Most leads go cold within the first hour. But what if your business could respond within seconds every single time, even while you’re sleeping?

Let’s face it: in the mortgage and lending space, time is money. The longer it takes to respond to a potential client, the higher the chance they’ve gone with someone else or worse, forgotten about you altogether.

But here’s the silver lining: automated follow-up systems are revolutionizing the way lenders do business. These tools ensure every lead gets a timely response, even when your team is out of office. Whether you’re a one-person show or managing a large branch, automation gives you the edge to stay competitive in a fast-paced market.

If you’re tired of leads slipping through the cracks or spending hours tracking down prospects, this article will help you create a smarter, more scalable follow-up strategy one that works for you around the clock.

Key Takeaways

- Automated follow-up ensures no lead is forgotten

- Lenders gain a competitive edge with immediate outreach

- Consistency and personalization improve conversion rates

- Multi-channel workflows support 24/7 engagement

- Teams save time while boosting customer satisfaction

What Is an Automated Follow-Up System

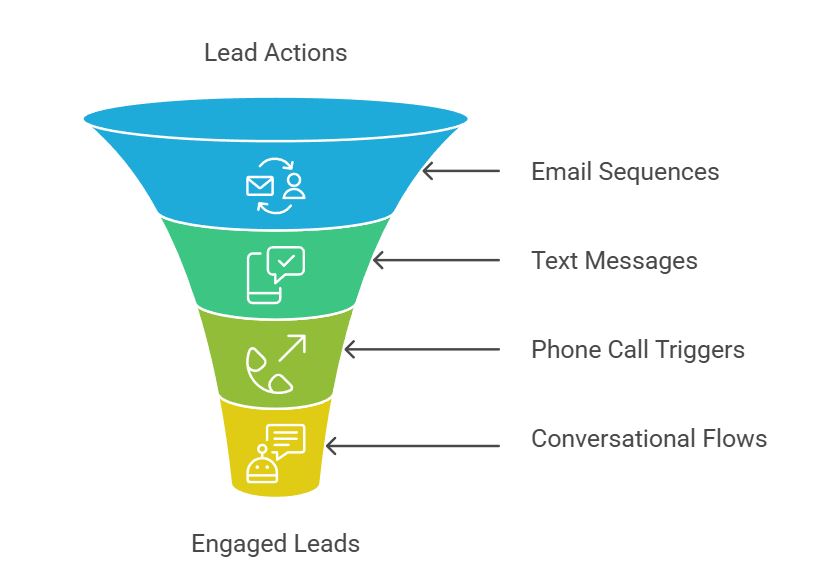

Think of it as your silent teammate, always working behind the scenes. An automated follow-up system is a structured process that responds to lead actions like form submissions, ad clicks, or inquiries with timely communication.

This can include:

📧 Email sequences for welcoming, nurturing, or educating leads

📱 Text messages offering quick replies or appointment confirmations

📞 Phone call triggers to connect while interest is high

💬 Conversational flows using prewritten messages or AI-driven logic

These responses happen instantly, without needing manual input. That means you can respond to inquiries at 2 p.m. or 2 a.m.—and your lead feels like they’re a priority either way.

Why Lenders Need Automated Follow-Up

Let’s talk about why this matters. The lending landscape is crowded, and potential borrowers have options. Many borrowers compare rates, read reviews, and inquire with multiple lenders. In that critical window of first contact, your speed and consistency set the tone.

Statistics reveal just how vital speed is:

🔔 78% of prospects go with the first lender who responds

⏱ The average industry lead response time is 42 hours

🧊 30% of leads receive no follow-up at all

In a world where buyers are researching online, reading reviews, and clicking “submit” on multiple websites, being the first to say Hello can win you the deal even if you’re not the cheapest option.

Everyday Example

Picture this: A potential buyer fills out a loan prequalification form at 10:45 PM. While you’re relaxing or fast asleep, an automated system reaches out with a friendly message confirming the inquiry, offering additional resources, and inviting them to chat the next morning. The prospect wakes up already impressed.

That’s the difference automation can make.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

Types of Automated Follow-Up Messages

Not all follow-ups are created equal. And different channels can serve different purposes depending on the stage of the customer journey.

Email Follow-Up

Email is great for:

- Providing educational content (e.g., loan types, first-time buyer tips)

- Following up after a call or consultation

- Sharing next steps or document checklists

These emails can be sent in a sequence over days or weeks to build trust and stay top-of-mind.

SMS

SMS is immediate, intimate, and effective. Whether it’s a quick acknowledgment or a gentle reminder, text messages are often read within minutes.

Example: “Hi Alex! Thanks for your inquiry I’ll be in touch shortly. Meanwhile, feel free to reply with any questions.”

Automated Callbacks

For high intent leads, setting up a system that instantly connects your sales team with new inquiries can be powerful. A prompt voice conversation builds rapport faster than any digital message can.

Some systems allow you

Some systems allow you to create full messaging journeys, adjusting tone, content, and timing based on how the lead interacts. These may involve pre-set questions, qualifying steps, or nudges to book a consultation.

Key Benefits for Lenders

Email Follow-Up

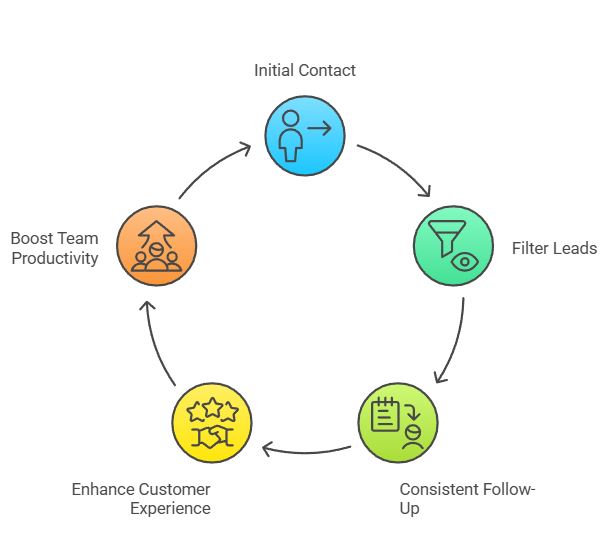

When a lead hears from you first, they’re more likely to stay engaged with your brand. This isn’t just about being fast it’s about being present at the moment your prospect is most curious and receptive.

Filter and Focus

Not every inquiry is a golden opportunity. Smart follow-up systems help filter leads by intent, loan type, timeline, and more freeing your time to focus on serious borrowers.

Increase Conversions with Less Work

Repetition and timing matter. Staying in touch across channels without overdoing it makes you more memorable and trustworthy. Automated sequences ensure your leads don’t go cold while you’re busy serving others.

Better Customer Experiences

Borrowers crave clarity. When your follow-up includes helpful information, timely replies, and polite reminders, you instantly elevate the customer journey.

A good experience isn’t just nice it’s profitable. Research shows consumers are willing to pay more for companies that offer superior customer service.

Maximize Team Productivity

Instead of managing sticky notes, spreadsheets, and forgotten voicemails, your team can work from a central system that tracks, assigns, and nurtures every lead automatically.

This results in:

Less burnout

Higher morale

More time closing deals

Getting Started with Automation

Setting up a follow-up system doesn’t have to be complicated. Here’s a simple, human-friendly game plan to help you start smart and scale up later:

1. Know Where Your Leads Are Coming From

Whether it’s your website, Facebook ads, or client referrals list out every lead source. This helps you stay organized and personalize your follow-ups based on where someone came from.

2. Write Messages That Sound Like You

Create a few message templates that match your tone. Are you casual and friendly? Or more professional and formal? Whatever your style, let it shine through. Keep it short, helpful, and easy to read on mobile.

3. Set Triggers for Follow-Up

Think about what should start the automation. Maybe it’s a form submission, a contact request, or someone downloading a free PDF. That’s your starting line.

4. Group Your Leads Smartly

Not all leads are the same. Segment your audience based on things like:

- Loan type (FHA, VA, refinance, etc.)

- Action taken (booked a call, just downloaded a guide, etc.)

- Behavior (opened emails, clicked a link, ghosted you 😅)

5. Time It Right

Don’t bombard people. Add short delays between messages, and space them out thoughtfully. A gentle nudge works better than a loud alarm bell.

6. Watch, Learn & Tweak

Keep an eye on what’s working. Are people replying? Booking calls? If not, change it up try new subject lines, adjust your timing, or simplify the message.

✅ Pro Tip:Start small. You don’t need a 25-step automation funnel from day one. Set up 1 or 2 smart follow-ups first, see how they perform, then build from there.

Real Impact: The Numbers Don't Lie

Here are a few eye-openers from industry studies:

📊 Leads contacted within 5 minutes are 8x more likely to convert

📊 74% of buyers say they would choose a lender who offers clear, consistent communication

📊 35% of borrowers select their lender within the first 72 hours of inquiry

Clearly, timing and messaging matter.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Can I still send custom messages?

Yes. Automation handles the routine stuff, freeing you to personalize deeper conversations.

Won’t people know it’s automated?

Not if you write with a natural voice. Most people appreciate a timely reply even if it’s automated.

How soon should I respond to a new inquiry?

The first 5 minutes are critical. Beyond that, odds of contact and conversion drop sharply.

Does this work for refinance leads too?

Absolutely. Refi borrowers are often comparison-shopping. Fast, professional follow-up sets you apart.

Will automation help me organize my pipeline?

Yes. You’ll have more visibility into who’s new, active, or ready to close.

Can I use automation for past clients too?

Definitely. Set up check-ins, review requests, or refinance reminders.

Is automation a replacement for good service?

No it’s an enhancement. It ensures you’re consistent even when busy.

How long until I see results?

Most lenders notice improved engagement and shorter sales cycles within weeks.

Conclusion

In a world where attention spans are shrinking and competition is growing, automated follow-up gives lenders a powerful advantage. It’s not just about technology it’s about showing up at the right time with the right message.

When you automate, you’re not removing the human touch you’re making sure it never misses a beat.

Whether you’re just getting started or refining your system, now is the perfect time to invest in automation. Because when your follow-up is fast, friendly, and consistent clients notice.

And when clients notice, deals close.

✅ Take the next step. Build an automated system that works while you sleep, and watch your lending business transform.

Take Control of Your Online Reputation

Get a website built to impress and convert.