Imagine this for a second: A first-time homebuyer is scrolling on their phone late at night, wondering if they can qualify for a mortgage. They Google “loan officer near me” and boom your competitor shows up with a modern, mobile-friendly website full of calculators, educational articles, and a simple pre-approval form. Meanwhile, your website (if you even have one) looks outdated and clunky.

Who do you think they’ll trust?

This is where Mortgage Website Development Services come in. They help loan officers like you build sleek, high-performing websites that work like a 24/7 assistant educating borrowers, capturing leads, and even automating follow-ups while you sleep.

In this guide, we’ll break down why every loan officer needs a professional website, what features to look for, and how these services can help you stand out in today’s competitive mortgage landscape.

Key Takeaways

🌐 A professional mortgage website builds instant trust with borrowers.

📱 Mobile-first design ensures prospects can connect with you 24/7.

⚙️ Mortgage Website Development Services often include CRM tools, calculators, and lead capture features.

📊 Loan officers with optimized websites generate 40% more online leads than those without.

🚀 Quick setup and automation let you focus on clients instead of tech.

Why Loan Officers Need Mortgage Website Development Services

According to the National Association of Realtors, 97% of homebuyers start their search online. If your website isn’t optimized, modern, and conversion-focused, you’re leaving money on the table.

Loan officers face unique challenges:

- Competing with large banks and national lenders.

- Building trust with first-time homebuyers.

- Managing referrals and leads efficiently.

A specialized mortgage website development service solves these pain points by combining sleek design with mortgage-specific features like loan program content, rate calculators, and integrated CRM tools.

How Mortgage Website Development Services Work Step by Step

When we talk about the best design, it’s not just about looks. It’s about functionality, performance, and the ability to turn visitors into leads.

Here are must have features:

Discovery Call : Share your goals: more leads, better branding, faster automation.

Website Build : Developers craft a professional, mobile-first design tailored to loan officers.

Integration Setup : Connect CRMs, calculators, forms, and review feeds.

Content Deployment : Add 20+ loan program pages, blogs, and a learning center.

Launch & Training : Your website goes live in 3–5 business days, and you get training to make quick edits.

💡 Pro Tip: Platforms like GetMortgageWebsite.com specialize in building these sites exclusively for loan officers no generic templates, just mortgage-focused performance.

Features That Set Mortgage Website Development Services Apart

Mobile-First, Performance-Driven Design

Over 60% of borrowers research mortgages from their smartphones. A responsive, mobile-first design isn’t optional it’s survival. With professional development, your site loads in under 3 seconds (Google recommends under 2.5), keeping visitors engaged.

Smart Lead Capture Forms

Imagine someone filling out a quick “Can I qualify?” form that not only captures their details but routes them directly into your CRM with tags like “First-Time Buyer” or “Refinance Lead.” That’s the power of intelligent lead forms.

Mortgage Calculators That Educate and Convert

Calculators don’t just “look nice” they keep visitors engaged 3x longer and position you as an advisor. From affordability to refinance and VA loans, these tools answer questions before borrowers even ask.

CRM Integration That Automates Follow-Ups

Instead of manually calling every lead, imagine your site automatically sending a friendly text:

“Hi Sarah, thanks for checking out our FHA calculator! Want to schedule a quick call to see if you qualify?”

Automation like this boosts response rates by 300% (Velocify).

Testimonials and Review Feeds

Borrowers trust reviews as much as personal recommendations. By integrating Zillow, Google, or Facebook reviews directly into your site, you instantly build credibility.

The Real Benefits for Loan Officers

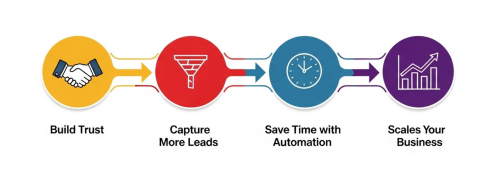

Build Instant Trust

Your website is your digital business card—but better. A sleek, modern design tells borrowers, “This loan officer is professional and credible.”

Capture More Leads

With calculators, chatbots, and lead forms, your site runs 24/7. Even when you’re at a closing or with your family, your website is working.

Save Time with Automation

From automated Google review requests to appointment reminders, you’ll free up hours each week—time you can reinvest in clients.

Stay Competitive in Local SEO

Local SEO + mortgage-specific content = your website showing up before competitors in your market.

How to Choose the Right Mortgage Website Development Partner

When evaluating providers, ask:

Do they specialize in the mortgage industry or just generic business websites?

Are their websites tested for speed and mobile optimization?

Do they include CRM integration and not just “contact forms”?

How fast is their turnaround? (3–5 days is excellent)

Is ongoing support included?

💡 Stat: Websites with calculators keep users engaged 2–3x longer than those without.

Why Mortgage Website Development Services for Loan Officers Work

At the end of the day, Mortgage Website Development Services aren’t just about pretty designs. They’re about giving you the digital infrastructure to:

- Attract leads consistently.

- Build credibility with borrowers.

- Automate tedious tasks.

- Scale your business without adding extra hours to your workday.

Launch Your Website in Days, Not Months

Get a mortgage site built for California professionals, live in just 3–5 business days.

Frequently Asked Questions

What is included in Mortgage Website Development Services?

They include design, calculators, loan program pages, CRM integration, review feeds, secure hosting, and ongoing support.

How long does it take to launch?

Most providers deliver within 3–5 business days once you complete onboarding.

Do I need my own hosting?

No, secure hosting with SSL is usually included.

Can I use my own domain?

Yes, you can connect your domain seamlessly.

Can I make my own edits?

Yes, user-friendly dashboards allow you to update content without calling support.

Are calculators included?

Yes, advanced calculators for FHA, VA, USDA, refinance, and affordability are standard.

Where can I get a mortgage website designed for leads?

GetMortgageWebsite.com specializes in professional, lead-ready mortgage sites.

What about SEO?

Sites are built with SEO best practices to rank well in Google.

Conclusion

The mortgage industry is more competitive than ever and your website is your secret weapon. By investing in Mortgage Website Development Services, you’re not just building a website you’re building a lead machine that works around the clock.

For loan officers serious about growth, it’s not a question of if you need a professional website, but when. And the sooner you launch, the faster you’ll see results in lead generation, trust, and closed loans.

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators