Imagine this: You’ve just helped a young couple lock in their dream home loan. They’re excited, relieved and totally overwhelmed. Now comes the scramble to secure home insurance before closing. Wouldn’t it be helpful if you, their trusted mortgage broker, had a solution ready?

This is where cross-selling comes into play. By offering or recommending home insurance, you’re not just adding a service you’re solving a problem. You become more than just the “mortgage person.” You become a trusted guide.

And the best part? You’re also opening a new stream of revenue without spending extra hours chasing cold leads. It’s not about “selling” it’s about creating a seamless, supportive experience that earns you repeat business and referrals.

Key Takeaways

- Cross-selling is about adding value, not being salesy.

- Mortgage brokers are perfectly positioned to offer home insurance.

- Timing, trust, and simplicity are key to successful insurance offers.

- A clear, educational approach will earn more respect and more referrals.

- Done right, insurance cross-selling can boost income by 15–30%.

Why Mortgage Brokers Should Embrace Cross-Selling

Clients already trust you with one of the biggest decisions of their lives buying a home. Offering home insurance through you saves them time, adds value, and helps build a longer lasting relationship.

📊 The Numbers Don’t Lie

According to a McKinsey report, cross-selling can increase customer lifetime value by up to 30%.

Homebuyers spend over $1,200 per year on homeowner’s insurance, presenting a significant upsell opportunity.

80% of consumers prefer bundled financial products when presented in a convenient way

Benefits of Cross-Selling Home Insurance for Mortgage Brokers

💰 Boost Revenue Streams

Each home insurance referral can translate into direct monetary gain. You can earn referral commissions or recurring revenue from partnerships.This diversifies your income without requiring extra clients.

It’s a low-effort, high-reward way to increase lifetime client value.

🛠 Strengthen Client Relationships

Offering both mortgage and insurance services adds convenience for clients. They appreciate working with someone who simplifies the homebuying journey. This positions you as a reliable, one-stop resource they can count on. The more value you offer, the stronger your bond becomes.

🧠 Position Yourself as a Knowledgeable Advisor

When you guide clients through multiple financial decisions, you stand out. Providing home insurance insights elevates your role beyond loan processing. It shows you’re invested in their long-term financial well-being. Your expertise becomes a trusted cornerstone in their homeownership journey.

🎯 Improve Retention and Referrals

Clients remember professionals who make the process seamless and stress-free. When they feel cared for, they’re more likely to stick around and spread the word.

Referrals become organic when you exceed expectations across multiple services. It’s not just about closing deals it’s about earning lasting loyalty.

Ready to Increase Your Value as a Broker?

You already close deals. Now it’s time to maximize your value per client. With the right approach

Best Time to Introduce Home Insurance

The golden window for cross-selling home insurance is between loan preapproval and closing day.

Here’s why:

- Clients are actively thinking about protecting their investment.

- They’re already overwhelmed; your bundled suggestion simplifies one more task.

- Lenders usually require proof of home insurance before closing anyway.

📌 Tip: Frame it as a helpful reminder, not a hard sell.

How to Present Insurance Without Sounding Like a Salesperson

Cross-selling isn’t about pitching. It’s about being helpful.

🧠 Keep it Informational

Position home insurance as something your clients will need anyway. Use phrases like:

- “You’ll need to get this done soon want a shortcut?”

- “I know a few good providers I trust. Want me to connect you?”

- “I’ve seen clients really appreciate getting this handled early.

🧲 Offer Options, Not Ultimatums

Instead of pushing one solution, offer a choice. This builds trust.

“I can connect you with a couple of providers who offer fast quotes and good coverage. No pressure—just want to save you a few hours of research.”

This makes your client feel empowered, not manipulated.

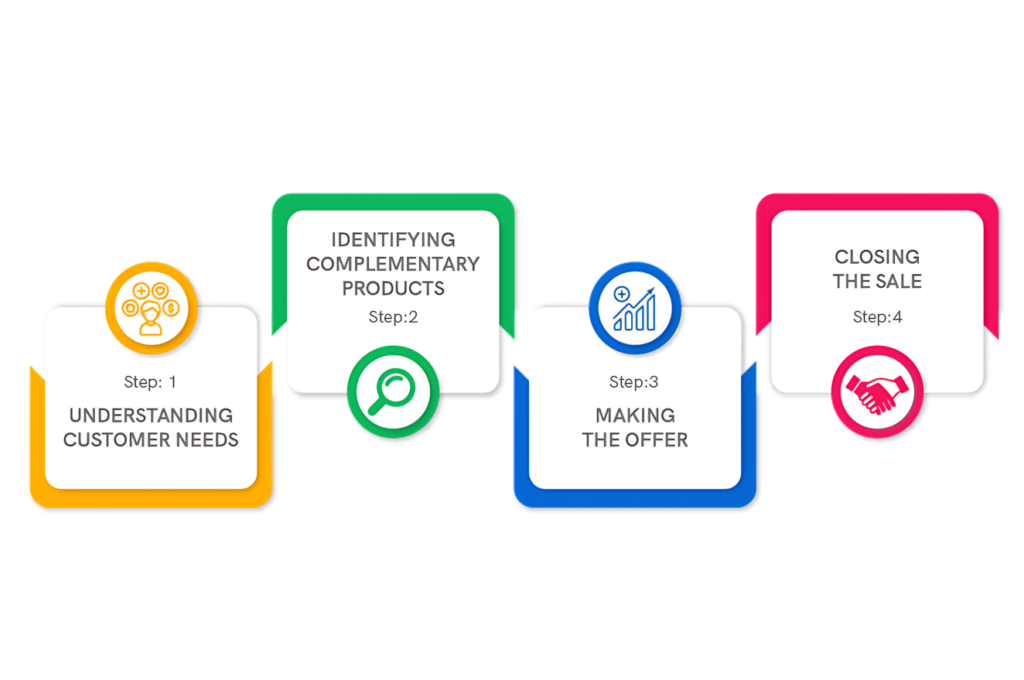

Step-by-Step Strategy to Cross-Sell Home Insurance

Step 1: Understand the Client’s Needs

Ask questions like:

“Have you thought about home insurance yet?”

“Do you already have a preferred provider?”

“Do you need help comparing quotes?”

This opens a conversation not a pitch.

Step 2: Introduce It Early

Don’t wait until the last second. The earlier you mention it, the more natural it feels.

Step 3: Educate Gently

Share a short explanation:

“Home insurance usually covers the structure, liability, and personal belongings. Rates vary depending on coverage, location, and home value.”

You can even create a short checklist or send a helpful email.

Step 4: Make It Convenient

Whether it’s a contact, a quote link, or a soft referral, clients appreciate simplicity.

Avoid These Common Mistakes

🚫 Being pushy: You’re not selling a vacuum. Be helpful, not salesy.

🚫 Using jargon: Explain things in plain English.

🚫 Only offering one provider: Give options or disclaim any financial connection.

🚫 Delaying the conversation: Bring it up early and casually.

🚫 Forgetting compliance: Always disclose relationships or potential earnings.

Let’s Help You Launch It

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Can mortgage brokers legally sell home insurance?

Mortgage brokers cannot sell insurance unless licensed, but they can refer clients and earn referral fees where allowed by law.

Is cross-selling home insurance profitable?

Yes, especially through recurring referral partnerships and added client retention benefits.

How do clients typically react?

If it’s offered helpfully and at the right time, most are relieved, not suspicious.

How much can I earn?

Commissions vary, but many brokers report earning $100–$300 per closed policy.

Can I recommend a friend’s agency?

Yes, just disclose your relationship and always prioritize your client’s best interests.

Do clients usually take the offer?

If presented correctly, many will—especially if they trust you and are short on time.

How should I refer clients?

A simple email introduction or a resource link works well.

Where can I get help with content creation?

Platforms like GetMortgageWebsite.com offer turnkey websites with pre-written content and automation.

Conclusion

Cross-selling home insurance isn’t about selling it’s about serving. You’re not just closing a loan. You’re helping someone protect the most important purchase of their life.

So take that step. Ask the question. Offer the help.

Because when you make life easier for your clients, they remember it. And when they remember it, they come back and they bring friends.

Let’s Build a Better Mortgage Website

Get a website built to impress and convert.