If your mortgage website is still just “online” instead of actively working for you, you’re leaving opportunities on the table.

Today’s borrowers expect instant answers, personalized experiences, and smooth digital journeys even at midnight. That’s where AI automation steps in. It doesn’t replace human loan officers; it enhances them. The right automation tools can turn your website into a 24/7 lead-generation engine that captures, qualifies, and nurtures prospects before you ever pick up the phone.

In this guide, we’ll break down exactly how AI automation improves mortgage websites, with practical examples you can actually use no tech jargon overload, no hype.

Key Takeaways

- AI automation helps mortgage websites capture and qualify leads 24/7

- Smart chatbots improve user experience without replacing human support

- Automated follow-ups increase response speed and conversions

- AI tools improve SEO, personalization, and site performance

- Mortgage professionals save time while delivering better borrower experiences

Why AI Automation Matters for Mortgage Websites

Mortgage decisions aren’t impulsive purchases. Borrowers research, compare, hesitate, and revisit multiple times. A static website can’t adapt to that behavior. AI-powered automation can.

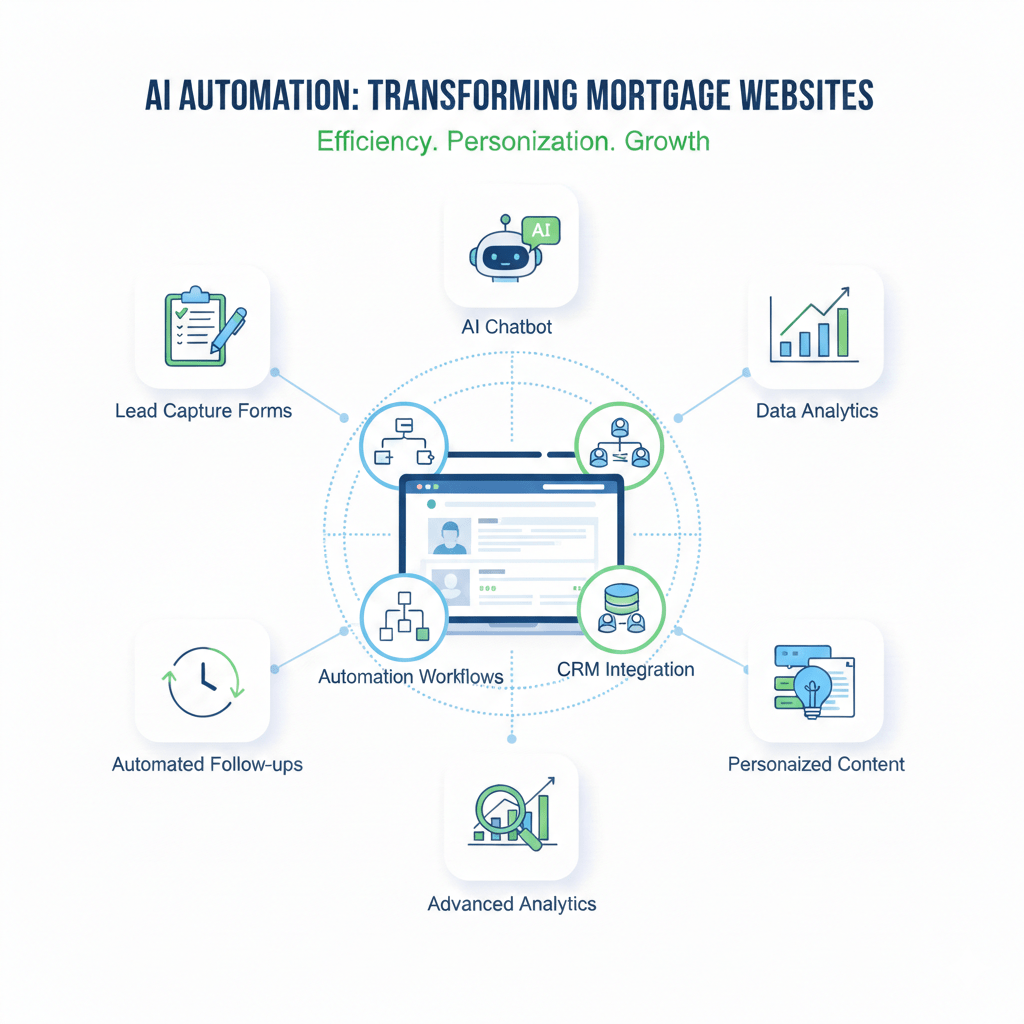

Here’s what automation changes:

- It responds instantly instead of hours later

- It personalizes content instead of showing the same page to everyone

- It nurtures leads instead of letting them disappear

In short, AI allows your website to behave more like a smart assistant and less like a digital brochure.

How AI Automation Improves Mortgage Websites Lead Capture

Smarter Forms That Ask the Right Questions

Traditional contact forms ask for name, email, and phone—and that’s it. AI-enhanced forms go further.

With automation, your mortgage website can:

- Ask follow-up questions dynamically

- Adjust questions based on user responses

- Segment leads automatically based on intent

For example, if a visitor selects “First-Time Homebuyer,” the form can instantly show questions related to credit score, down payment, or timeline without overwhelming them upfront.

This improves completion rates and gives loan officers better-quality leads.

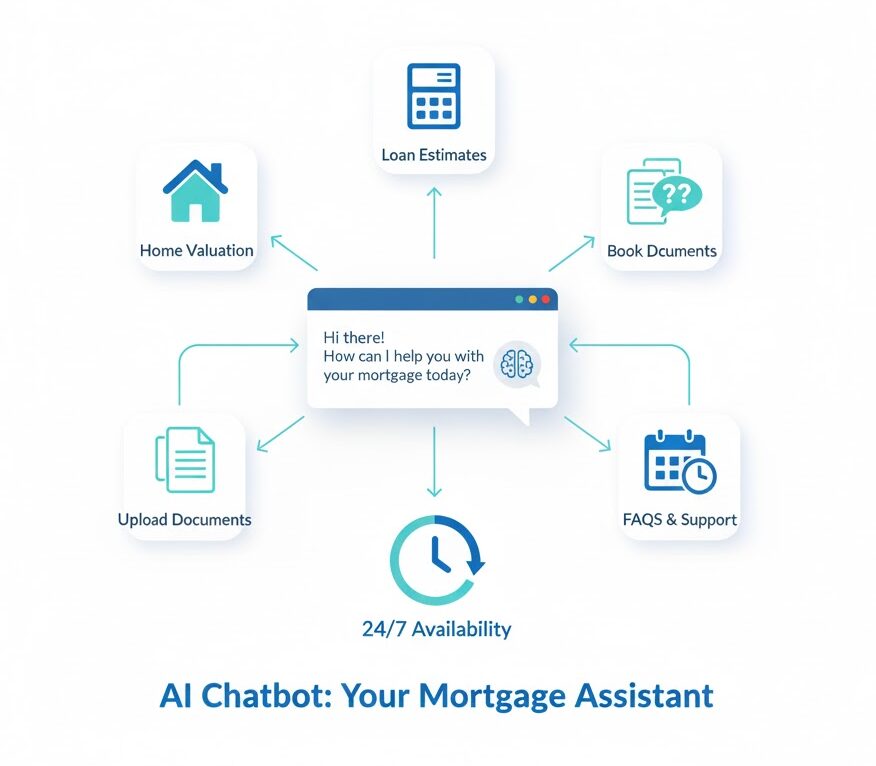

AI Chatbots That Actually Help Borrowers

Always-On Conversations Without Being Pushy

AI chatbots have come a long way. On modern mortgage websites, they’re no longer annoying popups—they’re helpful guides.

A well-trained chatbot can:

- Answer common mortgage questions instantly

- Help users find the right loan program pages

- Book appointments directly on your calendar

- Route high-intent leads to your CRM

Most importantly, chatbots reduce friction. Borrowers don’t need to “figure things out” — they’re guided.

This is especially powerful after business hours, when many prospects are researching quietly without wanting to make a call.

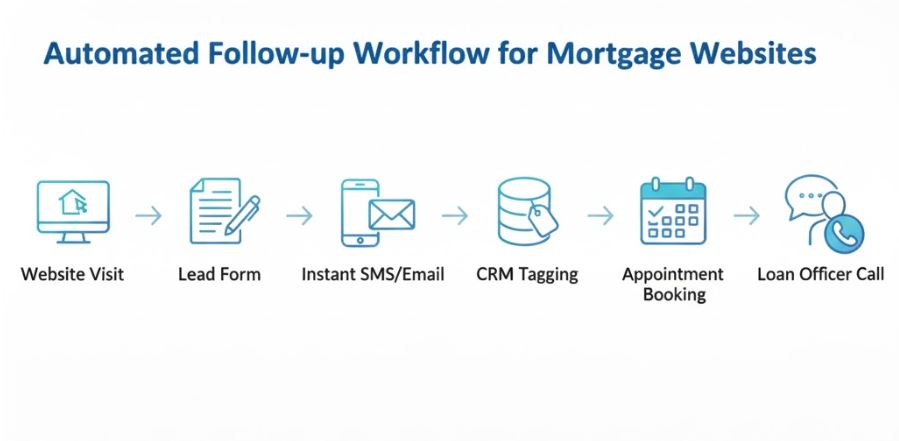

Automating Follow-Ups Without Losing the Human Touch

Speed Wins in Mortgage Lead Conversion

Studies consistently show that leads contacted within the first 5 minutes are far more likely to convert. AI automation makes that possible without burning out your team.

With automation, mortgage websites can trigger:

- Instant SMS or email confirmations

- Educational follow-up sequences

- Appointment reminders

- Long-term nurture campaigns

The key is that automation handles the first response, while humans handle the relationship.

Instead of replacing loan officers, AI gives them warmer, more informed conversations.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

Mortgage Websites and AI-Powered Personalization

One Website, Multiple Experiences

Not every visitor is the same — and AI makes sure your site doesn’t treat them that way.

AI automation allows mortgage websites to personalize:

- Headlines based on traffic source

- Content based on visitor behavior

- CTAs based on intent level

For example:

- A returning visitor may see “Continue Where You Left Off”

- A new visitor may see “Explore Loan Programs”

- A high-intent user may see “Get Pre-Qualified Today.”

This type of personalization significantly enhances engagement and reduces bounce rates.

Using AI Automation to Improve Mortgage Website SEO

Smarter Content, Better Rankings

AI doesn’t just help with leads it improves visibility.

Automation tools can help mortgage websites:

- Identify SEO keywords and content gaps

- Update blog content automatically

- Optimize page speed and mobile performance

- Improve internal linking structure

Some platforms even suggest content topics based on what borrowers are actively searching for—helping you stay relevant without constant manual research.

When paired with human oversight, AI becomes an SEO assistant, not a shortcut.

How to Add AI Automation to Your Mortgage Website

Step 1: Audit Your Current Website

Before adding tools, identify bottlenecks:

- Where do users drop off?

- Which forms don’t convert?

- How fast are follow-ups?

Step 2: Start With Lead Capture Automation

Add:

- Smart forms

- Chatbot entry points

- CRM integrations

This delivers immediate ROI.

Step 3: Automate Follow-Ups and Nurture

Set up:

- Instant confirmations

- Educational email flows

- SMS reminders

Keep messages friendly, helpful, and human.

Step 4: Add Personalization Gradually

Test:

- Dynamic CTAs

- Personalized content sections

- Behavior-based workflows

Step 5: Monitor and Improve

AI works best when refined. Review:

- Conversion rates

- Engagement metrics

- Lead quality

Adjust workflows as needed.

Common Myths About AI Automation for Mortgage Websites

AI Feels Robotic

Only when poorly implemented. Well-written automation feels more consistent and responsive than rushed human replies.

AI Replaces Loan Officers

It doesn’t. It removes repetitive tasks so loan officers can focus on conversations that matter.

AI Is Too Complicated

Modern platforms make automation accessible — often without coding.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Is AI automation expensive for mortgage websites?

Not necessarily. Many platforms bundle automation tools, making them more affordable than hiring additional staff.

Will automation hurt personalization?

Actually, it improves it by delivering timely, relevant responses based on user behavior.

Can AI automation work with existing CRMs?

Yes. Most modern mortgage websites integrate seamlessly with popular CRMs.

Is AI automation compliant for mortgage marketing?

Most modern mortgage chatbot systems integrate seamlessly with CRMs for automation and follow-up.

How long does it take to see results?

When configured correctly and reviewed regularly, AI tools can support compliance rather than hinder it.

How quickly can automation be implemented?

Many features can be live within days, not months.

Can Mortgage Website Templates be customized for my business?

Yes. Most modern Mortgage Website Templates allow you to customize branding, content, layouts, and calls to action so your website reflects your unique business while remaining optimized for mobile and SEO.

Does AI help with long-term nurturing?

Absolutely. Automation excels at staying in touch without being intrusive.

Conclusion

AI automation isn’t about turning mortgage websites into machines; it’s about making them more human at scale. When used thoughtfully, AI helps your website respond faster, guide borrowers more clearly, and support them at every stage of their decision-making journey.

Today’s borrowers expect convenience, clarity, and instant engagement. Mortgage websites powered by AI automation deliver exactly that without replacing the trust-building role of a loan officer. Instead of chasing leads, answering the same questions repeatedly, or worrying about missed follow-ups, professionals can focus on what truly matters: relationships, guidance, and closing the right loans.

The mortgage industry will continue to evolve, but one thing is clear websites that listen, adapt, and respond intelligently will outperform those that simply exist online. By embracing AI automation now, you’re not just upgrading your website; you’re future-proofing your entire digital presence and setting your business up for sustainable growth.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators