Let’s be honest. Generating mortgage leads is only half the battle. The real challenge? Turning those leads into actual closed loans. If you’ve ever watched a promising prospect go cold because you couldn’t follow up fast enough, you know exactly what I’m talking about. That’s where a well-designed mortgage lead nurture funnel comes into play.

Think of your funnel as a personal assistant that works around the clock. While you’re meeting with clients or catching up on paperwork, your email and SMS sequences are building relationships, answering questions, and gently guiding prospects toward that all-important application. In this guide, I’ll walk you through everything you need to know to build a lead nurturing system that feels personal, stays compliant, and most importantly, gets results.

Key Takeaways

- A mortgage lead nurture funnel automates your follow-up process so no prospect slips through the cracks

- Combining email and SMS creates a multi-channel approach that meets borrowers where they are

- Segmentation is crucial because first-time homebuyers need different messaging than refinance prospects

- Timing matters, and responding within five minutes can dramatically increase conversion rates

- Personalization goes beyond using someone’s first name and should address their specific situation

- Compliance with TCPA and CAN-SPAM regulations is non-negotiable for SMS and email marketing

What Is a Mortgage Lead Nurture Funnel and Why Does It Matter

A mortgage lead nurture funnel is essentially your automated relationship-building machine. It takes cold or warm leads and systematically moves them through a series of touchpoints designed to educate, build trust, and ultimately convert them into loan applications.

Here’s the thing about mortgage lending: the average borrower takes 30 to 45 days from initial inquiry to application. That’s a lot of time for them to forget about you, get distracted by a competitor, or simply lose momentum. Your funnel keeps you top-of-mind without requiring you to manually chase every single lead.

The beauty of combining email and SMS is that you’re meeting people on their preferred communication channels. Some folks check email religiously. Others respond better to text messages. By using both, you’re covering your bases and creating multiple opportunities to connect.

Why Mortgage Lead Nurturing Matters More Than Ever

🔢 Did you know?

Over 79% of mortgage leads never convert due to lack of follow-up.

rising competition and shifting market conditions, most consumers are exploring multiple lenders before choosing one. Your follow-up game needs to be faster, smarter, and consistent.

And the best way to do that? Automate your outreach while keeping it personal.

Step 1: Segment Your Mortgage Leads

The key to effective lead nurturing is relevance. The more relevant your content, the more likely your lead will engage.

Start by segmenting your leads based on:

- Buyer stage (cold, warm, hot)

- Lead source (ad, referral, website, open house)

- Buyer type (first-time, refi, investor, veteran)

- Credit score, employment type, or location

Using a CRM like theBigBot, you can automate tagging and segment sorting. Once categorized, you can send content that directly addresses their unique needs and objections.

For example, a first-time buyer might receive educational content about mortgage basics, while an investor might want interest rate trends and ROI calculators.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

Step 2: Build an Email Nurture Sequence

Emails are the backbone of your lead nurture funnel. They allow you to communicate at scale, provide consistent value, and establish trust while guiding potential clients toward taking action.

Creating an Email Sequence

Start with a 7–10 day email sequence designed to educate, engage, and convert. Here’s what to include:

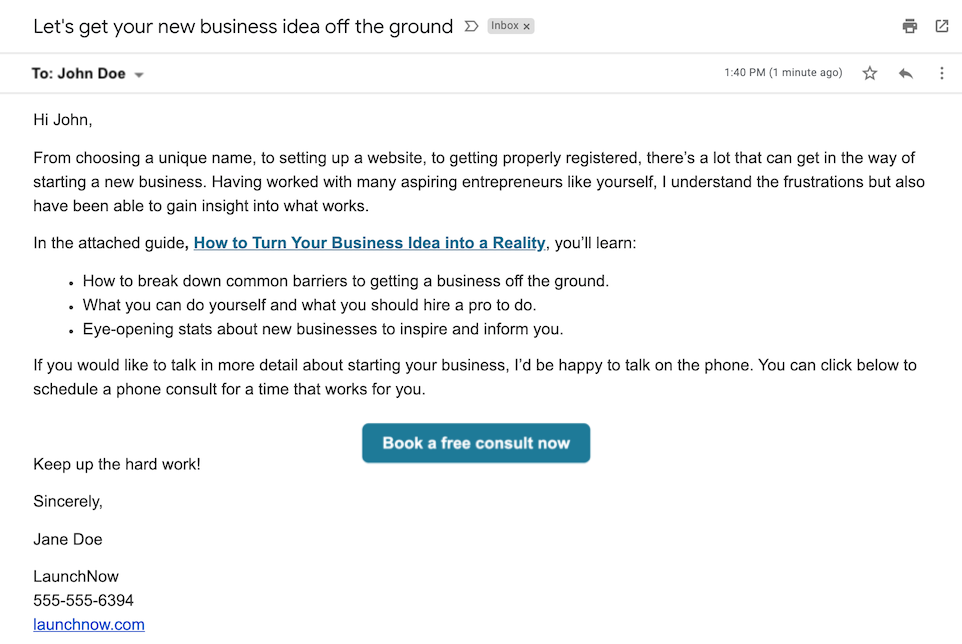

A Warm Welcome:

Begin with a personalized message that introduces your brand, sets expectations, and assures the reader they’re in good hands.

Educational Content:

Share bite-sized information about mortgage basics, the different loan types available, credit improvement tips, or what to expect during the home-buying process. Position yourself as a helpful resource.

Testimonials or Success Stories:

Build trust by featuring stories from satisfied clients who achieved their dream home with your help. Real experiences resonate more than any pitch.

Interactive Tools:

Include links to loan calculators, downloadable checklists, or quizzes that help users understand where they stand and what steps they need to take.

Clear Calls to Action:

Guide the next step—whether it’s scheduling a call, downloading a free guide, or getting pre-approved. Each email should have a single, clear CTA.

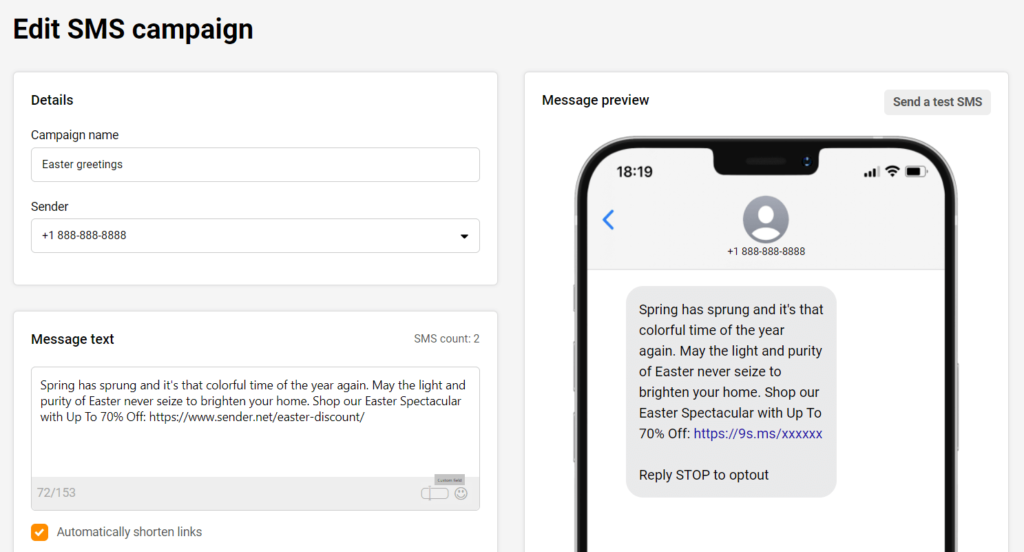

Step 3: Add SMS for Instant Connection

While emails offer depth, SMS offers immediacy. With a 98% open rate, text messages are perfect for quick reminders, updates, or nudges

Examples include:

- “Thanks for checking out our loan calculator! Have questions?”

- “Rates just dropped! Let me know if you’d like a comparison.”

- “Just following up on your pre-approval. Ready to chat?

Use SMS sparingly and respectfully. Personalize your messages and send them during business hours. Automation tools like the BigBot CRM allow you to set triggers based on user behavior, such as sending a text message if someone opens an email but doesn’t click through.

Step 4: Set Up the Right Tech Stack

To successfully run your nurture funnel, you need two core tools:

GetMortgageWebsite.com

This platform helps you build a beautiful, high-converting mortgage website with:

- Mobile-first designs

- Fast page speed

- Pre-written, optimized content

- Lead capture forms

- Mortgage calculators and tools

Your website should act as a magnet, pulling in leads and preparing them for nurture.

TheBigBot CRM

Use this for managing and automating your entire follow-up system:

- Drag-and-drop workflow builder

- Email & SMS automation

- Behavior-based triggers

- Lead scoring and segmentation

- Built-in calendar and form integrations

Together, these tools create a seamless system that attracts, engages, and converts leads on autopilot.

Step 5: Optimize Your Funnel Over Time

The best funnels are never finished. Continually analyze your performance:

- Monitor open and click-through rates

- A/B test subject lines and messaging

- Track SMS responses and timing

- Adjust message cadence based on lead behavior.

Pro Tip: Use storytelling—client journeys, struggles, and wins—to humanize your messages.

Frequently Asked Questions

How long should my nurture sequence be?

Start with 7-10 days, then move to weekly updates for up to 90 d

What’s the best time to send messages?

Mid-morning on weekdays works best for email. SMS should be sent during business hours only.

What kind of website do I need?

Use GetMortgageWebsite.com. It’s built for mortgage pros and includes tools specifically for lead capture and conversion.

Will this work for refinance leads?

Yes! Just tailor the content to their specific interests, like rate comparisons and closing costs.

Conclusion

A great mortgage lead funnel doesn’t just automate tasks; it builds relationships. Through consistent, value-driven email and SMS communication, you create trust, position yourself as an expert, and stay top-of-mind until the borrower is ready to move forward.

Use GetMortgageWebsite.com to bring in quality leads and theBigBot CRM to nurture them into loyal clients.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.