If you run a mortgage business today, whether you’re a loan officer, broker, or a full team, your website isn’t just a digital brochure. It’s a compliance tool.

Borrowers submit forms. They ask questions. They share personal financial details.

And regulators expect you to protect that information.

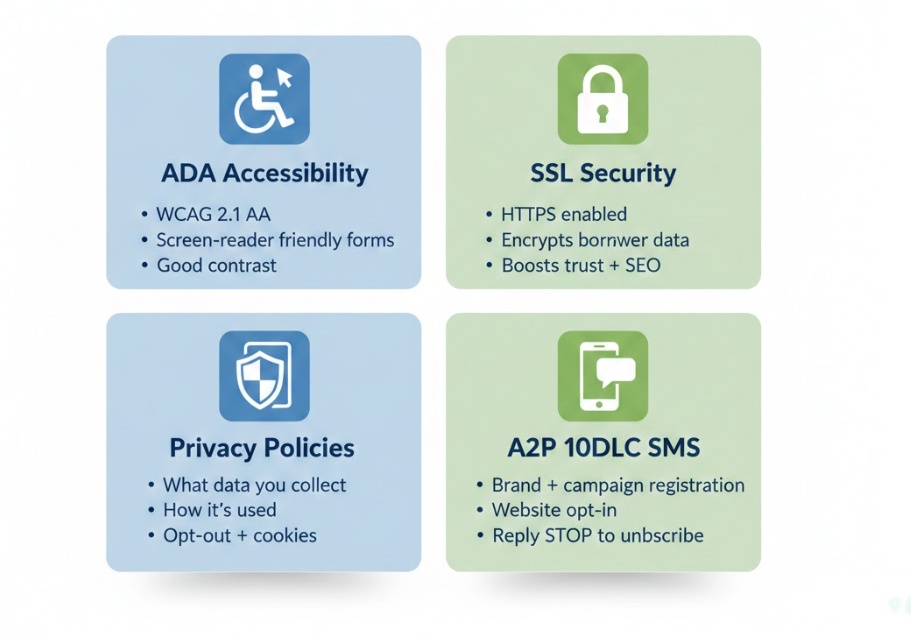

That’s where these four pillars come in:

👉 ADA compliance

👉 SSL security

👉 Privacy policies

👉 A2P 10DLC for SMS

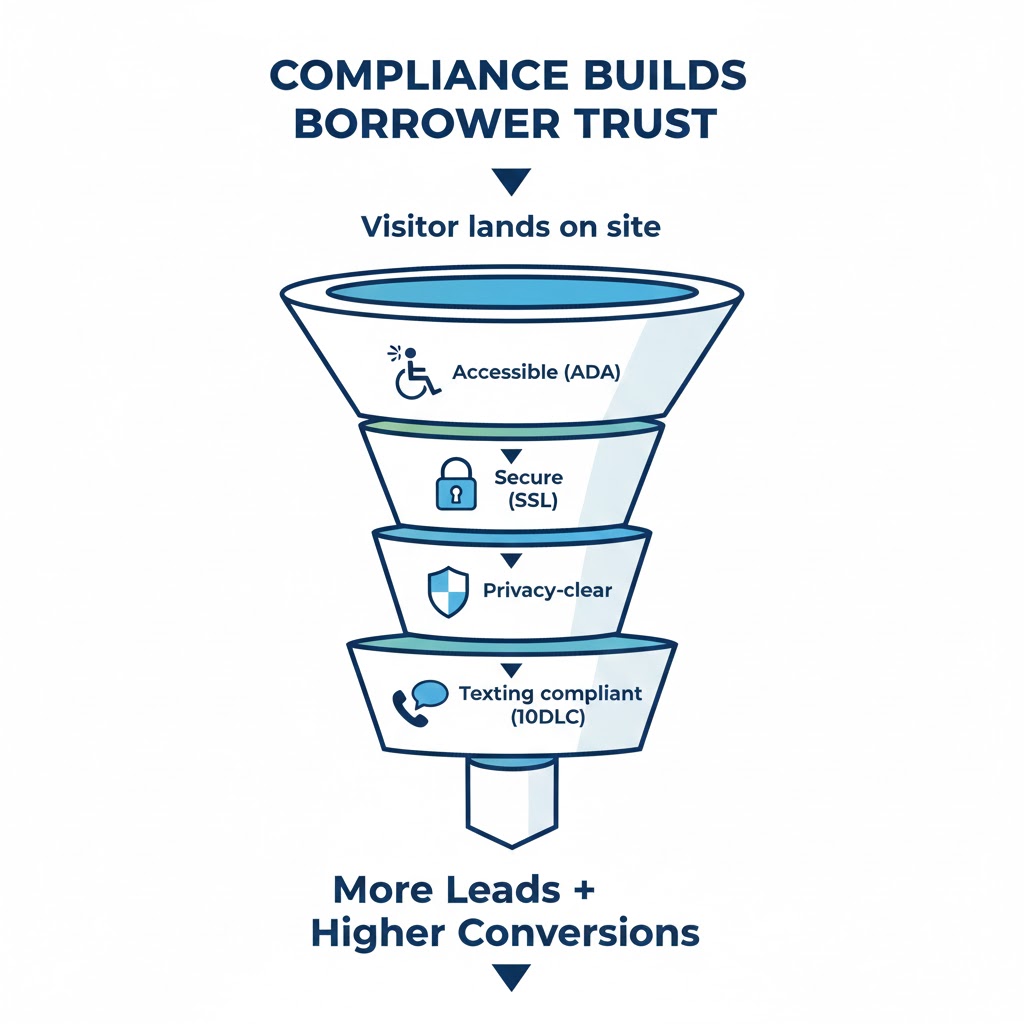

Together, they determine whether your website is safe, legal, trustworthy, and ready to scale in 2026.

Let’s break each one down in a simple, human way—no technical jargon.

Key Takeaways

- Your website must be easy for everyone to use, including people with disabilities.

- Google and consumers expect your site to be secure (HTTPS).

- Privacy policies are required by law—especially in financial services.

- A2P 10DLC registration is now mandatory for SMS marketing.

- Staying compliant protects your brand and boosts your conversion rates.

Why mortgage website Compliance Matters More Than Ever

Mortgage clients don’t just look at your brand; they judge your website within seconds.

A slow, insecure, or non-compliant website sends red flags like

❌ “Is this company legit?”

❌ “What happens to my information?”

❌ “Why does this site say ‘Not Secure’?”

ADA Compliance: Making Your Site Accessible to Everyone

ADA compliance simply means your website should be usable by people with disabilities.

Not just for legal reasons but because it’s the right thing to do, and it creates a better user experience for all.

What ADA Compliance Looks Like

A compliant mortgage website includes:

- Text that screen readers can understand

- Clear labels on forms

- Proper color contrast (no light-grey-on-white text)

- Keyboard navigation

- Captions for videos

- Alt text for images

Ready to grow your mortgage business online?

Stop losing leads to competitors with better websites

SSL: The Little Lock That Builds Big Trust

When you visit a website and see https:// instead of http://, that’s SSL.

It protects the information people send through your website.

Mortgage clients share personal details like:

- Name

- Phone

- Loan goals

- Property detail

Sometimes even income or credit information.

Without SSL, that data is vulnerable, and borrowers will instantly lose confidence in your business.

Why SSL Matters

- Google ranks secure websites higher

- Without SSL, browsers show a red “Not Secure” warning

- Many lenders require it for partner compliance

- It protects you legally when collecting consumer data

SSL is one of the simplest compliance steps but one of the most important.

Privacy Policy, Disclosures & Legal Requirements

Every mortgage website must clearly show:

✔ Privacy Policy

Explains what data you collect and how you use it.

✔ Terms & Conditions

Protects you legally and sets rules for website use.

✔ Licensing Information

Your NMLS number and company details must be visible.

✔ Disclaimers

This covers things like

Rates are changing. Not a commitment to lend. Loan terms subject to credit approval

Mortgage is a regulated industry these disclosures aren’t optional.

Why They Matter

- Builds trust with borrowers

- Required by financial regulations

- Helps avoid compliance violations

- Protects your business

A2P 10DLC: What Every Loan Officer Must Know About SMS Rules

- Lead follow-up

- Appointment reminders

- Rate updates

- Application status

- Drip campaigns

…then you MUST register your brand and campaigns.

If You Don’t Register:

❌ Your messages may be blocked

❌ Your number can be flagged as spam

❌ SMS delivery rates drop

❌ Your CRM automations stop working

What You Need to Be Compliant

✔ A2P brand registration

✔ Campaign approval

✔ Clear opt-in

✔ Mandatory opt-out language:

“Reply STOP to unsubscribe.”

Need a Website That Comes Fully Compliant Out-of-the-Box?

If you don’t want to deal with:

❌ Building ADA

❌ Writing legal policies

❌ Designing secure forms

❌ Setting up A2P

❌ Fixing SEO issues

…then you can get a turnkey mortgage website here:

Launch Your Website in Days, Not Months

Get a mortgage site built for California professionals, live in just 3–5 business days.

Frequently Asked Questions

Do mortgage websites really need ADA compliance?

Yes — and lawsuits for non-accessible websites are at an all-time high.

What happens if my website doesn’t have SSL?

Browsers alert users with a “Not Secure” warning, which kills trust immediately.

Why is A2P 10DLC so important?

Without registration, your SMS messages will get filtered or blocked.

Do I need a Privacy Policy even if I only collect emails?

Yes. Any data collection, even a contact form, requires a policy.

Should my NMLS number be on every page?

It must be easily visible. Most loan officers put it in the footer and on key pages.

Does compliance affect SEO?

Absolutely. Secure, accessible websites rank higher and convert better.

What’s the easiest way to stay compliant long-term?

Use a website platform that handles updates, SSL, forms, and legal pages for you.

What if I need support after launch?

An in-house support team is available to help with updates, edits, and guidance whenever you need it.

Conclusion

In today’s mortgage landscape, compliance is no longer something you “get to later.” It’s the foundation of a trustworthy, high-converting, professional online presence. When a borrower lands on your website, they expect a secure environment, clear disclosures, accessible information, and reliable communication and ADA, SSL, privacy policies, and A2P 10DLC are the tools that make that possible.

By taking these four compliance areas seriously, you not only protect your business from lawsuits, blocked messages, or licensing issues you create a smoother, safer experience for every borrower who interacts with your brand.

A compliant mortgage website builds confidence, improves SEO, increases lead quality, and positions you as a credible lender in a highly competitive market.

Get these foundations right today, and your website will continue working for you professionally, securely, and compliantly for years to come.

If you want a fully compliant mortgage website done for you, platforms like GetMortgageWebsite.com make the process simple, fast, and stress-free.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators