If you’re a mortgage broker, loan officer, or independent mortgage banker in Florida, having a website is no longer optional it’s your digital storefront. With more than 97% of homebuyers starting their journey online (source: NAR), a great Mortgage Website Design can make the difference between gaining a loyal client and losing them to a competitor.

But what does a “great” mortgage website actually look like? And how can you build one that attracts leads 24/7, builds trust, and fits seamlessly into your workflow?

In this guide, we’ll break it down step by step.

Key Takeaways

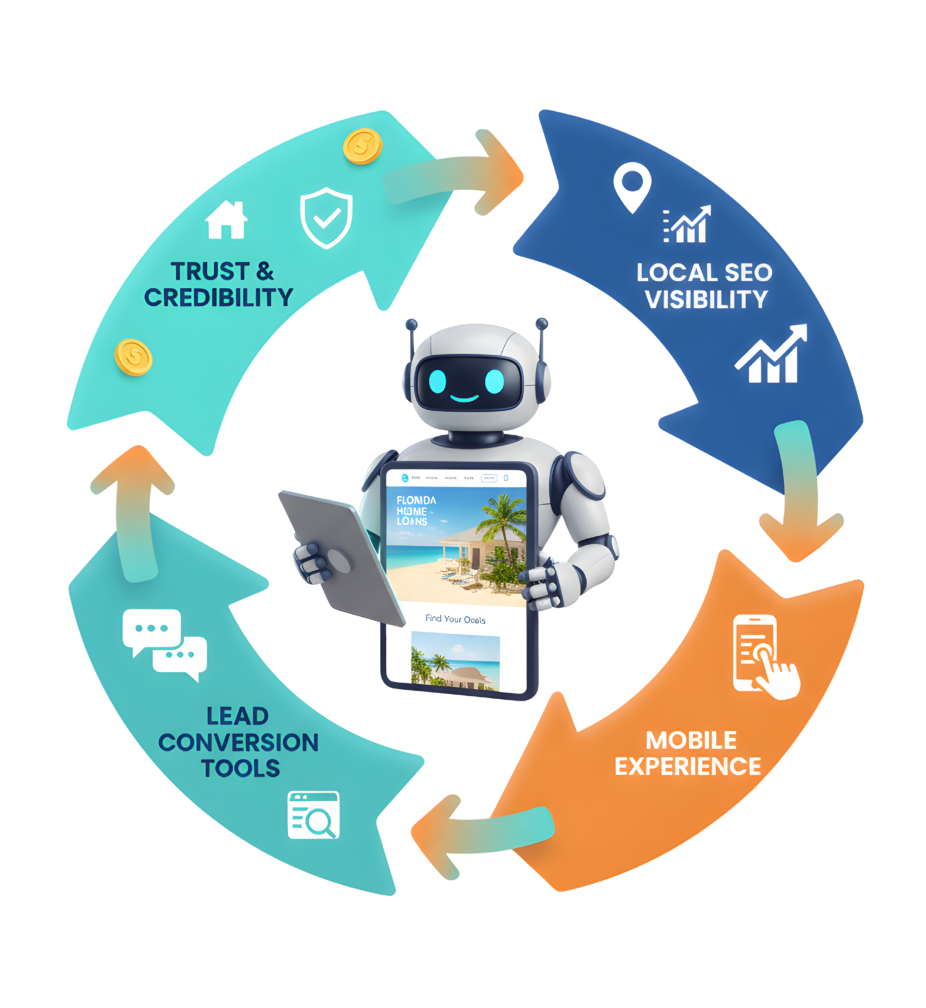

- A modern mortgage website is your #1 tool for trust and lead generation in Florida’s competitive market.

- Mobile-first design and SEO optimization are essential to rank and convert effectively.

- Integrating CRM tools and lead capture systems boosts response times and follow-ups.

- Florida-specific branding, loan program pages, and local SEO give you a competitive edge.

- You don’t need to be a tech wizard to launch a powerful site the right platform does the heavy lifting.

Why Florida Mortgage Professionals Need Strong Website Design

- Build instant trust with a professional, modern design.

- Rank locally for competitive keywords like “Florida mortgage broker” or “home loans in Miami.”

- Offer seamless experiences across mobile and desktop.

- Convert browsers into leads through forms, chat tools, and calculators.

👉 According to Zillow, 67% of borrowers choose the first lender they connect with online, highlighting why first impressions matter more than ever.

Key Elements of Effective Mortgage Website Design

Mobile-First and SEO-Optimized

More than 60% of mortgage site visitors come from mobile devices. Your design must be responsive, fast-loading, and easy to navigate on smartphones and tablets. Google’s Core Web Vitals also affect your rankings so a 90+ performance score should be your goal.

Tips:

- Use lightweight images and optimized code.

- Stick to clean navigation menus.

- Ensure forms work flawlessly on all devices.

Trust-Building Visuals and Messaging

💡 Example: A Tampa-based loan officer increased conversions by 34% after adding verified Google Reviews to their homepage.

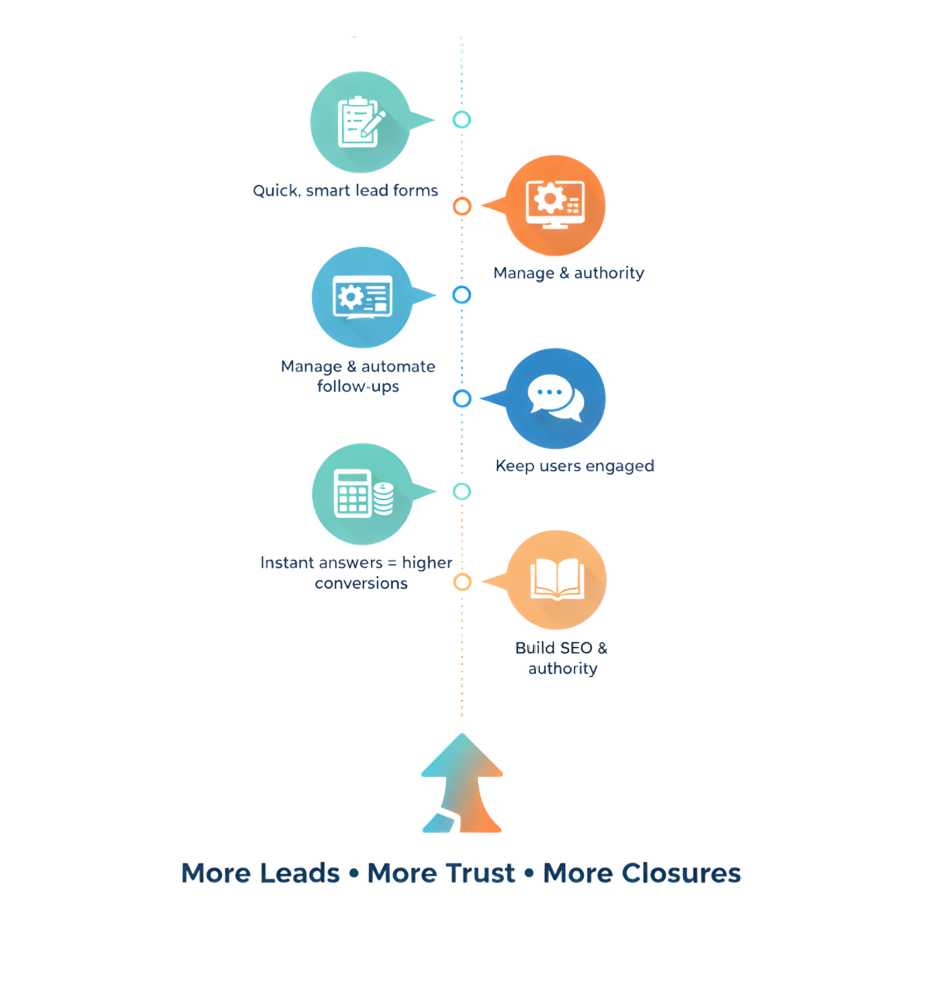

Lead Capture Systems That Work 24/7

Embedding customizable forms, real-time chat, and 1003 loan application integration makes it easy for prospects to take the next step—even after business hours. Automated follow-ups ensure no lead slips through the cracks.

Lead Capture Systems That Work 24/7

Ready to grow your mortgage business online?

Stop losing leads to competitors with better websites

Step-by-Step Guide to Building Your Florida Mortgage Website

Step 1 Choose the Right Platform

Step 2 Define Your Florida-Focused Branding

- Use local keywords like “Orlando Mortgage Broker” or “Miami FHA Loans.”

- Include Florida maps, neighborhood guides, and local imagery.

- Create blog content targeting Florida homebuyer questions.

Step 3 Structure Pages Strategically

Essential pages to include:

🏠 Homepage with clear CTAs

🧍 About Us / Team Page to humanize your brand

📝 Loan Programs highlighting FHA, VA, USDA, Conventional, Jumbo, and Florida-specific programs

📞 Contact Page with embedded maps and click-to-call buttons

📚 Blog / Learning Center for SEO and client education

Step 4 Add Advanced Mortgage Calculators

A good Mortgage Website Design includes interactive calculators for purchase, refinance, VA, and more. These tools keep users engaged and encourage lead form submissions once they’ve explored their numbers.

Step 5 Launch and Optimize for SEO

- Submit your site to Google Search Console.

- Optimize title tags, meta descriptions, and internal links.

- Add schema markup for local business data.

- Continuously update blog content to target seasonal Florida mortgage trends.

Real Florida Mortgage Website Examples

Example 1 Miami Mortgage Pros

Example 2

Focused on mobile-first design, this site loads in under 2 seconds and includes 7 mortgage calculators, blog updates, and a multilingual interface for Florida’s diverse audience.

Core Features Every Mortgage Website Should Have

Lead Capture Forms

CRM Integration

A powerful backend CRM helps you track leads, automate emails, and schedule follow-ups effortlessly. This ensures no opportunity slips through the cracks.

Real-Time Chat Support

Mortgage Calculators

Florida buyers love to “crunch the numbers” before reaching out. Offering purchase, refinance, and VA calculators keeps them engaged longer.

Blog and Resource Center

Regular blog posts on topics like “Florida Mortgage Rates 2025” or “FHA vs Conventional in Miami” improve SEO and establish authority.

Launch Your Website in Days, Not Months

Get a mortgage site built for California professionals, live in just 3–5 business days.

Frequently Asked Questions

How long does it take to build a mortgage website?

Typically, 3–5 business days with a professional platform.

Do I need technical skills to manage the website?

No. The platform is designed for mortgage professionals, not developers.

Do I need to sign a long-term contract?

No, flexible monthly plans are available — no contracts needed.

What’s the cost of a mortgage website?

Plans start at affordable monthly rates, often less than the cost of a single lead.

Is SEO included?

Basic on-page SEO is included, and you can expand it with blog content.

Can I make edits myself?

Yes, the platform allows easy drag-and-drop edits without needing a developer.

What integrations are available?

Calculators, email tools, review platforms, social media, and more.

What if I need support after launch?

An in-house support team is available to help with updates, edits, and guidance whenever you need it.

Conclusion

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators