If you’re running a mortgage business in today’s digital-first world, your website can’t just look good. It needs to work for you around the clock. That’s exactly where a Mortgage CRM that integrates seamlessly with your website becomes a game changer.

Instead of juggling spreadsheets, inboxes, and disconnected tools, a website-connected Mortgage CRM turns your site into a lead-generating, follow-up-driven system that never sleeps. Visitors come in, leads are captured automatically, conversations are tracked, and follow-ups happen without you chasing every detail.

Let’s break down how this works, why it matters, and how you can use it to grow without burning out.

Key Takeaways

- A website-integrated Mortgage CRM captures leads instantly and automatically

- Seamless integration improves response time, conversions, and borrower experience

- Automation reduces manual work while keeping communication personal

- The right setup helps you scale without hiring more staff

- Your website becomes a true business tool, not just an online brochure

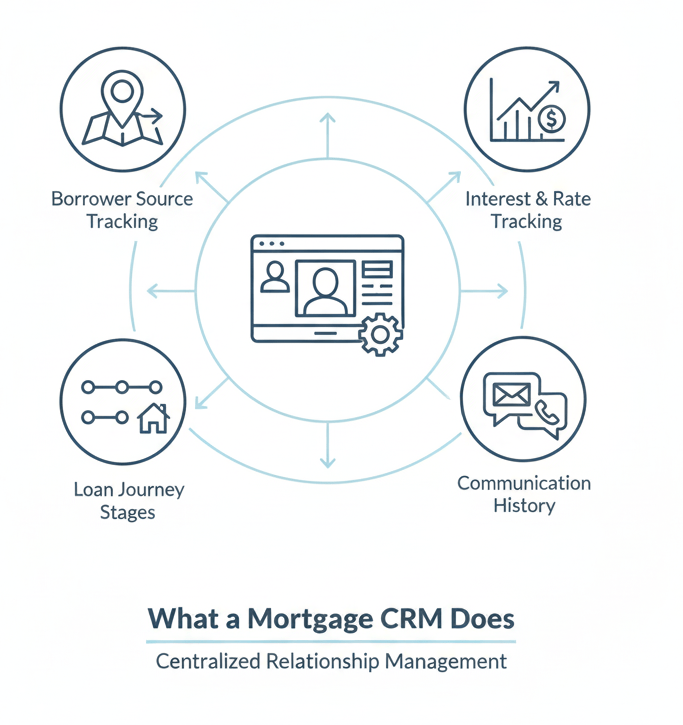

What Is a Mortgage CRM and Why Website Integration Matters

A mortgage CRM is a customer relationship management system designed specifically for loan officers, brokers, lenders, and mortgage teams. Unlike generic CRMs, it’s built around mortgage workflows, inquiries, applications, follow-ups, documents, and long sales cycles.

But here’s the key difference maker: integration with your website.

When your mortgage CRM is fully connected to your website:

- Every form submission goes directly into your CRM

- Leads are tagged, organized, and tracked automatically

- Follow-up messages trigger instantly

- No manual data entry is needed

Without integration, your website and CRM operate like two separate worlds. With integration, they work as one smooth system.

How a Mortgage CRM Integrates Seamlessly With Your Website

Website integration doesn’t mean complicated coding or duct-taped plugins. A properly built system connects everything behind the scenes so the experience feels effortless both for you and your visitors.

Here’s how it usually works step by step.

Step 1: Website Forms Connect Directly to the CRM

Every contact form, loan inquiry form, or application form on your website is linked directly to your mortgage CRM.

When someone fills out a form:

- Their information is instantly saved in the CRM

- A new lead profile is created automatically

- No emails to forward or spreadsheets to update

This ensures zero lead loss, even outside business hours.

Step 2: Automatic Lead Tagging and Segmentation

Once a lead enters your CRM, the system can tag them automatically based on:

- Loan type (purchase, refinance, FHA, VA, jumbo)

- Timeline (ready now vs future buyer)

- Source (calculator, blog, contact page, ad)

This makes it easier to send the right message at the right time without guessing.

Step 3: Instant Follow-Ups Without Manual Effort

Speed matters in the mortgage industry. A website-connected mortgage CRM can send:

- Instant SMS confirmations

- Personalized email responses

- Appointment booking links

- Internal task reminders

All of this can happen within seconds, even while you’re busy or offline.

Benefits of Using a Mortgage CRM With Your Website

Let’s talk about why this setup isn’t just convenient; it’s powerful.

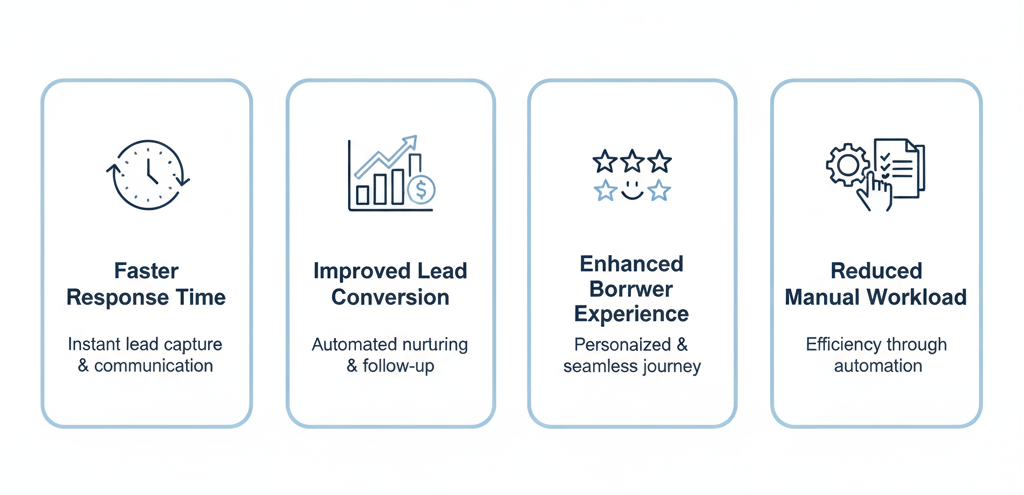

Faster Lead Response Times

Studies consistently show that leads contacted within the first few minutes convert at much higher rates. With a mortgage CRM integrated into your website, response time drops from hours to seconds.

That alone can dramatically increase conversions.

Better Borrower Experience

Borrowers today expect smooth, modern experiences. When your website and CRM work together:

- Forms feel simple and intuitive

- Follow-ups feel timely, not spammy

- Communication feels organized and professional

- This builds trust before you even speak to them.

Fewer Manual Tasks

Manually copying data, sending reminders, and tracking conversations eats up hours each week. A website-integrated mortgage CRM automates:

- Lead entry

- Follow-up sequences

- Appointment scheduling

- Pipeline tracking

You spend less time managing systems and more time closing loans.

Clear Visibility Into Your Pipeline

Because everything flows into one system, you always know:

- Where each lead came from

- What stage they’re in

- Who needs follow-up

- Which marketing efforts are working

That clarity makes decision-making easier and smarter.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

Mortgage CRM Features That Work Best With Your Website

- Built-in website forms and funnels for fast, error-free lead capture

- Native forms that improve page speed and ensure accurate data flow

- CRM and mortgage calculator integration to turn calculator users into qualified leads automatically

- Automated email and SMS workflows for timely, consistent follow-ups without sounding robotic

- Calendar and appointment booking synced directly with your CRM

- One-click scheduling from your website for faster lead conversion

- Review and reputation management to request reviews after successful interactions

- Automated review collection to boost trust and website credibility

Common Mistakes When Connecting a Mortgage CRM to a Website

- Using disconnected third-party plugins that slow down your website and increase errors

- Relying on too many tools instead of a native or tightly integrated CRM system

- Over-automating workflows without personalization, making communication feel impersonal

- Replacing human follow-up entirely instead of using automation to support it

- Ignoring mobile optimization, leading to poor form performance on smartphones

- Using CRM forms that aren’t mobile-friendly, reducing conversions

- Not tracking lead sources, making it impossible to measure what’s working

- Failing to capture source data automatically inside the CRM

Is a Mortgage CRM With Website Integration Right for Your Business

If you rely on online inquiries, referrals, ads, or organic traffic, the answer is yes.

A mortgage CRM integrated with your website is especially valuable for:

- Solo loan officers

- Growing brokerages

- Mortgage teams

- Independent mortgage banks

It creates structure, speed, and scalability without adding complexity.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

What makes a Mortgage CRM different from a generic CRM?

A Mortgage CRM is built specifically for mortgage workflows, loan stages, and borrower communication.

Does a Mortgage CRM replace my website?

No. It enhances your website by capturing leads, automating follow-ups, and organizing client data.

Can small mortgage businesses benefit from a Mortgage CRM?

Yes. Smaller teams often see the biggest impact because automation replaces manual effort.

Is website integration secure?

Modern platforms use SSL encryption, secure hosting, and data protection standards to keep information safe.

Do I need technical skills to manage it?

Most platforms are designed for non-technical users and include onboarding support.

Why is mobile-friendliness important for mortgage websites?

Most borrowers research lenders on their phones. A mobile-friendly website enhances trust, usability, and search engine rankings, while also making it easier for visitors to contact you or submit forms.

Can Mortgage Website Templates be customized for my business?

Yes. Most modern Mortgage Website Templates allow you to customize branding, content, layouts, and calls to action so your website reflects your unique business while remaining optimized for mobile and SEO.

Are these platforms suitable for teams?

Most mortgage website builders support multiple users, pipelines, and team workflows.

Conclusion

Your website is where trust begins. Your CRM is where relationships are built.

When those two systems work together, your mortgage business operates smarter, faster, and more efficiently. A mortgage CRM that integrates seamlessly with your website ensures no lead is missed, no follow-up is delayed, and no opportunity slips through the cracks.

In a competitive market, integration isn’t a luxury it’s a necessity. And for mortgage professionals ready to grow without overwhelm, it’s one of the smartest investments you can make.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators