The mortgage world isn’t what it was five years ago. Borrowers are smarter, faster, and more digitally connected than ever before. As a loan officer in 2025, you’re no longer just competing against the bank down the street you are competing against online lenders, AI-powered apps, and national brands with million dollar ad budgets.

So how do you stand out?

How do you ensure that when a prospect starts Googling “best mortgage lender near me,” your name rises to the top?

This guide is your blueprint. Whether you’re a seasoned loan officer looking to level up your lead pipeline or a newcomer trying to break into the industry, you’ll find practical strategies, insider tips, and the latest tools to make lead generation your superpower.

Key Takeaways

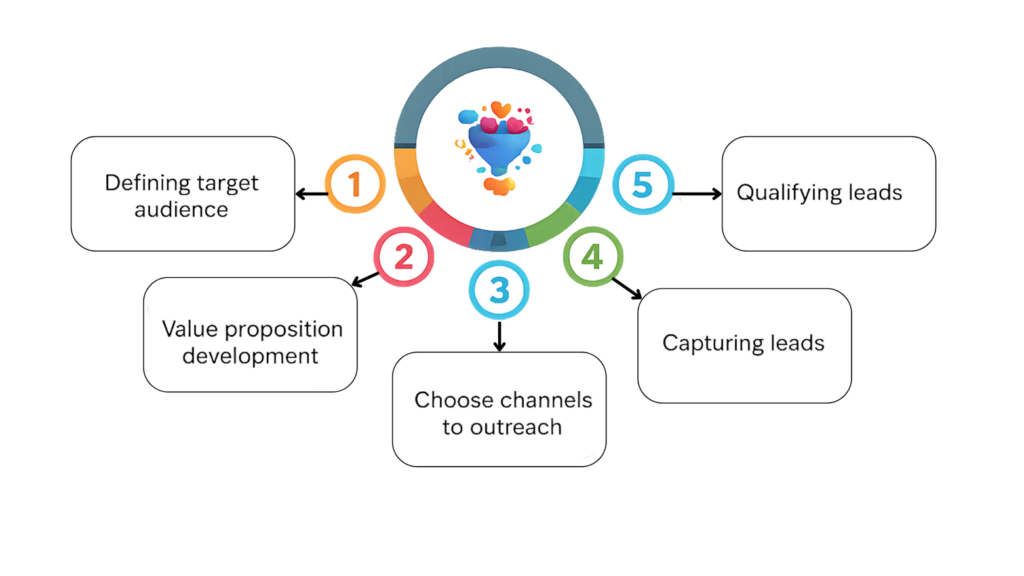

✅ Proven lead generation tactics tailored for loan officers in 2025

✅ Step-by-step guide to setting up a lead funnel that actually converts

✅ Insights into using automation and AI without losing your personal touch

✅ Tips for building referral networks that bring in high-quality leads

✅ Tools and resources to help you dominate your market this year

Why Lead Generation for Loan Officers Is a Game-Changer in 2025

Today’s homebuyers are digital first. According to a 2025 report from the National Association of Realtors, 97% of buyers begin their home search online. Yet, only 48% of loan officers say they have a consistent digital lead generation strategy. That’s a massive gap and a massive opportunity for you.

Imagine this:

You wake up to five new pre-qualified leads sitting in your CRM. Each one already familiar with your brand, your services, and ready for a conversation. No cold calls. No door knocking. Just warm, high-intent prospects.

That’s the power of modern lead generation done right.

Build a High-Converting Mortgage Website

Think of your website as your digital handshake it’s often the very first interaction a potential client will have with your business. And as we all know, first impressions matter. If your site looks outdated, loads slowly, or is tricky to navigate on a smartphone, you’re not just losing visitors you’re losing leads. In 2025, borrowers expect a seamless online experience, and if they don’t get it from you, they’ll move on to the next lender faster than you can say pre-approval.

So, what sets a truly high-performing mortgage website apart from the rest?

✅ Mobile-first design – With over 70% of mortgage-related searches now happening on smartphones, your website needs to look and function flawlessly on smaller screens. A clunky mobile experience is no longer forgivable—it’s a deal breaker.

✅ Lead capture forms – Make it easy for visitors to take the next step. Whether it’s a quick pre-approval application, a rate checker tool, or an offer for a free consultation, your site should invite action with clear, user-friendly forms.

✅ Trust signals – Borrowers want to know they’re in good hands. Show off your 5-star reviews, display trust badges, and use professional photos of yourself and your team to build credibility at a glance.

✅ Educational content – Position yourself as an expert by providing value. FAQs, mortgage calculators, and a regularly updated blog not only help your clients but also boost your SEO rankings.

🔗 Pro Tip: Want to see what a modern, lead-focused mortgage website looks like? Check out GetMortgageWebsite.com for stunning examples designed specifically for loan officers.

Leverage Social Media to Build Your Brand

You don’t have to dance on TikTok unless that’s your style. In 2025, showing up on social media is no longer optional for loan officers; it’s essential. Why? Because your audience is already there. Homebuyers, especially millennials and Gen Z, scroll through Facebook, Instagram, and LinkedIn every day, looking for advice, recommendations, and lenders they can trust.

By building a consistent presence on these platforms, you’re not just marketing. You’re starting conversations, nurturing relationships, and staying top of mind when prospects are ready to take action.

Platforms That Work Best

✅ Facebook – Ideal for targeting local audiences and first-time buyers. Facebook Ads allow you to reach hyper-specific demographics like “first-time homebuyers within 10 miles of [your city].” Plus, groups and community pages are great spaces to answer questions and share insights.

✅ LinkedIn – Perfect for networking with real estate agents, financial advisors, and other potential referral partners. Share professional updates, industry news, and thought leadership content to position yourself as a trusted authority.

✅ Instagram – Showcase your brand’s personality through photos and short videos. Use Stories and Reels to highlight success stories, offer quick mortgage tips, or take followers behind the scenes of your day as a loan officer.

What Should You Post?

📌 Mortgage tips – (“Marketing Tips Using Your Website”) Simple, helpful advice builds trust and keeps you top of mind.

📌 Client testimonials – Share success stories (with client permission) to demonstrate real results and social proof.

📌 Market updates – (“Interest rates dropped this week—here’s what it means for buyers”) This shows you’re on top of trends and adds value for your audience.

📌 Quick videos – Answer common borrower questions in 30–60 seconds. Short-form video is one of the most engaging content types in 2025.

📌 Behind-the-scenes posts – Show your team at work, community involvement, or even a photo of your favorite coffee shop. These posts humanize your brand and build connection.

🔗 Pro Tip: Schedule your posts in advance using tools like Buffer, Later, or Hootsuite to stay consistent without feeling overwhelmed.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

Automate Follow-Ups with a CRM

Every minute you wait to respond to a lead increases the chance they’ll contact another lender. That’s why CRM automation is no longer optional.

Features You Need:

✅ Automated email and SMS drip campaigns

✅ Task reminders for follow-up calls

✅ Pipeline tracking to see which stage every lead is in

✅ Integration with your calendar for instant booking

Example: With a system like CRM, you can set up a welcome email sequence that triggers as soon as a lead fills out your form. It feels personal, yet you’re hands-free.

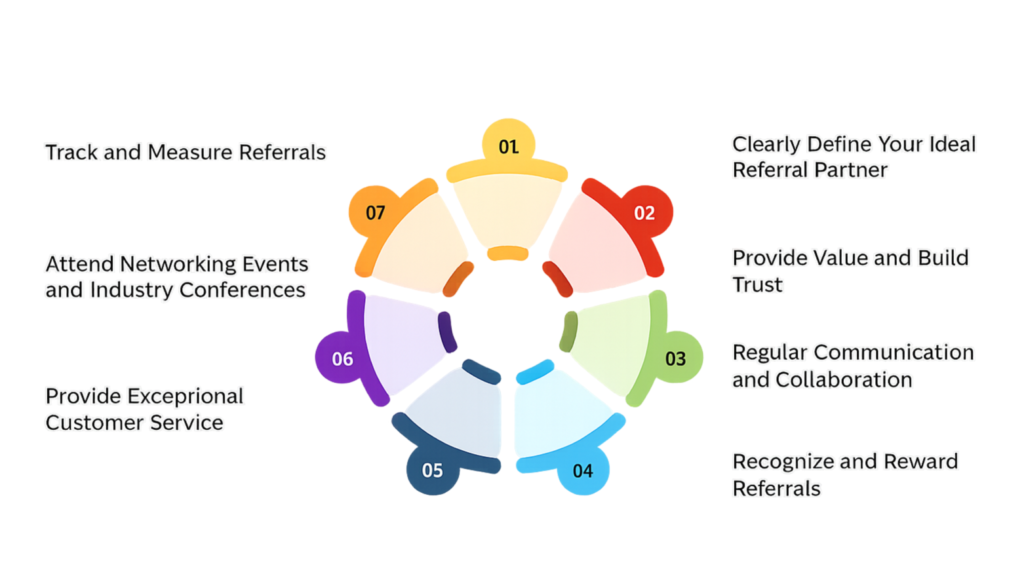

Cultivate Realtor and Referral Partner Relationships

Referral partners remain the backbone of many successful loan officers’ businesses. But in 2025, you have to offer more than donuts and flyers.

Ways to Provide Value:

Co-branded marketing campaigns

Exclusive market insights and data

Joint webinars or first-time homebuyer seminars

Pro Tip: Start a monthly email newsletter for your referral partners with updates on rates, market trends, and shared success stories.

📊 Fact: 78% of mortgage professionals say referrals are still

Master Content Marketing and SEO

If you want to position yourself as the go-to mortgage expert in your area, there’s no better strategy than content marketing paired with smart SEO. Why? Because today’s borrowers aren’t calling random lenders from the Yellow Pages they’re heading straight to Google to research their options. And the loan officer who shows up first with helpful, relevant content? That’s the one who wins their trust.

Content marketing allows you to educate, engage, and build relationships with potential clients long before they ever pick up the phone. By answering the questions your prospects are already asking online, you establish yourself as an authority in the mortgage space and attract highly qualified leads organically.

Here are some blog and video topics that resonate with borrowers in 2025:

✅ “How Much House Can I Afford in 2025?”

A practical, step-by-step guide that demystifies affordability and helps first-time buyers plan their budget.

✅ “FHA Loans for First-Time Homebuyer ”

An actionable resource that positions you as a supportive guide for new buyers entering the market.

✅ “Is Refinancing Worth It This Year?”

A timely article that explains the pros and cons of refinancing, tailored to current market trends.

✅ “5 Ways Loan Officers Can Attract More Clients”

A myth-busting piece that builds trust by clarifying common misconceptions.

✅ “What Credit Score Do You Need for a Mortgage in 2025?”

An SEO-friendly topic that addresses a question many buyers are Googling right now.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

Frequently Asked Questions

What is the best lead generation strategy for loan officers?

How can I generate mortgage leads without cold calling?

Leverage content marketing, social media ads, and AI chatbots to attract leads organically.

What types of content should a mortgage website include?

Loan program details, blogs, FAQs, calculators, and client testimonials.

What’s the biggest mistake loan officers make in lead generation?

Not having a follow-up system most leads are lost because they aren’t nurtured properly.

How do I follow up with leads quickly?

Yes, automation handles volume, but personalized manual touches can close deals.

How can a mortgage website stand out from competitors?

Focus on intuitive design, strong trust signals, and educational resources tailored to client needs.

Can SEO really bring in mortgage leads?

Yes! High-ranking content brings in warm leads actively searching for mortgage solutions.

Conclusion

The mortgage industry is rapidly evolving, and loan officers who embrace modern lead generation strategies will always stay ahead of the curve. By focusing on building a strong online presence, leveraging automation tools, and nurturing relationships with both clients and referral partners, you can create a predictable flow of high-quality leads that fuels your business growth. Remember, success in 2025 isn’t about working harder—it’s about working smarter with the right systems and strategies in place. From SEO-driven content to personalized email campaigns and AI-powered CRMs, the opportunities to scale your business have never been greater. Start today by implementing even one of these tactics and watch how quickly your pipeline begins to transform. The future of your mortgage business is digital, and with the right approach, you can dominate your market and become the go-to loan officer in your area.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.