Your website is your first impression—make it count.

Imagine walking into a mortgage office that hasn’t updated its flyers, technology, or branding since 2015. It would feel outdated, right?

Well, your website is your digital office—and it’s often the first place borrowers and partners visit. If it’s not updated regularly, it could be doing more harm than good. In fact, 48% of users say a website’s design is the number one factor in deciding a business’s credibility.

In a competitive space like mortgage lending, where trust, authority, and timely information are critical, keeping your website fresh is more than just a “nice to have”—it’s essential for growth, SEO, compliance, and conversion.

Let’s explore exactly how regular website updates can help your mortgage business thrive online.

Key Takeaways

📈 Fresh websites perform better in search engines and attract more organic traffic

🤝 Updated designs increase trust and conversion rates

💬 Modern features like live chat and calculators boost user engagement

🧠 Educational content shows authority and helps borrowers make decisions

🔐 Updated websites stay secure, compliant, and mobile-optimized

🚀 Platforms like GetMortgageWebsite make updates fast and simple

🔄 When paired with TheBigBot CRM, updates lead to better follow-up and more deals

First impressions are more important than ever

Did you know that it takes only 0.05 seconds for users to form an opinion about your website?

And 88% of online visitors won’t return to a website after a bad user experience.

That’s why the look, feel, and speed of your mortgage website can be a deal-maker—or breaker.

An outdated website

- Feels untrustworthy

- Loads slowly, especially on mobile

- Isn’t optimized for modern browsers or devices

- Lacks compelling visuals or social proof

- Is missing features borrowers now expect (like live chat or calculators)

✨ Example Fix: Switching from an old WordPress theme to a mobile-first design on GetMortgageWebsite boosts your Google PageSpeed score to 90+ and cuts bounce rates by up to 35%.

SEO Rewards Fresh Relevant Content

Search engines love websites that evolve. If your site hasn’t changed in 6+ months, it signals to Google that it may be outdated or irrelevant.

Here’s how regular updates improve your SEO:

New blog posts give you more opportunities to rank

Fresh metadata and alt text improve keyword targeting

Updated internal links improve crawlability

Optimized headlines and CTAs increase time on site

Stat to Know: Companies that blog 16+ times per month get 3.5X more traffic than those that blog fewer than 4 times. With GetMortgageWebsite, you get access to over 200+ blog articles, a built-in blogging platform, and weekly content updates—saving you time while boosting SEO.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

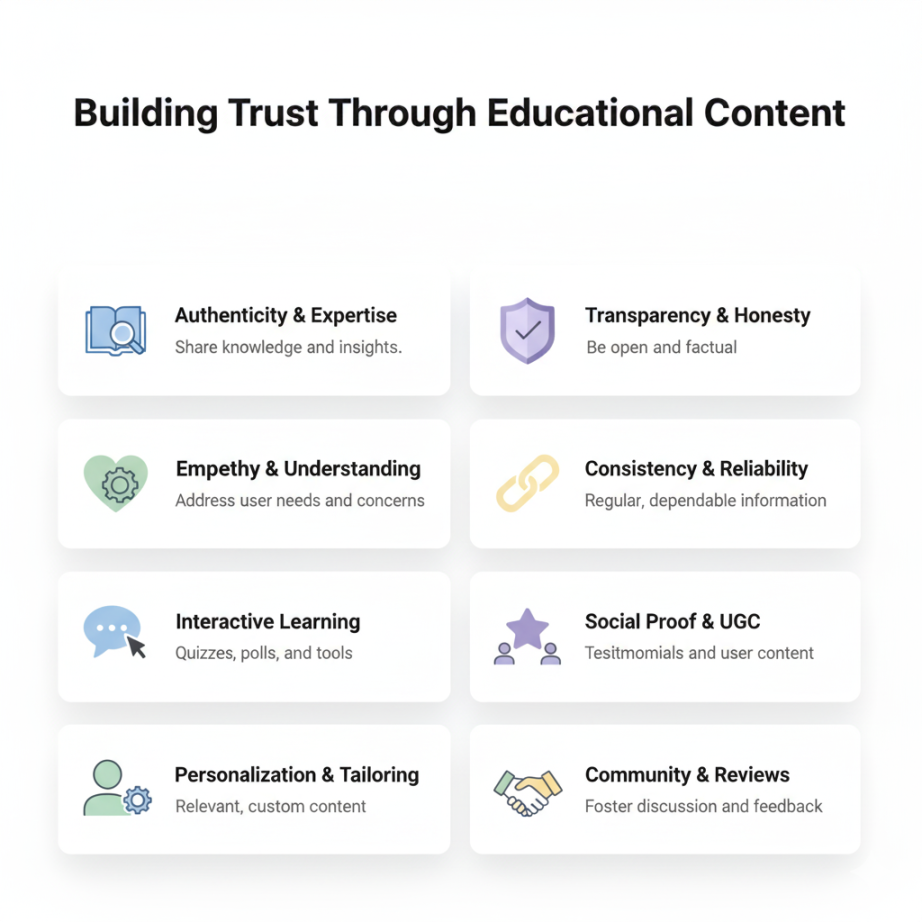

Educational Content Builds Trust

Buying a home (or refinancing one) is a huge decision. Most borrowers are nervous, confused, or overwhelmed. What they need is education—and that’s where your website can shine.

Add content like:

- FAQs about mortgage terms

- Articles explaining loan programs (FHA, VA, USDA, etc.)

- Guides for first-time buyers

- Loan comparison tools

- Educational videos and webinars

🎓 Platforms like GetMortgageWebsite include a full Learning Center with 27 prewritten articles that position you as the expert.

The more helpful your content is, the more likely people are to trust you—and convert.

Conversion Optimization Through Design and Functionality

Great content draws people in. But it’s your forms, CTAs, calculators, and layout that get them to act.

Updating your website regularly ensures:

All contact forms are working correctly

Mortgage calculators are accurate and intuitive

Lead magnets and landing pages are optimized

Your CTAs reflect seasonal or market-relevant messaging

Review widgets and trust signals are visible

🔥 Example: Custom Thank You Pages on GetMortgageWebsite let you add a video message, calendar booking link, or next-step instructions—reducing drop-offs by over 40%.

Security and Compliance Require Regular Updates

The mortgage industry is no place for sloppy data handling or non-compliant websites.

If your site collects data (lead forms, 1003s, calculators, reviews), it must be:

- SSL-secured

- Regularly backed up

- Updated to prevent hacking vulnerabilities

- GDPR/CCPA compliant if applicable

With GetMortgageWebsite, you’re covered:

✅ SSL included

✅ Daily backups

✅ Secure hosting

✅ Compliant lead capture forms

✅ Option for secure 1003 integration (MISMO 3.4)

Stay Competitive and Relevant

It’s not just about looking good—it’s about staying ahead of the pack.

Today’s borrowers are savvier than ever. They compare sites, check online reviews, and Google lenders before ever picking up the phone.

If your competitors have sleek designs, fresh reviews, smart lead funnels, integrated CRMs, and fast response times, they’re setting a high standard that today’s customers expect. These features not only make their brand look modern and trustworthy but also ensure a smoother, faster, and more personalized experience for potential clients—giving them an edge in capturing leads and closing deals before you even get a chance.

🧠 The average mortgage client checks 5-10 websites before making a decision. You need to stand out and provide real value fast.

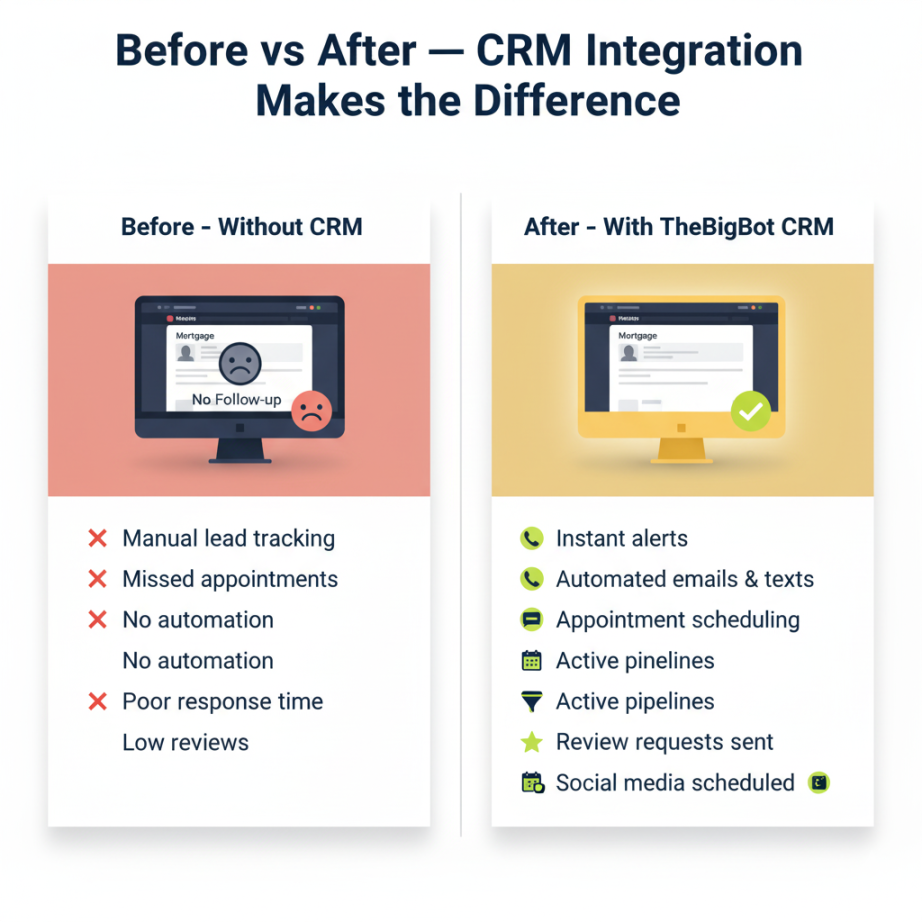

CRM + Website = A Conversion Powerhouse

You can have the best-looking website in the world—but if you’re not following up with your leads, you’re wasting traffic.

That’s why pairing your updated site with a smart CRM like TheBigBot CRM is key.

Benefits of using TheBigBot CRM:

- Instant lead alerts to your phone or email

- Text, email, and voice automation

- Pipeline management tools

- Integrated appointment booking

- Automated review requests

- Social media scheduling

💬 Imagine a lead comes in through your updated site… they instantly receive a welcome email, a follow-up text, and an appointment link. You didn’t have to lift a finger.

That’s the power of sync between GetMortgageWebsite and TheBigBot CRM.

Action Plan to Start Updating Today 🧭

Want to revamp your site but not sure where to start? Here’s a simple checklist:

Benefits of using TheBigBot CRM:

✅ Review all lead forms (are they working?)

✅ Check for broken links or outdated info

✅ Add at least one new blog post this month

✅ Highlight your latest client reviews

✅ Add a mortgage calculator or explainer video

✅ Ensure your site is mobile-friendly and secure

✅ Schedule a demo with GetMortgageWebsite to explore options

🚀 Bonus Tip: Launch a seasonal campaign with a custom landing page (e.g., “Spring First-Time Buyer Offers”) to attract niche traffic.

Frequently Asked Questions

How often should I update my mortgage website?

Ideally, update blog content weekly and other features (CTAs, rates, reviews, etc.) monthly.

Can I use my own domain?

Yes! You can connect your existing domain or get help securing a new one.

Is a CRM really necessary?

Absolutely. Without one, you’re likely losing leads that could be nurtured into closed deals.

How much does it cost to get started?

Plans are flexible and affordable. There are no long-term contracts, and everything is included—hosting, backups, CRM integration, blog access, and more.

Conclusion

Your mortgage website is more than a digital brochure.

It’s your top salesperson, working around the clock to attract, inform, and convert.

But just like any star employee, it needs training, upgrades, and attention to keep performing.

If you haven’t updated your site in a while, now is the time.

✔️ A modern design

✔️ Fresh content

✔️ Smart automation

✔️ Secure and mobile-friendly

And with platforms like GetMortgageWebsite and TheBigBot CRM, you don’t have to do it all yourself.

🎯 Schedule a free demo today and see how effortless it can be to give your mortgage business the online upgrade it deserves.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.