more insights.

🔒 Offer It in Exchange for an Email

This step is key. Don’t just upload your PDF to your website for anyone to download. Make it a lead magnet by requiring visitors to fill out a simple form.

Keep your form short and sweet:

📌 Name + Email = Access

Why? Because asking for too much upfront (like phone numbers or full addresses) can scare off prospects. Start small. You can nurture the relationship later through email.

✨ Pro Tip: After they submit the form, don’t just send the PDF. Deliver it alongside a warm thank-you email that introduces you and invites them to reply with questions. This turns a cold download into the start of a conversation.

Launch Your High Performing Mortgage Website Today

Stop losing leads to outdated websites or DIY templates. Get a professional mortgage website

Offer Mortgage Calculators to Keep Visitors Engaged

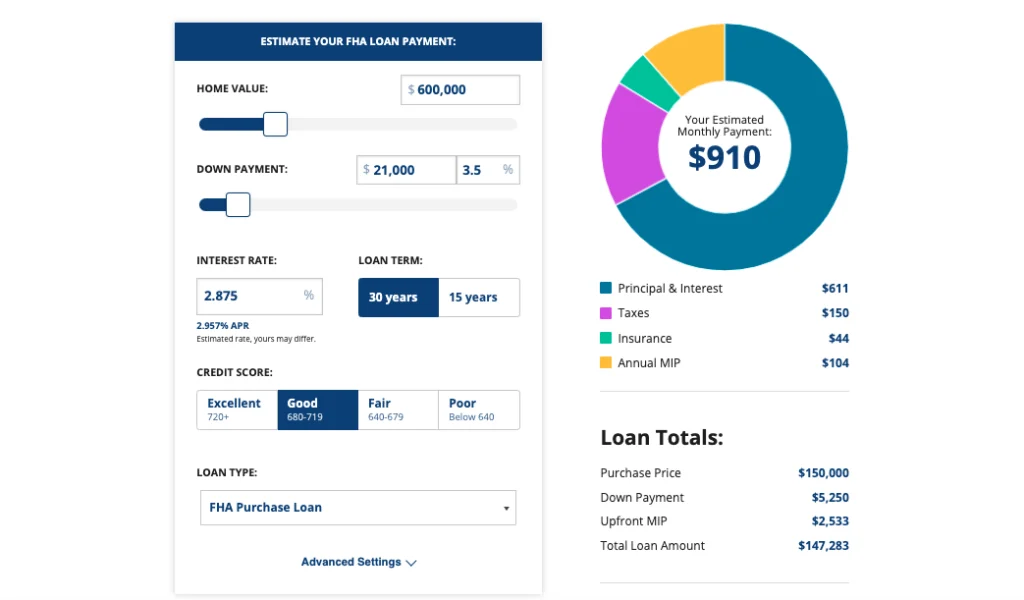

Benefits of Adding Calculators

- Visitors stay on your site longer (good for SEO)

- Prospects get valuable insights instantly

- Builds a sense of trust and professionalism

Types of Calculators You Can Include

✔ Monthly Mortgage Payment Calculator

✔ Loan Affordability Calculator

✔ Refinance Savings Calculator

✔ Debt-to-Income Ratio Estimator

How to Maximize Their Impact

So, you’ve added mortgage calculators to your website—great start! But simply having them isn’t enough. To really make them work as lead magnets, you need to think about how and where they’re used. Here’s how to get the most out of them:

Place Calculators Prominently on Your Site

Don’t hide your calculators on some buried page that no one visits. Put them front and center where visitors are most likely to engage

✅ Add them to your homepage as a featured tool

✅ Include them on landing pages aimed at first-time buyers or refinance prospects

✅ Link to them in blog posts like “How Much House Can You Afford?”

The goal is to make them easy to find so people start interacting right away.

Pair Results with a Soft Lead Capture Form

Here’s a little secret: calculators are the perfect opportunity to collect leads if you do it right.

As users finish their calculations, prompt them gently with something like:

Want a personalized breakdown of these numbers? Enter your name and email, and I’ll send you a full report.”

Host Webinars That Build Connection and Trust

🎥 Webinars are one of the fastest ways to position yourself as a trusted mortgage expert.

Why Webinars Work

Allow real-time interaction with prospects

Create a personal connection at scale

Help attendees understand complex topics through Q&A

Engaging Webinar Topics

🎯 Homebuyer Education: The Mortgage Process Demystified

🎯 Refinancing: How to Save Thousands

🎯 Market Outlook: What Homebuyers Should Know in 2025

How to Plan and Host a Successful Webinar

Hosting a webinar doesn’t have to feel overwhelming. When done right, it’s one of the most effective ways to showcase your expertise and turn curious prospects into warm leads. Here’s how to make your webinars stand out:

Engaging Webinar Topics

Your topic is what draws people in. Focus on common questions or challenges your audience faces. Think about what would make a first-time homebuyer or someone considering refinancing stop scrolling and say, “I need to know this.”

✨ Example topics:

“The Mortgage Process Demystified: What Every Buyer Should Know”

“Refinancing 101: How to Save Thousands Over the Life of Your Loan”

Promote It Widely

Even the best webinar won’t fill itself—promotion is key. Start early and get the word out across multiple channels:

✅ Post about it on social media

✅ Send email invitations to your list

✅ Encourage past clients to share with friends and family

The more touchpoints you create, the higher your attendance rate will be. A good rule of thumb is to begin promotion 2–3 weeks before the event and send reminder emails as the date approaches.

Keep It Simple

You don’t need fancy production or a two-hour lecture. A concise 30–45 minute session with clear, valuable insights followed by a Q&A is ideal. This format respects your audience’s time and gives them space to ask questions that matter to them.

Use slides for visual support but keep them clean and uncluttered. Speak conversationally, like you’re explaining things to a friend over coffee—not reading from a script.

Ready to Attract More Mortgage Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

Frequently Asked Questions

What are the best lead magnets for mortgage leads?

PDF guides and calculators are excellent because they provide immediate value.

How do I promote these free resources?

Use your website, social media, email campaigns, and even local partnerships.

Are webinars too technical for beginners?

Not at all. Start simple your audience values your knowledge, not fancy production.

How long does it take to set up?

PDFs and calculators can be live in 3-5 days. Webinars take 1-2 weeks to plan and promote.

Can I use my own domain and branding?

Absolutely. Platforms like GetMortgageWebsite let you personalize everything.

Can I edit my site after launch?

Yes! With GetMortgageWebsite.com, you get full control to make updates anytime.

Should I create my own calculators?

Yes! Share a link to your affordability calculator with captions like “How much house can you afford?” to drive traffic.

Conclusion

Free resources like PDFs, calculators, and webinars aren’t just trendy marketing tools—they’re strategic assets for growing your mortgage business. By offering value upfront, you not only attract more mortgage leads but also build trust and credibility with prospects long before they pick up the phone.

Think of these resources as your digital sales team, working tirelessly day and night. When combined with consistent follow-up and genuine customer care, they create a self-sustaining ecosystem that fuels your business growth.

The best part? You don’t need huge budgets or technical skills to get started. Begin small—create a single guide, add one calculator, or host your first webinar. Each step you take moves you closer to a future where leads come to you, eager and ready to work with a mortgage expert they already trust.

Now is the time to position yourself as that expert. Build your foundation, give your prospects the answers they’re searching for, and watch your pipeline fill with qualified, motivated clients.

Book a Strategy Call

Launch your high-performing mortgage website fast no contracts, no hassle.