If you’re a mortgage broker or loan officer, your website is more than just a digital business card—it’s your online headquarters. And yet, many mortgage professionals unknowingly make costly website mistakes that send potential clients running. Whether you’re building from scratch or overhauling an old site, avoiding these common pitfalls can dramatically improve your leads and conversions.

Let’s walk through the biggest mortgage website blunders and how to fix them—with real-world examples, easy-to-follow solutions, and expert tips using tools like GetMortgageWebsite and TheBigBot CRM.

Key Takeaways

- Poor design and slow loading speeds lead to high bounce rates

- Missing CTAs and unclear navigation confuse visitors

- Not optimizing for mobile can cost you over 50% of traffic

- Lack of CRM integration hinders lead follow-up

- Tools like GetMortgageWebsite and TheBigBot CRM simplify fixes

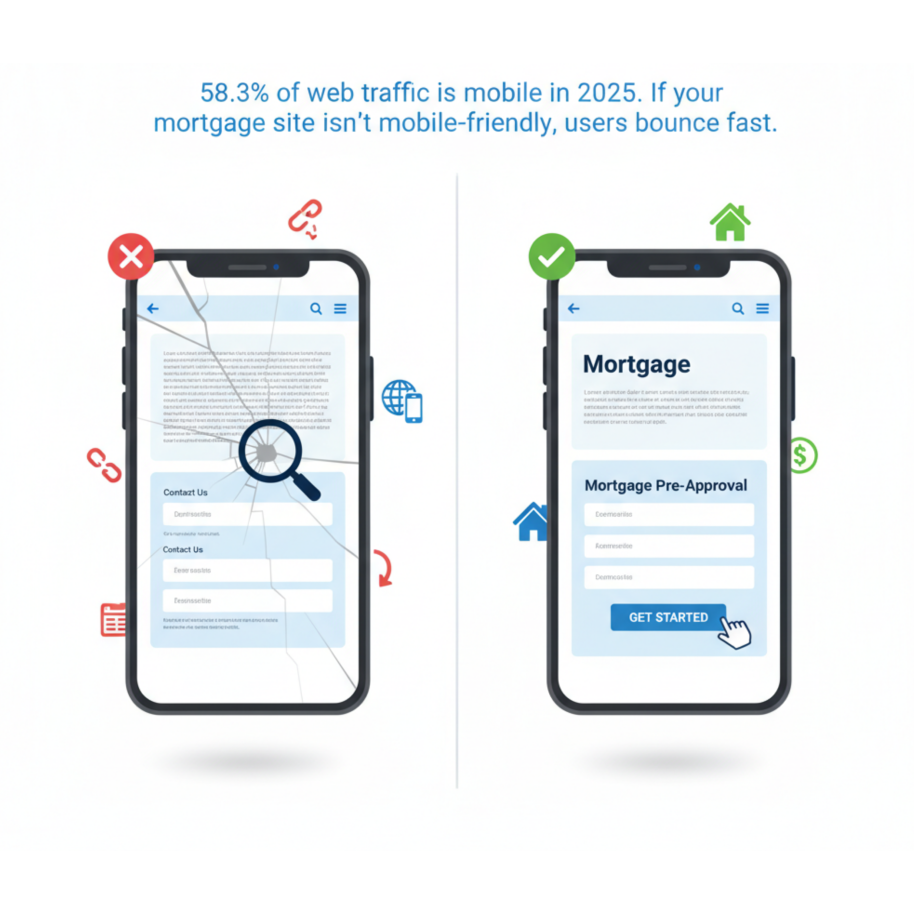

Mistake 1: Ignoring Mobile Optimization

If your site doesn’t work on mobile, it doesn’t work—period.

Why it’s a big deal:

According to Statista, 58.3% of web traffic in 2025 is mobile. If your mortgage website isn’t mobile-friendly, users will bounce and they’ll bounce fast.

User Experience Issues on Mobile

Pinch-to-zoom needed to read text

Buttons are too small or misaligned

Forms are unusable or cut off on mobile

How to Fix It

- Scales text and buttons

- Adapts layouts fluidly for all devices

- Loads lightning-fast on smartphones

🔧 Pro Tip: Run a Google Mobile-Friendly Test and use real devices to spot issues.

Mistake 2: Having a Slow Website

A delay of just 1 second can reduce conversions by 7%.Mortgage seekers are often stressed, time-sensitive, and multitasking. A slow site sends the message: “We’re not ready for you.”

What causes slow speeds?

Slow websites are often caused by uncompressed images, bloated code, cheap shared hosting, and outdated WordPress themes or plugins

How to Fix It

Compress images with TinyPNG or ShortPixel

Use caching tools and lazy loading

Switch to high-speed hosting (like the GetMortgageWebsite stack offers)

Minimize JavaScript and external scripts

🧠 Example: Sites using GetMortgageWebsite’s stack load 30–50% faster than average WordPress sites with the same content.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

Mistake 3: Weak Calls to Action (CTAs)

Visitors should know what to do within 5 seconds of landing on your page. If they don’t, they’ll bounce.

Common issues:

Poor navigation and unclear menu items like “Services” or “Learn More” confuse users. Key actions like “Apply Now” or “Schedule a Call” are often missing or hidden behind long blocks of text, leading to missed opportunities and lower conversions.

How to Fix It

- Make use of obvious CTA buttons such as “Book Your Consultation” or “Get Pre-Approved.”

- Menus should be kept simple, with no more than three to five top-level items.

- Put calls to action above the fold.

✅ Pro Tip: Platforms like GetMortgageWebsite have built-in, high-converting CTA layouts.

Mistake 4: No Integrated CRM for Lead Follow-up

Capturing a lead is just step one. Following up effectively is what closes the deal.

What goes wrong:

Manual follow-ups often get missed, leaving leads stuck in spreadsheets with no system to track them. Without automated reminders, follow-up calls are easily forgotten, costing you valuable opportunities.

How to Fix It

Automated email/SMS follow-up sequences

Real-time lead notifications

Pipeline tracking from lead to close

📈 Companies using CRM automation see a 15–25% boost in lead conversion rates.

Mistake 5: Poor SEO and No Local Optimization

Most mortgage clients search for help in their area. If your site isn’t optimized for local SEO, you’re invisible.

Symptoms:

If you’re not ranking for “mortgage broker in your city” it could be due to missing a Google My Business profile or having inconsistent Name, Address, and Phone details across platforms. These local SEO gaps make it hard for clients to find and trust you.

How to Fix It

- Add your city/region in titles, H1s, and meta descriptions

- Create a Google Business Profile and collect reviews

- Use local schema markup

Mistake 6: Weak Content and Bland Branding

Users today prefer useful, authentic content over filler.

Content issues to avoid:

Websites with generic headlines like “Your Local Mortgage Experts,” thin or copied content, and no blogs or FAQs often fail to build trust or rank well in search results.

Content that works:

Real testimonials with photos

Video intros or explainer clips

Value-driven blog posts (e.g., “5 Mistakes to Avoid in Your First Home Loan”)

FAQ sections that address common fears and questions

Bonus Tip: Add a 1-minute video introducing yourself. It builds rapport faster than any paragraph ever could.

Miatake 7: Missing Legal Pages and Disclaimers

In the mortgage industry, compliance is mandatory.

What’s often missing:

Missing key pages like a Privacy Policy, Terms of Use, Accessibility Statement, or Fair Lending Disclosures can hurt credibility and may lead to compliance issues, especially in regulated industries like mortgage.

Why it matters:

Required for legal and ethical compliance

Google factors in legal transparency

Builds visitor trust

Solution: GetMortgageWebsite includes these essentials out-of-the-box, tailored for the mortgage industry.

Frequently Asked Questions

Is GetMortgageWebsite only for big agencies?

Not at all. It’s built for individual loan officers, small teams, and large brokers alike—with templates and features for every stage of growth.

Is GetMortgageWebsite good for beginners?

Absolutely. It’s designed for mortgage pros, not tech experts—no coding required and full support included.

Do I need coding skills to fix these issues?

Nope! Everything mentioned here—from mobile optimization to lead automation—can be done without writing a single line of code.

Can these platforms grow with my business?

Yes! Both are scalable whether you’re solo or managing a large team.

Conclusion

Your mortgage website isn’t just an online brochure—it’s your 24/7 salesperson. Avoiding these common mistakes can mean the difference between crickets and a calendar full of qualified appointments. Whether you’re starting fresh or revamping, using tools like GetMortgageWebsite and TheBigBot CRM gives you the edge to convert more leads and grow confidently.

✨ Ready to transform your mortgage website?

Start with a platform that does the heavy lifting for you—and gives your visitors a reason to trust and take action.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.