Mortgage websites are no longer just digital brochures; they’re full-service lending hubs. In 2026, the competition in mortgage lending will be won (or lost) online. Whether you’re an independent broker or a major lender, your website will play a decisive role in how customers find, trust, and choose you.

The digital mortgage experience is being reshaped by AI, hyper-personalization, speed, and user-friendly automation. In this article, we’ll explore the mortgage website trends that every lender should be watching and acting on to stay ahead in a fast-evolving landscape.

Key Takeaways

🚀 AI and automation are transforming how lenders engage visitors and prequalify leads.

🎯 Personalization will become the foundation of online mortgage experiences.

📱 Mobile-first design and speed optimization will define competitive websites.

💬 Conversational tools like chatbots and virtual loan assistants are now must-haves.

🔒 Trust and security signals will drive conversions in a skeptical market.

📈 Data-driven UX decisions will separate industry leaders from laggards.

Understanding the Shift in Mortgage Website Design

The mortgage industry is traditionally slow to adopt tech, but that’s changing fast. In the post-2025 digital economy, consumers expect Amazon-like simplicity even for complex financial products.

According to a 2025 Fintech Insight survey, 82% of borrowers start their mortgage journey online, and nearly 60% abandon sites that feel outdated or confusing. That means your website isn’t just a marketing tool it’s a conversion engine.

Mortgage Website Trends Redefining 2026

AI-Powered Prequalification Tools

Gone are the days of long forms and static calculators. In 2026, AI-driven prequalification systems can analyze credit data, income patterns, and goals in real-time, giving borrowers instant feedback.

Example: Tools like Blend and Maxwell now use predictive AI to suggest loan options within minutes. This builds trust and keeps potential borrowers engaged.

✅ Pro Tip: Embed an AI-powered quiz or pre-approval widget directly on your homepage for instant engagement.

Want to simplify your mortgage journey?

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

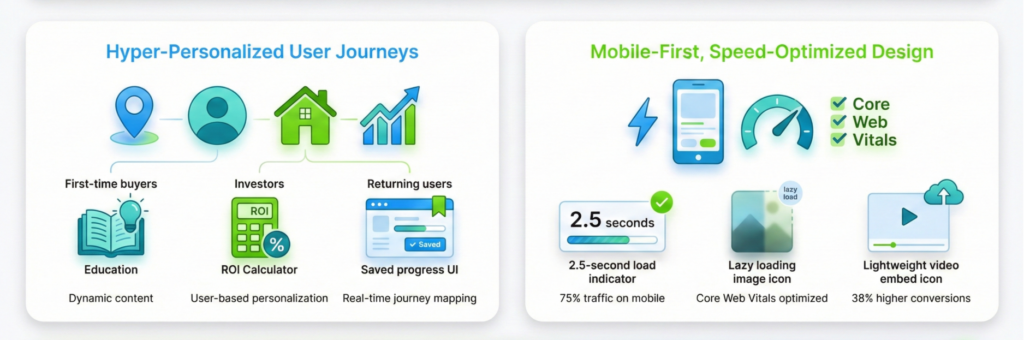

Hyper-Personalized User Journeys

Personalization goes beyond addressing someone by name. In 2026, leading mortgage sites will deliver dynamic content changing based on the user’s location, loan goals, or browsing behavior.

For instance:

- First-time homebuyers see tailored educational guides.

- Real estate investors get tools to calculate ROI.

- Returning users see their pre-saved quotes or application progress.

Mobile-First, Speed-Optimized Design

With over 75% of mortgage searches now on mobile, a sluggish site can kill conversions. Google’s Core Web Vitals remain key ranking factors in 2026, emphasizing page speed, interactivity, and stability.

💡 Optimization checklist:

Use lightweight video embeds

Enable image compression and lazy loading

Minimize scripts and plug-ins

A site that loads in under 2.5 seconds can increase lead conversions by up to 38%, according to HubSpot’s 2025 Web Benchmark Report.

Conversational Chatbots and Virtual Loan Assistants

AI chatbots are no longer gimmicks; they’re digital loan officers.

A smart chatbot can:

- Answer FAQs 24/7

- Schedule appointments

- Start prequalification

- Collect documents securely

These bots, powered by natural language AI, now integrate seamlessly with CRMs like Salesforce and HubSpot.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Data Transparency and Trust Indicators

Trust remains the cornerstone of lending. In a market filled with scams and misinformation, transparency is the new marketing.

2026 websites are adding:

Clear fee disclosures

Real client reviews with verification

Security badges and compliance certifications

Detailed “Meet Our Team” sections with photos and credentials

Seamless CRM Integrations

Modern mortgage websites must talk to your CRM, marketing tools, and compliance systems.

This integration:

- Ensures faster lead follow-up

- Reduces data errors

- Allows automated nurturing campaigns

In 2026, the best mortgage platforms act as end-to-end digital ecosystems, not isolated marketing sites.

How to Apply These Trends

- Audit your site for performance and design.

- Start small with AI tools like automated forms or chatbots.

- Personalize your homepage for each buyer type.

- Use clear visuals and microcopy to explain the process.

- Test, tweak, repeat data will tell you what works.

Emerging Technologies Powering Mortgage Websites

AI & Predictive Analytics

Lenders now use predictive models to forecast borrower intent, offering loan products before customers even ask.

API-Driven Architecture

Open banking APIs allow mortgage sites to securely connect user data, making loan approvals faster and more accurate.

AR & Virtual Property Tours

Some 2026 websites will include virtual walkthroughs that link directly to financing options, bridging real estate and lending like never before.

Frequently Asked Questions

What are the top Mortgage Website Trends in 2026?

AI-driven personalization, automation, mobile optimization, and transparency are the key trends shaping 2026.

How does AI impact mortgage websites?

AI improves lead qualification, chat support, and personalized content delivery, helping boost conversions.

Why is mobile optimization so critical?

Because most users now search and apply for mortgages via smartphones, and Google prioritizes mobile-first sites.

What role does video play on mortgage websites?

Videos explain complex terms visually, build trust, and improve visitor engagement metrics.

How can lenders build trust online?

By showcasing reviews, transparent pricing, security certifications, and real human connections.

Are chatbots necessary for mortgage websites?

Absolutely they provide 24/7 assistance, reduce response time, and enhance user experience.

How can I use SEO for my mortgage website?

Focus on local SEO, long-tail keywords, and conversational queries to capture high-intent leads.

How can lenders use data to improve websites?

Conclusion

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators