Buying a home is one of life’s most rewarding and sometimes stressful milestones. It marks a new chapter filled with dreams of a backyard barbecue, a cozy kitchen, or maybe a space for your growing family. But for many homebuyers, especially first-timers, one thing often stands between them and that front door: the 20% down payment. And that’s where mortgage insurance steps in.

Mortgage insurance often gets a bad rap. People think of it as just another expense an extra burden. But what if we told you it’s actually a helpful tool that enables millions of people to become homeowners sooner than they ever thought possible?

Let’s unpack the real story behind mortgage insurance: what it is, how it works, who it protects, and why it could be your stepping stone into homeownership. Whether you’re applying for your first mortgage or simply want to understand the nitty-gritty, this guide is here to make it clear, simple, and human.

Key Takeaways

- What mortgage insurance is and how it works

- Who needs it and when it’s required

- How it differs for FHA, USDA, VA, and conventional loans

- How to avoid it or cancel it when possible

- Real-world examples and cost breakdowns

- Smart strategies to reduce mortgage insurance expenses

What is Mortgage Insurance?

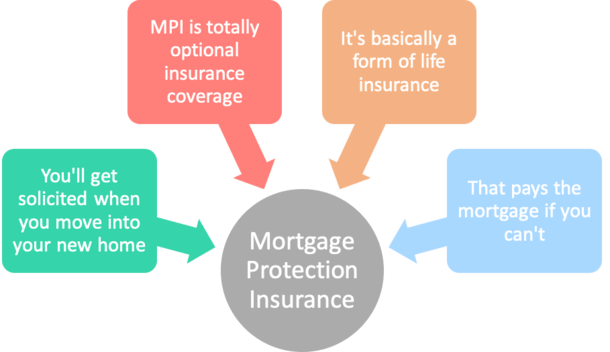

Mortgage insurance is a type of protection—for lenders. It’s designed to safeguard them if a borrower stops making payments on their loan. But while it protects the lender, it also gives buyers like you a leg up, helping you qualify for a mortgage with as little as 3% to 5% down.

Think of mortgage insurance like a safety net. Lenders are more willing to take a risk on you, knowing that if you default, the insurance will cover part of the loss.

There are two key types of mortgage insurance:

- Private Mortgage Insurance (PMI) is common with conventional loans

- Government-backed insurance Required for FHA, USDA, and VA loans

📈 According to the Urban Institute, nearly half of first-time homebuyers use mortgage insurance to make their purchase possible.

Why Mortgage Insurance is Important

Let’s say you’re ready to buy a home. You’ve found the perfect spot, but you only have 5% saved for the down payment. Without mortgage insurance, many lenders would turn you away. Why? Because low down payments typically mean higher risk.

Mortgage insurance closes the gap. It says to the lender, “Go ahead and approve the loan. If anything happens, we’ve got your back.”

The Benefits for You

While it doesn’t protect you directly, mortgage insurance offers these hidden benefits:

Easier loan approval

Lower upfront savings required

Faster path to homeownership

Opportunity to build equity sooner

For people with solid income but limited savings or younger buyers just starting out it’s often the only path to owning a home.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

Types of Mortgage Insurance

Understanding how mortgage insurance works with different loan types can save you thousands of dollars. Let’s explore each one.

Conventional Loans and PMI

Private Mortgage Insurance (PMI) is used with conventional loans. It’s arranged by your lender and provided by a private insurer.

Required when your down payment is less than 20%

Monthly premiums vary based on loan amount, credit score, and loan term

PMI can be canceled once you reach 20% equity in your home

📝 Pro Tip: If your credit score is excellent (typically above 740), PMI can be surprisingly affordable—sometimes under $100/month.

FHA Loans

FHA loans are backed by the Federal Housing Administration. They’re ideal for borrowers with lower credit scores or smaller down payments.

- Require an upfront mortgage insurance premium (UFMIP), usually 1.75% of the loan amount

- Monthly mortgage insurance premiums (MIP) are also required

The monthly MIP lasts for the life of the loan unless you refinance into a conventional loan later on.

USDA Loans

These loans are for rural and some suburban homebuyers. They don’t require a down payment but do include:

1% upfront guarantee fee

0.35% annual fee, broken into monthly payments

They’re more affordable than FHA in terms of insurance, but refinancing options may be limited.

VA Loans

VA loans are available to veterans, active-duty service members, and eligible surviving spouses.

- No monthly mortgage insurance

- A one-time VA funding fee replaces traditional insurance

🎖️ Veterans with service-related disabilities may qualify for a waiver of the funding fee, making this one of the most affordable loan types available.

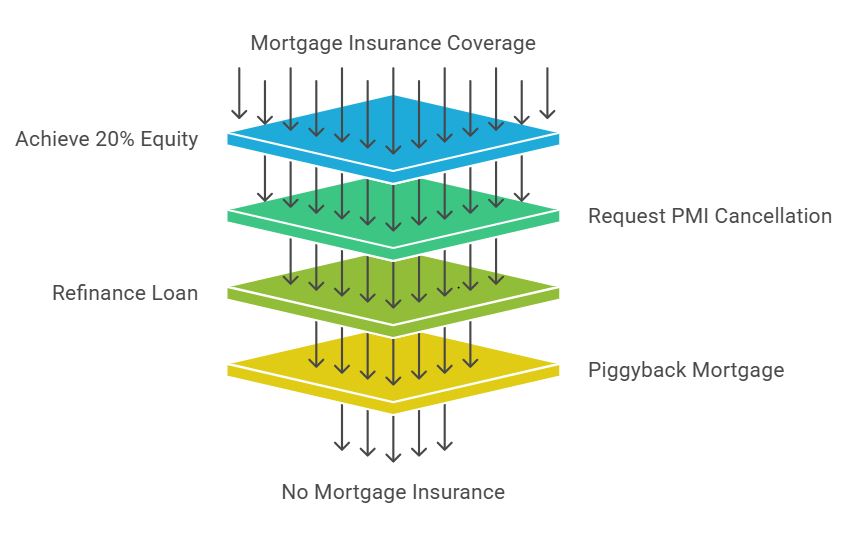

How to Cancel or Avoid Mortgage Insurance

While mortgage insurance helps you get in the door, it doesn’t have to stick around forever.

1. Reach 20% Equity

Once your loan balance is 80% or less of your home’s value, you can request PMI cancellation. Lenders are legally required to cancel it automatically at 78%.

2. Refinance to a Conventional Loan

If your home value has increased, refinancing could eliminate MIP from FHA loans or guarantee fees from USDA loans.

3. Piggyback Second Mortgage

An 80/10/10 loan structure can help you avoid PMI entirely. Just be aware that the second loan may come with a higher interest rate.

🔍 Always compare the long-term costs of mortgage insurance versus second mortgages or higher rates.

How Much Does Mortgage Insurance Cost?

The cost varies depending on the loan type, your credit score, and your down payment amount.

Here are some ballpark figures:

PMI: 0.5% to 1.5% annually

FHA MIP: 0.45% to 1.05%, plus 1.75% upfront

USDA: 0.35% annually + 1% upfront

VA Funding Fee: 1.25% to 3.3% (one-time fee)

Steps to Manage and Reduce Mortgage Insurance

✅ Track your equity

Check your mortgage statement and monitor your home’s value.

✅ Make extra payments

Even small additional payments toward your principal can build equity faster.

✅ Refinance strategically

Once your home appreciates in value or you pay down enough principal, refinancing can eliminate mortgage insurance.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Is mortgage insurance tax deductible?

Yes, for some homeowners. The deduction has been renewed multiple times by Congress. Check with a tax advisor for your eligibility.

How long does itDoes mortgage insurance cover me if I lose my job? take to launch?

No. Mortgage insurance protects the lender, not the borrower.

Does mortgage insurance affect my interest rate?

Only if you choose lender-paid mortgage insurance.

Can mortgage insurance be canceled?

Yes, PMI can. MIP from FHA loans often requires refinancing to remove.

Will mortgage insurance hurt my loan approval?

Not at all. It can actually make loan approval more likely!

Why do FHA loans require MIP?

Because they’re designed for lower down payments and more flexible qualifications, the risk is higher—hence the insurance.

How do I know if my forms are secure?

Check if your form provider offers encryption. All forms from GetMortgageWebsite are secure.

What platform should I use?

GetMortgageWebsite.com is built specifically for mortgage professionals with top-notch security baked in.

Conclusion

Mortgage insurance isn’t the villain it’s often made out to be. In fact, it’s a tool that has helped millions of people achieve homeownership faster and smarter.

While nobody loves extra monthly costs, the opportunity mortgage insurance unlocks is often worth it. Whether you’re buying your first home or guiding someone else through the process, understanding mortgage insurance gives you an edge.

So take a deep breath, run the numbers, and remember: you’re closer to owning a home than you think.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators