In today’s digital-first world, reputation isn’t just part of your business it is your business. For mortgage professionals, your ability to attract new clients often depends on what others say about you online. Whether you’re an independent loan officer or part of a large brokerage team, prospective borrowers are scrutinizing your digital footprint. A glowing client review can become your strongest marketing asset, while a negative one, if left unaddressed, can deter leads before they even contact you. This comprehensive guide explores how to generate more mortgage leads with client reviews. You’ll learn why reviews matter more than ever, how to harness them to build trust, and how to turn satisfied clients into a steady stream of referrals and leads.

Key Takeaways

🌟 Online reviews are a trust-building powerhouse for mortgage professionals.

📈 Displaying reviews can dramatically increase lead conversions and revenue.

🛠️ Proactively managing your online reputation gives you a competitive edge.

💬 Responding to negative reviews can strengthen not harm, your credibility.

🔑 A strategy for collecting, showcasing, and maintaining client reviews is essential for long-term growth

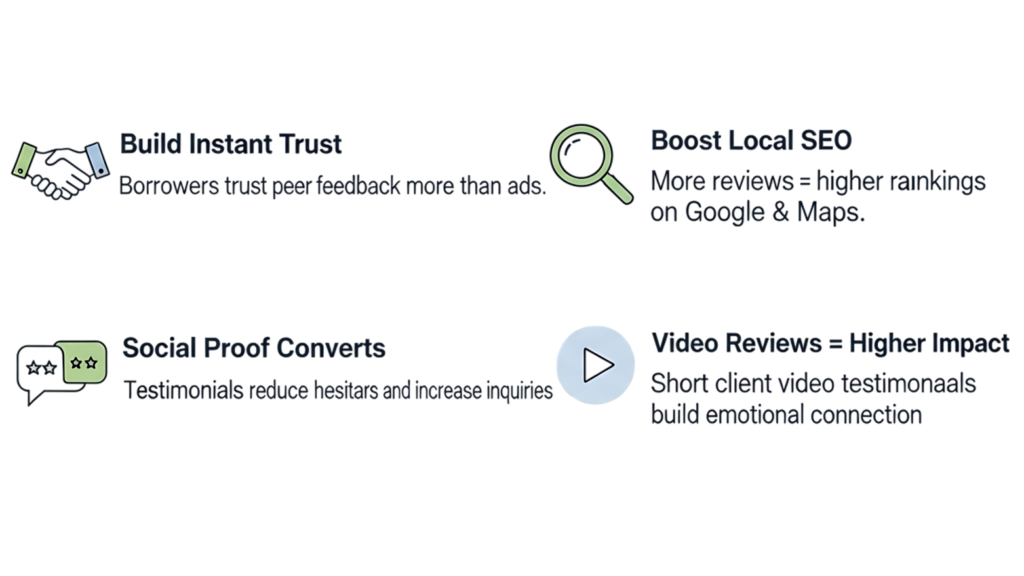

Why Client Reviews Are Essential for Mortgage Lead Generation

Mortgage lending is deeply personal. Clients aren’t just buying a product; they’re trusting you with one of the biggest financial decisions of their lives.

In this context, client reviews act as modern word-of-mouth referrals, only with far greater reach.

🌐 The Numbers Don’t Lie

- 97% of mortgage borrowers begin their journey with online research (National Association of Realtors).

- Businesses that display reviews see a 270% increase in conversion rates.

- Every 1-star increase on platforms like Yelp can boost revenue by 5–9%

In short, a robust portfolio of positive reviews doesn’t just enhance your reputation it directly impacts your bottom line.

Analyzing Your Current Online Reputation

Before creating a strategy to use client reviews for lead generation, you need to assess where you currently stand.

🕵️♂️ Audit Your Online Presence

Start by searching your name and business on major platforms:

- Google Business Profile

- Zillow and Realtor platforms

- Facebook and LinkedIn

- Yelp and Better Business Bureau

Make note of:

✅ Average star ratings

✅ The total number of reviews

✅ The most common feedback

🔔 Monitor Mentions

It’s not just official reviews borrowers talk about their experiences on social media, forums, and even in comments on ads. Check hashtags, tags, and community groups for mentions of your name or business.

📄 Don’t Forget Internal Reviews

Employee satisfaction matters too. Sites like Glassdoor can influence public perception. A culture of excellence internally often reflects externally.

Ready to Attract More Mortgage Leads?

See how a mobile-first mortgage website CRM can transform your business

Building a Reputation Strategy to Generate More Mortgage Leads

📌Keep Your Online Profiles Accurate and Updated

A study of over 6,000 mortgage professionals revealed nearly 50% had outdated or incomplete profiles. Incorrect phone numbers, old addresses, or inconsistent business names can frustrate potential clients and send them straight to a competitor.

Steps to Optimize Your Profiles

- Use your official business name consistently across all platforms.

- Include updated contact details, hours of operation, and professional photos.

- Add client testimonials where allowed.

💬 Ask for Feedback the Right Way

Asking for a review should never feel transactional. Instead, focus on the client experience first.

Timing Matters

The best time to request feedback is soon after a successful closing when emotions are high, and clients are most likely to respond positively.

🚀 Make It Effortless to Leave Reviews

Clients are more likely to leave a review if the process is simple.

✅ Provide direct links to your review profiles.

✅ Reduce steps—send clients straight to the review submission page.

✅ Use multiple channels like email and SMS for reminders.

📣 Showcase Positive Reviews Strategically

Once you start collecting reviews, let them work for you:

On Your Website

Create a dedicated testimonials page.

Highlight a rotating selection of reviews on your homepage.

On Social Media

- Turn reviews into branded posts or video testimonials.

- Share screenshots with a personal thank-you message.

In Marketing Collateral

Include reviews in email campaigns, brochures, and presentations.

Turning Negative Reviews into Opportunities

A negative review isn’t the end of the world. In fact, 67% of consumers say they are more likely to trust a business that responds to reviews

📝 How to Respond Professionally

- Acknowledge the feedback: Thank the reviewer for sharing their experience.

- Apologize if necessary: A simple apology can go a long way.

- Offer to resolve the issue offline: This shows others you care about client satisfaction.

Example:

“Thank you for bringing this to our attention. We’re sorry to hear about your experience and would appreciate the opportunity to discuss this further and make things right.”

Maintaining Your Online Reputation Over Time

Building a stellar reputation isn’t a one time effort it’s an ongoing process.

📅 Set Aside Time for Review Management

Regularly check platforms for new feedback.

Respond promptly (ideally within 24–48 hours).

🔔 Automate Alerts

Set up email notifications on key platforms or use free services like Google Alerts to be notified when your business is mentioned online.

👀 Study Competitors’ Reviews

Reading competitors’ reviews can reveal:

- What borrowers in your area value most.

- Common pain points you can address in your service.

- Opportunities to differentiate yourself.

More Statistics to Inspire Action

93% of consumers say online reviews influence their purchasing decisions.

84% trust online reviews as much as a personal recommendation.

Mortgage businesses with over 50 reviews earn 4x more leads than those with fewer than 10 (industry analysis).

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Where should I display client reviews?

On your website, social media, and in emails to maximize visibility and trust.

How can I get more 5-star reviews?

Ask happy clients right after closing and make it easy with direct links to review platforms.

Can I show all my reviews in one place?

Yes. Platforms like GetMortgageWebsite.com let you display reviews from Google, Zillow, and more.

Do reviews help with SEO?

Definitely. In SEO More positive reviews improve your Google ranking and attract organic mortgage leads.

How do I handle negative reviews?

Respond quickly, professionally, and offer to resolve issues offline.

Can I automate review requests?

Yes. Many mortgage platforms include features to automate follow-ups and review requests.

Do I need tech skills to manage reviews?

No. A user-friendly platform makes it easy to update content and manage reviews.

Conclusion

In a highly competitive mortgage market, trust and credibility are everything. Client reviews offer a cost-effective, high-impact way to generate more mortgage leads and grow your business.

By proactively collecting, managing, and showcasing feedback, you’ll create a strong digital presence that attracts new clients and keeps referrals flowing. Remember: your reputation isn’t built in a day, but every positive interaction brings you closer to being the go-to mortgage professional in your area.

Take Control of Your Online Reputation

Get a website built to impress and convert.