In the mortgage industry, landing a new client is only half the battle keeping them for life is where the real growth happens. For mortgage brokers, repeat clients aren’t just easier to convert, they also bring in valuable referrals and a steady flow of business that reduces the need for constant prospecting.

With today’s competitive market, borrowers have more choices than ever. To stand out, mortgage brokers must master the art of creating an exceptional experience that keeps clients coming back whether it’s for refinancing, investment properties, or their next dream home.

In this guide, we’ll explore practical, proven strategies to help you transform one-time borrowers into lifelong clients who trust you above the competition.

Key Takeaways

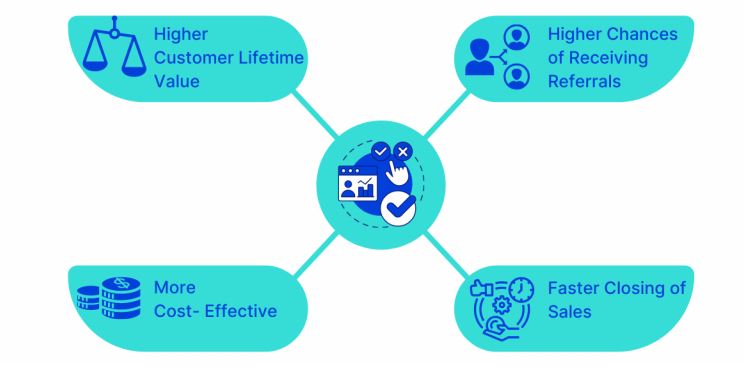

Repeat clients cost far less to retain than acquiring brand-new ones.

Consistent, meaningful follow-ups keep you top of mind.

Technology and automation make staying connected easier than ever.

Personalization turns good service into memorable service.

A great post-closing experience can lead to years of loyalty and referrals.

Why Repeat Clients Matter More Than Ever

Acquiring a new mortgage client can cost 5–10 times more than keeping an existing one. And yet, according to the National Association of Realtors, while 90% of clients say they would work with the same professional again, only about 12% actually do.

Why the drop-off? Most brokers simply lose touch. Without regular, valuable communication, clients drift toward other options.

For mortgage brokers, the math is simple: staying in touch and delivering ongoing value directly increases your chances of repeat business and that’s where the most profitable relationships are built.

Build Trust From the First Conversation

When you meet a new client, you’re not just arranging financing you’re asking them to trust you with one of the biggest financial decisions of their life. That trust starts immediately.

How to build trust quickly:

- Be upfront and transparent about rates, fees, and timelines.

- Educate; don’t just sell. Explain options clearly so clients feel empowered.

- Show proof of results with client testimonials and case studies.

Pro Tip: Trust isn’t a one-time win. Keep reinforcing it through every interaction, even after closing.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

Stay in Touch Without Feeling sale

Too many brokers go silent after the loan closes and that’s where repeat business is lost. The key is to stay in touch naturally, without always “selling” something.

Year-round touchpoints:

Quarterly newsletters with mortgage tips, market updates, or rate changes.

Annual mortgage reviews to identify refinancing or investment opportunities.

Personal notes on birthdays, holidays, or homeownership anniversaries.

A mortgage CRM can handle most of this automatically. Platforms like GetMortgageWebsite.com integrate CRM tools so you can set it up once and stay connected forever.

Personalize Every Interaction

Clients remember how you made them feel. That’s why personalization is one of the most powerful retention tools you have.

Examples:

Remember their kids’ names or major life milestones.

Tailor your recommendations based on their long-term goals.

Follow up with investment tips if they’ve expressed interest in rental properties.

Personalized follow-up emails enjoy a 29% higher open rate because people respond when they know you’re speaking directly to them.

Deliver Value Long After Closing 📈

Most clients won’t need a new mortgage right away but they will still need mortgage-related insights, market updates, and homeowner advice.

Ideas for post-closing value:

- Send homeownership guides

- Host annual Q&A webinars about real estate market changes.

- Offer free rate checks when market conditions shift.

Even small touches, like sending property value updates, keep you relevant and appreciated.

Use Technology to Make Loyalty Effortless

Borrowers expect convenience, speed, and smooth communication. The right tools make this simple.

Tech to consider:

- Mortgage CRM for contact management and automated follow-ups.

- Online applications for quick, paperless submissions.

- Mortgage calculators embedded in your website so clients can explore scenarios anytime.

With a platform like GetMortgageWebsite.com, you can combine these features into one sleek, professional site giving clients the digital experience they expect.

Turn Clients Into Referral Champions

A happy client is your best salesperson. If you’ve provided a great experience, they’ll gladly share your name but you have to ask.

Ways to encourage referrals:

- Offer a simple “thank you” gift or card when they refer someone.

- Make review requests easy with direct links to Google or Zillow.

- Share client success stories on your social channels (with permission).

Fun fact: A referred client is 4x more likely to close than a cold lead.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Why do mortgage brokers lose repeat clients?

Usually because they don’t stay in touch or offer post-closing value.

How often should I follow up with past clients?

At least quarterly, plus special occasions like birthdays or home anniversaries.

Is email marketing still effective for client retention?

Yes especially when messages are personalized and relevant to the client’s needs.

What tools help mortgage brokers keep in touch?

Mortgage CRMs, automated email platforms, and scheduling tools .

Do clients really refinance with the same broker?

How can I personalize my client communication?

Yes, if you’ve built trust and stayed in touch with timely updates.

How do I get more online reviews?

Ask right after closing, send direct review links, and make it quick and easy.

What platform should I use?

GetMortgageWebsite.com is built specifically for mortgage professionals with top-notch security baked in. Mortgage website security also avaliable.

Conclusion

For mortgage brokers, repeat clients aren’t just “nice to have” they’re the foundation of a profitable, sustainable business. By building trust early, maintaining regular and meaningful contact, personalizing every interaction, and using technology to make the process effortless, you can turn one-time borrowers into lifelong advocates.

The brokers who will thrive in 2025 aren’t just great closers they’re relationship builders. When you master client loyalty, the referrals and repeat business will follow.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators