A Game-Changer for Modern Mortgage Professionals

It’s no secret today’s borrowers want fast answers and clear insights before they ever pick up the phone. They’re researching rates over their morning coffee, comparing monthly payments during lunch breaks, and expecting instant results while scrolling on their phones at night.

As a loan officer, how do you meet those expectations without burning out or working 24/7?

That’s where mortgage calculators come in.

These aren’t just number-crunching widgets—they’re powerful lead magnets, trust builders, and workflow accelerators that can transform your business. In this article, we’ll dive deep into why mortgage calculators have become essential tools for loan officers and how you can use them to attract, engage, and convert more clients.

Key Takeaways

✅ Mortgage calculators build trust by offering instant insights to borrowers.

✅ They pre-qualify leads and save loan officers hours every week.

✅ Integrated calculators improve your site’s SEO and keep users engaged longer.

✅ Using calculators can boost lead conversion rates by up to 40%.

✅ We’ll show you exactly how to leverage them for maximum impact.

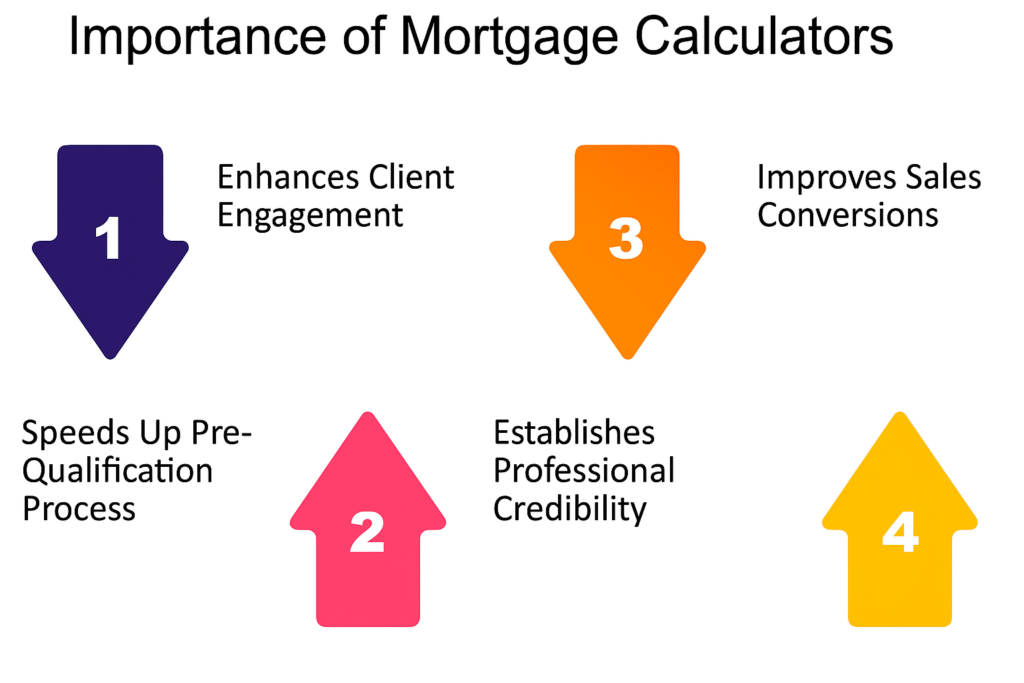

The Growing Importance of Mortgage Calculators for Loan Officers

Why Borrowers Expect Instant Answers

📊 Did you know? 72% of homebuyers use online mortgage calculators before speaking to a loan officer (Source: NAR 2024 Home Buyer Survey).

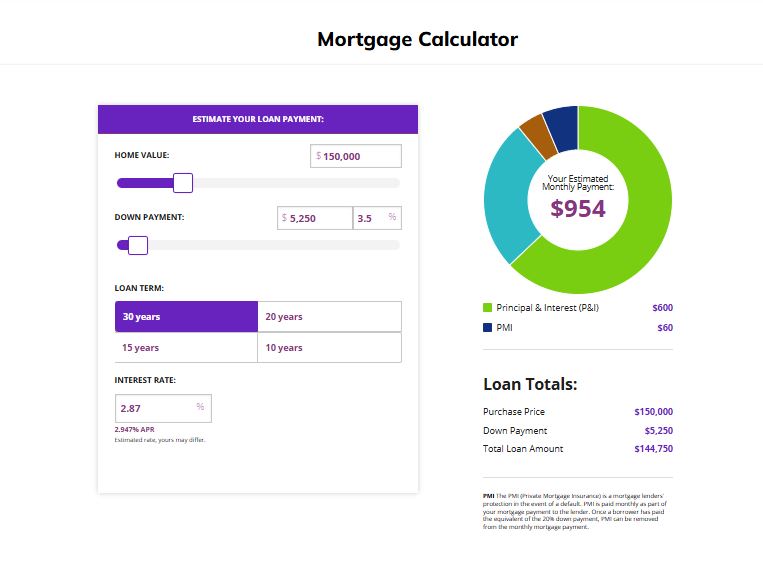

In an age where information is just a click away, borrowers don’t want to wait for phone calls or email quotes. By embedding mortgage calculators on your website or CRM platform, you meet them where they are online, searching for answers 24/7.

This immediate access positions you as a helpful, tech savvy loan officer. It’s a small feature with a massive impact on client trust and engagement.

Benefits of Mortgage Calculators for Loan Officers

Attract More Leads Through Your Website

When visitors land on your site, what keeps them there? A static “About Us” page? Probably not.

But a suite of interactive mortgage calculators? That’s engaging. It encourages prospects to play with numbers, explore scenarios, and stay on your site longer which is great for both SEO and your lead funnel.

📈 Fact: Websites with interactive tools like calculators see 40% more engagement and higher lead conversions

Pro Tip: Platforms like GetMortgageWebsite.com already include calculators that integrate seamlessly with your site

Pre-Qualify Leads and Save Time

Imagine getting a lead where the client has already figured out they can afford a $450,000 home, their preferred loan term is 20 years, and they understand the impact of different interest rates.

This makes your first conversation far more productive.

“When clients come to me after using my online calculators, they’re already educated. I can focus on solutions instead of basics.” Sarah L., Loan Officer

Build Trust and Position Yourself as an Expert

Mortgage calculators aren’t just functional—they’re also psychological. By offering these tools, you’re showing transparency and empowering your clients to make informed decisions.

This positions you as a trusted advisor instead of someone just trying to close a deal.

Educate Clients Without Overwhelming Them

For many first-time homebuyers, the mortgage process feels like learning a foreign language. Terms like “amortization” or “LTV ratio” can be intimidating. A mortgage calculator breaks down these concepts visually, allowing clients to see the numbers and understand the process in a low-pressure way.

This self education makes them feel more confident and ready to engage with you for the next steps.

Ready to Transform Your Client Experience?

Make it easy for clients to explore their options and reach out. GetMortgageWebsite.com provides mortgage websites with 7 powerful calculators

Types of Mortgage Calculators Every Loan Officer Should Offer

Conventional Loan Calculator

Helps clients estimate monthly payments for a conventional mortgage, including principal, interest, taxes, and insurance. It’s ideal for buyers with solid credit and a standard down payment. This tool shows them how different loan terms and interest rates impact their budget.

VA Home Loan Calculator

Designed for veterans, active-duty service members, and eligible spouses, this calculator factors in VA-specific benefits like zero down payment and no private mortgage insurance (PMI). It simplifies the process of estimating costs and highlights the financial advantages of VA loans.

FHA Home Loan Calculator

Perfect for first-time buyers and those with lower credit scores, this calculator helps estimate monthly payments while including FHA-specific costs like mortgage insurance premiums (MIP). It gives clients a realistic picture of affordability with government-backed support.

Affordability Calculator

Gives buyers a clear view of what they can afford based on income, debts, down payment, and expenses. It’s perfect for loan officers to use as a conversation starter with first-time buyers and to pre-qualify leads before diving deeper into loan products.

Refinance Calculator

Shows existing homeowners how much they can save by refinancing their current mortgage at today’s rates. It calculates potential monthly savings, total interest reduction, and the break-even point. A great tool to reconnect with past clients and generate repeat business.

Real-World Impact of Mortgage Calculators

Loan officers report saving 5–7 hours per week by pre-qualifying leads through calculators.

Using calculators in follow-up emails increases response rates by 26%.

65% of borrowers say they’re more likely to call a loan officer after using a website’s calculator

Step-by-Step Guide to Adding Mortgage Calculators to Your Website

Choose a Platform or Plugin: Select tools compatible with your current site.

Decide Which Calculators to Offer: Start with 3-5 essential ones.

Customize for Branding: Add your logo, colors, and contact details.

Integrate With CRM: Set up lead capture and notifications.

Promote Your Tools: Share links on social media, emails, and marketing campaigns.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

Frequently Asked Questions

Why are mortgage calculators important for loan officers?

They provide instant value to prospects, save time during consultations, and help pre-qualify leads.

Are online calculators accurate?

While they offer excellent estimates, a full application is needed for exact numbers.

Do calculators help improve SEO?

Yes! Interactive tools like calculators keep visitors engaged longer, boosting your site’s SEO.

Can I get calculators on my mobile site?

Absolutely. Mobile-friendly calculators are essential since over 65% of borrowers use smartphones for research.

Do I need technical skills to add them?

Not if you use a platform like GetMortgageWebsite—it’s all done for you.

Can I edit my site after launch?

Yes! With GetMortgageWebsite.com, you get full control to make updates anytime.

Can I use calculators for social media content?

Yes! Share a link to your affordability calculator with captions like “How much house can you afford?” to drive traffic.

Conclusion

Mortgage calculators are no longer optional they’re the secret weapon every loan officer needs to stay ahead in today’s fast-paced, digital-first market. These tools don’t just crunch numbers; they attract high-quality leads, free up hours in your week, and help you deliver the kind of instant insights modern borrowers expect. More importantly, they position you as the trusted expert your clients are searching for—the one who makes the complex simple and the stressful seamless.

So why wait? Every day without these tools is another missed opportunity to connect with clients and grow your business. If you’re ready to elevate your online presence, engage clients like never before, and stand out from the competition, there’s no better time to get started than right now.

Ready to Attract More Leads and Save Time?

GetMortgageWebsite.com gives you a professionally designed site with 7 powerful calculators