If you’re still tracking mortgage leads on a spreadsheet, you’re leaving money and deals on the table.”

We’ve all been there. A new lead comes in from Facebook. Then another one from your website. One sends a DM. Two, fill out your calculator form. You tell yourself, “I’ll follow up tonight,” but life happens. Suddenly, it’s a week later and those leads? They’ve gone cold.

That’s where a Mortgage CRM for Lead Generation changes the game.

This isn’t just about managing contacts; it’s about building a seamless, automated system that captures interest, nurtures relationships, and turns clicks into closings. Whether you’re a solo loan officer, part of a growing mortgage team, or running a full-fledged agency, having a smart CRM strategy is no longer optional.

It’s your secret weapon.

Key Takeaways

Understand how a CRM automates your lead generation and follow-up process

Learn how to set up lead capture flows using forms, ads, and calculators

Discover how email and SMS automation build trust and drive action

Segment leads by interest to send personalized follow-ups

Integrate your CRM with your website, social media, and ad platforms

Track every lead’s journey and optimize based on real data

What Is a Mortgage CRM and Why It’s a Must-Have

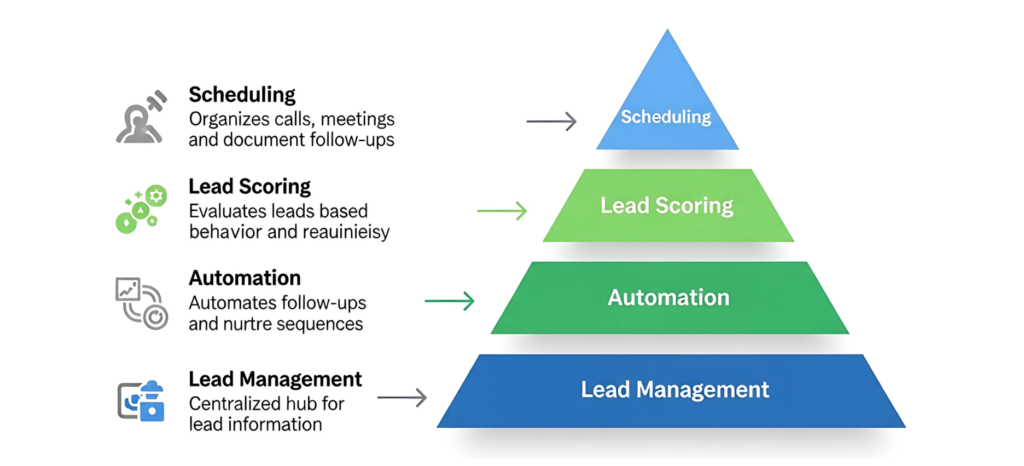

Let’s break it down. CRM stands for Customer Relationship Management. At its core, a CRM is a digital command center where all your lead info lives contact details, loan preferences, conversations, and more. But a mortgage CRM is specifically designed for the real estate finance world. It speaks your language. It understands pre-approvals, credit scores, FHA vs. VA, and what happens when a lead ghosts you halfway through the application.

With a good CRM:

🛋 Track every touchpoint from website form to closing

📞 Automate follow-up messages and nurture sequences

📊 Score leads based on behavior and readiness

🗒️ Schedule calls, meetings, and document follow-ups

📊 Stat to Know: 74% of mortgage companies using a CRM report a significant improvement in lead follow-up time. ( National Mortgage News)

Choosing the Best Mortgage CRM for Lead Generation

Now, let’s talk tools.

The market is flooded with CRM platforms but those are general-purpose. What you need is purpose-built software that understands mortgage-specific workflows.

✅ Look for CRM features like:

- Lead capture forms and landing pages

- Drip email and SMS campaigns

- Loan-type tagging (FHA, VA, jumbo, refinance, etc.)

- Built-in mortgage calculators

- Integration with Facebook, Google Ads, and Realtor.com

- Document tracking and task management

- Pre-built pipelines with stages like “New Lead,” “Application Sent,” “Pre-Approval,” and “Closed”

Turn Clicks Into Clients

See how a mobile-first mortgage website CRM can transform your business

Capturing Leads Into Your CRM Automatically

Gone are the days of manually entering contacts into spreadsheets. Today, your CRM should integrate with your lead sources:

📉 Website Forms: Embed smart forms on landing pages and blogs.

💬 Live Chat Bots: Convert curious visitors into leads.

📲 Facebook/TikTok Lead Ads: Directly feed into your pipeline.

📢 Referral Partner Forms: Realtors can submit warm leads.

🔎 SEO Blog CTAs: Add lead capture beneath valuable content.

Once captured, the CRM can tag and sort leads by type, location, interest level, or timeline.

Mortgage CRM for Lead Generation Through Automation

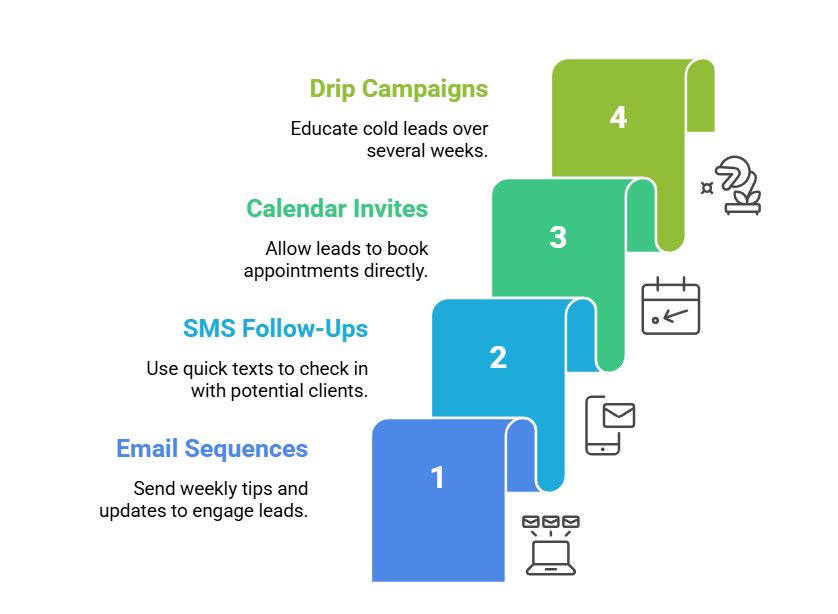

Here’s where things get powerful. Your CRM becomes your 24/7 assistant, always following up:

📧 Email Sequences: Send weekly tips, news, or refinance updates.

📞 SMS Follow-Ups: A quick “Hey, still need help?” can go a long way.

📝 Calendar Invites: Let leads book your time without back-and-forth.

💰 Drip Campaigns: Slowly educate cold leads over 4–8 weeks.

These messages can include:

First-time buyer checklists

Loan eligibility tips

Video walkthroughs of your process

FAQs about rates, down payments, or closing timelines

Personalize Every Message Using CRM Segmentation

Not every lead is the same. Your CRM should allow you to tag and segment based on:

Loan type (FHA, Jumbo, VA)

Buying timeline (3 months, 6 months, ASAP)

Credit score range

First-time buyer vs. investor

📊 Stat to Remember: Personalized emails deliver 6x higher transaction rates than generic ones.

Don’t Forget Social Media Integration

Here’s where a lot of mortgage pros drop the ball. Social media can be your biggest lead gen machine—if it’s connected to your CRM.

Connect These Platforms:

Facebook Lead Ads

Instagram Forms

YouTube Video CTAs

TikTok Profile Link to Pre-Qual Form

The moment someone fills out your ad form your CRM should trigger a welcome text or email within seconds.

Track, Analyze, and Optimize Your Lead Generation Efforts

You can’t improve what you don’t track.

Most CRMs give you:

- Lead source reports (Google, Facebook, Website, Referral)

- Open/click rates on emails

- Conversion rates per funnel

- Pipeline stage tracking

📈 Tip: Review these reports weekly and A/B test your subject lines, form copy, or CTAs.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

Is a mortgage-specific CRM really necessary?

Yes. It offers features and templates tailored for loan officers, which saves you time and increases conversion rates.

Can CRMs help with compliance?

Absolutely. They log communication, track timelines, and help you manage documentation safely.

Will I need a tech team to set it up?

Not necessarily. Many providers offer white-glove onboarding or templates you can plug and play.

Is it hard to set up?

Most CRMs come with templates and onboarding support. Some, like GetMortgageWebsite, offer white-glove setup.

Do CRMs integrate with social media?

Yes, most support Facebook Lead Ads, Google Ads, and social media triggers.

What’s the best way to capture leads?

Use forms, calculators, pop-ups, and lead magnets (like guides or checklists).

What if I don’t have time?

CRMs automate the heavy lifting, giving you more time to close deals and build relationships.

Can I change my mind after making an offer?

Yes but you could lose your earnest money unless you back out for a valid reason during your contingency period.

Conclusion

Here’s the truth: most mortgage pros don’t have a lead problemthey have a follow up problem. A smart mortgage CRM for lead generation doesn’t just help you organize your pipeline it helps you scale it.

It captures, segments, nurtures, and converts all while you’re helping clients, spending time with family, or even sleeping.

So if you’re tired of juggling spreadsheets, missing follow-ups, or feeling like your marketing isn’t converting, now’s the time to act.

Take Control of Your Online Reputation

Get a website built to impress and convert.