If you’re still relying on word-of-mouth and cold calling to get mortgage leads, you’re leaving thousands of dollars on the table. The modern borrower is digital-first and you need to be too.

With rates shifting, competition heating up, and borrowers doing their research online, digital marketing is no longer optional for mortgage loan officers—it’s essential. The right strategy can help you generate leads while you sleep, nurture relationships automatically, and position yourself as the go-to mortgage expert in your area.

Whether you’re a seasoned loan officer or just getting started, this article will walk you through actionable digital marketing tips tailored to the mortgage industry.

Key Takeaways

💡 How to build trust online without being salesy

💬 Ways to turn social followers into real conversations

🌟 Strategies for earning 5-star reviews without sounding pushy

📱 Tips to make your entire digital presence mobile-ready

🎯 Tactics that specifically resonate with today’s Millennial homebuyers

🔄 How to automate follow-ups without losing the human touch

🤝 Simple techniques to get more referrals organically

Why Mortgage Loan Officers Need Digital Marketing in 2025

Let’s be honest—referrals are great, but they’re not enough.

More than 90% of homebuyers start their search online. If you’re not showing up, you’re handing leads over to competitors who are.

📊 Stat to Know: According to NAR, 97% of homebuyers used the internet in their home search journey.

Digital marketing gives you more control over your pipeline. You can:

- Generate leads consistently

- Build brand trust and familiarity

- Educate your audience 24/7

- Nurture prospects until they’re ready to act

- Reduce time spent chasing dead leads

Start by Giving More Than You Take

Reciprocity is the oldest marketing trick and it still works better than ever.

As a mortgage loan officer, your ability to educate and serve before selling can set you apart in a saturated market. Consider offering:

- Free mortgage calculators on your site

- Downloadable checklists like “Steps to Mortgage Pre-Approval”

- A short but actionable eBook for first-time homebuyers

- Local real estate market updates in your blog or email newsletter

Why this matters: People are more likely to trust you, engage with your brand, and share their contact info when they feel you’ve already given them something valua

📌 Example

Offer a free “Mortgage 101” email course that leads users step-by-step through buying their first home, then invite them to book a consultation at the end.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

Build Relationships, Not Just a Pipeline

Relationships turn into referrals. Transactions don’t.

Social media isn’t just about “being present”—it’s about being intentional. Before posting your dog’s Halloween costume, ask:

“Does this strengthen my relationship with a potential borrower?”

If not, save it for your personal page. Instead, focus on posts that:

Answer common borrower questions

Share mortgage approval success stories

Introduce local real estate partners

Break down complex mortgage terms in simple language

Highlight community involvement or events

👥 Also, go beyond your own feed. Comment on realtors’ posts, engage in housing Facebook groups, and show up in conversations.

📊 Stat to know: Businesses that engage actively on social media experience 20–40% more inbound traffic

Master Online Reviews and Reputation

Reviews are your digital word-of-mouth. Whether it’s Zillow, Google, Yelp, or Facebook your reputation online plays a major role in building trust.

🛠️ Set up a process for collecting reviews:

- Request immediately after closing

- Send a polite reminder a week later

- Share links to your review profiles in emails and texts

- Use CRM automation to schedule follow-up requests

💡 Tip: Don’t wait until you “have time.” Automate this process once and let the system work for you.

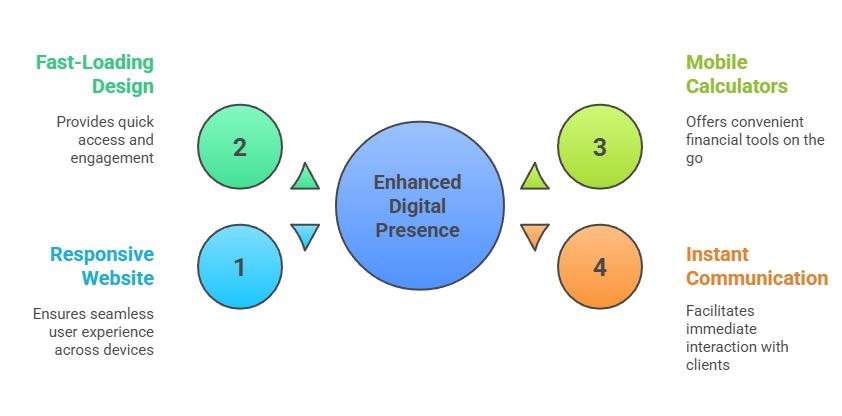

Mobile Optimization Is Non-Negotiable

If your website, lead forms, and applications aren’t mobile-first, you’re losing business. Simple as that.

📉 What’s at stake? 75% of users admit they judge a company’s credibility by their website design (Stanford Web Credibility Study).

🧠 You need:

A responsive mortgage website

A clean, fast-loading design

Mobile-friendly calculators and forms

Instant click-to-call or message features

🎯 Focus on Millennial Buyers

Millennials represent the largest segment of homebuyers and they’re just getting started.

👨💻 They prefer:

Transparency

Instant communication

Educational content

Self-serve tools

To win this audience:

- Offer an easy pre-qualification quiz

- Keep your branding consistent across all digital platforms

- Use Instagram Reels or YouTube Shorts to explain rates, approvals, or programs in under 60 seconds

📊 Millennials now make up over 63% of all mortgage originations (National Association of Realtors, 2024)

Build a Simple Email Marketing Funnel

Don’t overthink this.

Start with:

A lead magnet (PDF, checklist, quiz result)

Welcome email introducing your services

3–5 helpful follow-ups explaining mortgage options, FAQs, and next steps

A clear CTA to book a consultation or apply online

🧠 Use email platforms like MailerLite or ActiveCampaign

📲 Or better use a CRM designed for mortgage pros,

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Do I need to hire a marketing agency?

Not necessarily. Many tools today are DIY-friendly and tailored for mortgage professionals. You can implement a strong strategy solo.

How often should I update my mortgage website?

Ideally, at least monthly add new content, update rates, and post articles.

Is Facebook still relevant for mortgage pros?

Absolutely! Especially for local awareness, referrals, and retargeting.

How do I avoid being “salesy” on social media?

Focus on education and storytelling. Help first, sell later.

What’s one thing I should do today?

Claim and optimize your Google Business Profile your future self will thank you.

Is video necessary?

It helps—especially short-form video. Even a simple phone video explaining rate changes can build trust.

Can I use the same content across platforms?

Yes. Repurpose blog posts into social content, emails, or scripts for video.

What platform should I use?

GetMortgageWebsite.com is built specifically for mortgage professionals with top-notch security baked in. Mortgage website security also avaliable.

Conclusion

You don’t have to become a digital marketing expert to grow your mortgage business. By focusing on high-trust, low-tech strategies and leveraging the right tools, you can build visibility, capture leads, and nurture long-term success.

✅ Start with value

✅ Engage with authenticity

✅ Simplify your tech stack

✅ Stay consistent

Your clients are already online. It’s time your mortgage business meets them there—professionally, confidently, and with a digital experience that’s built to win.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators