If you’re a loan officer still relying on referrals, social media posts, or a basic business card-style site, you’re leaving money on the table. Today’s borrowers don’t call first—they research first. They Google you, read reviews, compare options, and decide whether they trust you before they ever reach out.

That’s where loan officer websites come in—not as digital brochures, but as 24/7 sales engines that educate, build credibility, and quietly convert visitors into qualified leads.

In this guide, we’ll break down exactly what modern loan officer websites need, how much they really cost, and what kind of return on investment you can expect—without hype, fluff, or tech jargon.

Key Takeaways

- Loan officer websites act as your 24/7 digital storefront

- Mobile-first design is no longer optional—it’s mandatory

- The right features can dramatically improve lead quality

- Costs vary widely depending on DIY vs professional platforms

- A well-built site often pays for itself with one closed loan

- ROI is driven by trust, speed, automation, and visibility

- Platforms like GetMortgageWebsite.com remove technical barriers

Why Loan Officer Websites Matter More Than Ever

Borrower behavior has changed—and fast.

According to the National Association of Realtors, over 93% of homebuyers use online websites during their home search. Before they ever speak to a loan officer, they want answers to questions like:

- Can I afford this home?

- What loan programs apply to me?

- Is this lender credible and experienced?

- Are there reviews from real borrowers?

Without a professional website, you lose control of that narrative.

Your Website Is Your First Impression

- Think of your website as

- Your credibility filter

- Your digital assistant

Your lead qualification system

Strong loan officer websites don’t chase borrowers—they attract and convert them naturally.

Best Mortgage Website Platforms vs DIY Solutions

Not all mortgage websites are created equal. Below are the features that separate average sites from those that actually generate ROI.

Mobile-First, High-Performance Design

Over 65% of mortgage-related searches happen on mobile devices. If your site isn’t optimized for mobile, you’re already behind.

Key elements include

- Fast loading speeds (90+ Google PageSpeed score)

- Thumb-friendly navigation

- Clean layouts with readable fonts

- Tap-to-call and tap-to-apply buttons

Platforms like GetMortgageWebsite.com

specialize in mobile-first mortgage design, ensuring every page performs across devices.

Trust-Building Elements That Convert

Borrowers are making one of the biggest financial decisions of their lives. Trust matters.

Must-have trust signals:

- Google, Zillow, and Facebook reviews

- Professional bio with credentials

- NMLS number and licensing details

- Clear privacy and security policies

- SSL encryption

The best mortgage website platforms integrate these elements seamlessly rather than treating them as afterthoughts.

Mortgage Calculators That Keep Visitors Engaged

Mortgage calculators aren’t just tools—they’re engagement drivers.

High-converting loan officer websites include:

- Purchase calculator

- Refinance calculator

- Affordability calculator

- FHA, VA, USDA estimators

These tools:

- Increase time on site

- Reduce bounce rates

- Pre-qualify borrowers before contact

Each interaction builds trust while capturing intent-driven leads.

Online Application and Lead Capture Forms

Your website should never say, “Call me to get started.”

Instead, it should offer:

- Online 1003 application forms

- Smart lead capture funnels

- Custom thank-you pages

- Automated follow-ups

Modern systems connect directly to your CRM, so no lead slips through the cracks.

Educational Content That Positions You as an Expert

Content is what separates a website from a resource.

High-performing loan officer websites include:

- First-time buyer guides

- Loan program explanations

- Blog posts and mortgage news

- FAQ sections

Educational content improves:

- SEO rankings

- Borrower confidence

- Lead quality

Google rewards websites that teach, not just sell.

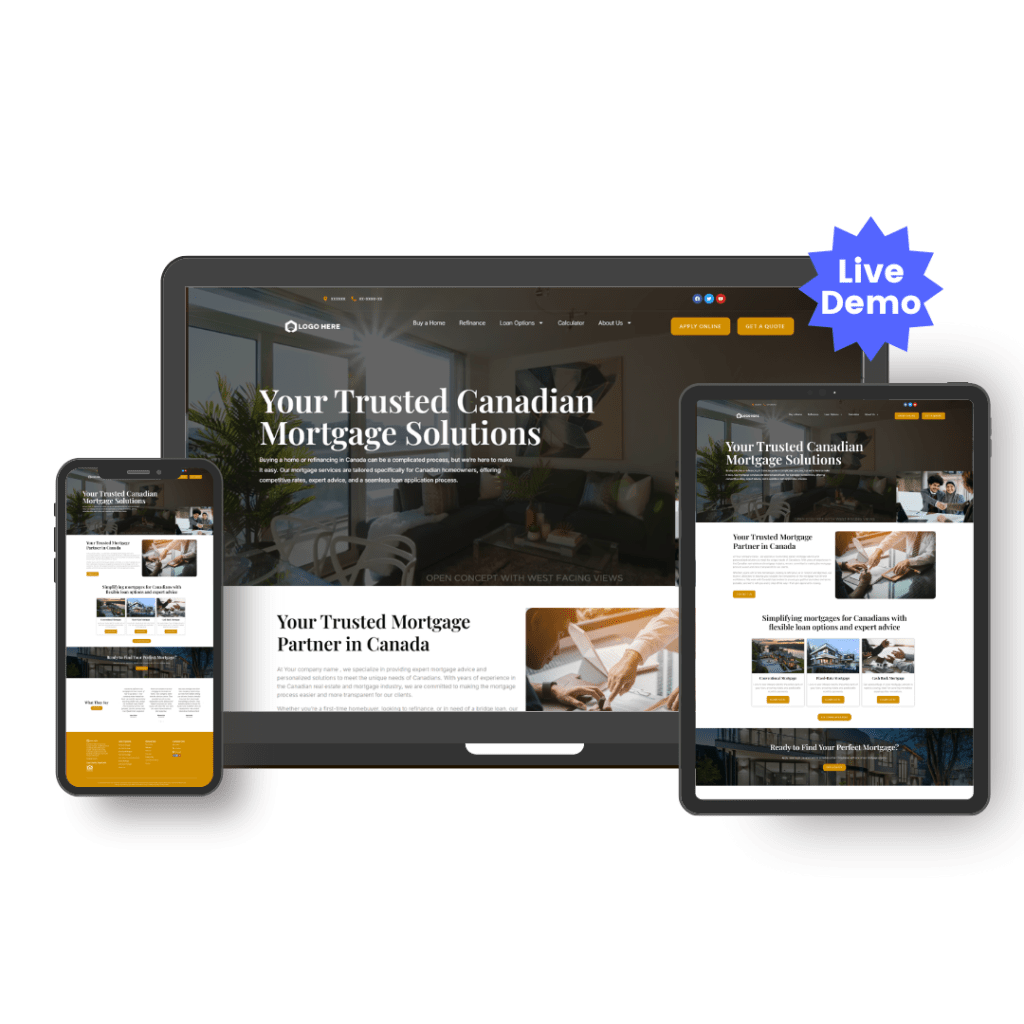

View a Real Loan Officer Website

If you want to see how a modern loan officer website actually looks and functions not just read about it viewing a live demo is the best way to understand its real value.

This website template demonstrates:

- A clean, mobile-first design built for today’s borrowers

- Built-in mortgage calculators that keep visitors engaged

- Trust-building sections such as reviews, professional bios, and licensing details

- Simple lead capture forms and online application flow

- Fast loading speed with clear, easy navigation

The template is designed specifically for loan officers, ensuring borrowers can quickly find information, build confidence, and take action without confusion.

How Much Do Loan Officer Websites Cost?

Let’s talk numbers without sugarcoating.

Typical Cost Ranges

| Type | Cost Range |

|---|---|

| DIY Website | $10–$50/month + time |

| Freelancer Build | $1,500–$5,000 upfront |

| Mortgage Website Platform | $150–$300/month |

Ready to grow your mortgage business online?

Stop losing leads to competitors with better websites

ROI of Loan Officer Websites: What Can You Really Expect?

One Closed Loan Can Cover the Cost

Let’s break it down with real numbers:- Average commission per loan: ~$3,000

- Monthly website cost: ~$200

What a Good Website Really Does

A properly optimized loan officer website isn’t just “online presence.” It becomes a quiet partner in your business.

It helps you:

- Generate consistent inbound leads

- Convert more visitors into real conversations

- Save time by answering common questions upfront

That’s real ROI not just traffic numbers or vanity metrics.

Step-by-Step: How to Build a High-ROI Loan Officer Website

For real results, stick to this simple framework.

Step 1: Know Your Ideal Borrower

Decide who you’re targeting—first-time buyers, VA loans, or self-employed borrowers—and speak directly to them.

Step 2: Use a Mortgage-Specific Platform

Choose a platform that handles compliance, includes calculators, integrates with CRM, and offers real support. This is why many loan officers avoid DIY tools.

Step 3: Focus on Local SEO

Use city/state keywords, Google Maps, reviews, and local pages. Local search brings high-intent borrowers.

Step 4: Automate Follow-Up

Instant replies, email/SMS workflows, and auto-booking build trust fast.

Simple steps. Strong ROI.

Frequently Asked Questions

Are loan officer websites mandatory?

They are not legally required, but they are essential for competitiveness and credibility.

How quickly can a mortgage website launch?

Most mortgage platforms deliver sites within 3–5 business days.

Can I use my existing domain?

Yes, professional platforms support custom domains.

Is hosting included?

Yes. Any data collection, even a contact form, requires a policy.

Can I update content myself?

Most platforms provide user-friendly editing tools.

How does SEO benefit loan officers?

SEO delivers long-term, high-intent traffic without ongoing ad spend.

What’s the easiest way to stay compliant long-term?

Use a website platform that handles updates, SSL, forms, and legal pages for you.

What if I need support after launch?

An in-house support team is available to help with updates, edits, and guidance whenever you need it.

Frequently Asked Questions

In today’s competitive lending environment, loan officer websites are no longer just a marketing add-on—they are a core business tool. A well-designed website helps establish credibility, educate borrowers, and capture leads long before the first conversation takes place.

When built with the right features, clear messaging, and a mobile-first approach, a mortgage website can deliver real ROI—often paying for itself with just one additional closed loan. More importantly, it supports your long-term growth by working for you around the clock.

Choosing the Best Mortgage Website solution ensures your online presence reflects the professionalism, trust, and expertise you bring to every client relationship.