What if you could gather dozens of potential homebuyers in one place, answer their biggest questions, and leave them eager to work with you all without leaving your office? That’s exactly what webinars make possible.

In today’s fast-paced digital world, webinars have become a game-changer for mortgage professionals looking to build trust, educate clients, and generate high-quality leads. Whether you’re a loan officer, mortgage broker, or lender, using webinars to educate mortgage clients allows you to position yourself as an industry authority while capturing prospects ready to take action.

In this guide, we’ll explore why webinars work, how to plan and execute them successfully, and how to turn attendees into loyal clients.

Key Takeaways

Webinars are online seminars designed to educate and engage audiences on specific topics.

Mortgage professionals can use them to build trust, provide value, and generate quality leads.

This guide includes step-by-step tips to plan, promote, and host successful webinars.

Studies show businesses using webinars see up to 40% higher lead conversion rates.

You’ll learn how to keep your audience engaged and follow up effectively to close more deals.

What Is a Webinar?

A webinar (short for “web seminar”) is an online event where a host shares information with an audience in real time. Unlike prerecorded videos, webinars are interactive; they allow participants to ask questions, respond to polls, and even join discussions.

For mortgage professionals, webinars are an ideal platform to:

📢 Explain complex mortgage concepts in simple terms

🤝 Build relationships with potential clients and referral partners

📝 Answer common questions from homebuyers or homeowners

🎯 Demonstrate expertise in the mortgage field

Think of a webinar as your virtual stage, where you can educate, inspire, and convert prospects into clients all from the comfort of your office.

Why Mortgage Professionals Should Use Webinars

A Growing Demand for Online Education

Today’s clients want information at their fingertips. According to a recent study, over 60% of consumers prefer online learning to in-person events. For mortgage brokers and loan officers, this means an opportunity to meet clients where they already are online.

Key Benefits of Webinars for Mortgage Businesses

💡 Educate and Empower Clients

Webinars allow you to break down complex mortgage topics into simple, actionable advice. When clients understand the process, they feel more confident making decisions about buying or refinancing a home. This trust in your expertise sets you apart from competitors.

👩💻 Build Authority and Trust

Sharing insights and answering real client questions during a webinar positions you as a knowledgeable, reliable advisor. As you consistently deliver value, your audience will start seeing you as the go-to mortgage professional in your market.

📥 Generate High-Quality Leads

People who register and attend webinars have already expressed interest in your services. These engaged prospects are more likely to convert into clients because they’ve interacted with you and received valuable information upfront.

🔄 Repurpose Content

Webinar recordings are goldmines for content marketing. You can slice them into blog posts, social media snippets, or email campaigns, ensuring your message continues to reach new audiences long after the live event.

🌎 Expand Your Reach

Unlike in-person seminars, webinars aren’t limited by geography. You can educate and connect with potential clients from different cities, states, or even countries, growing your influence and client base dramatically.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

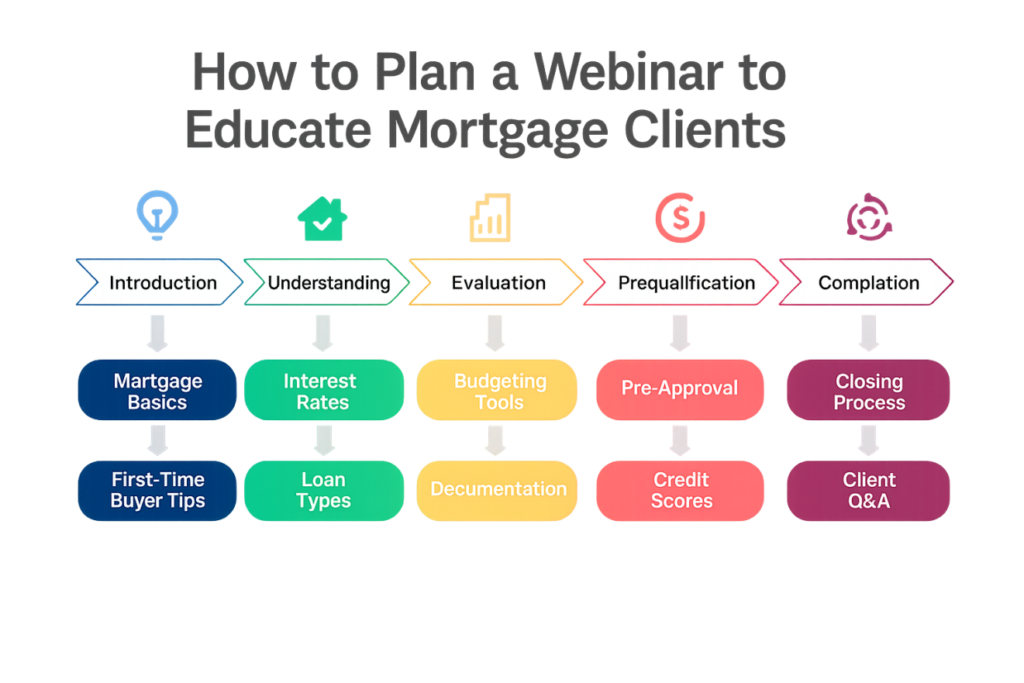

How to Plan a Webinars to Educate Mortgage Clients

🎯 Define Your Objective

Ask yourself: What do you want to achieve?

Do you want to attract first-time homebuyers?

Why Every Loan Officer Needs a High-Converting Mortgage Website

Or are you educating real estate agents to grow your referral network?

📌 Select a Topic That Resonates

Choose subjects that address common client pain points. Here are some ideas:

🏡 First-Time Homebuyer Tips: Navigating the Mortgage Process

💳 Improving Your Credit Score for Better Mortgage Rates

📈What You Need to Know About FHA Loans for First-Time Homebuyers

💼 Understanding Mortgage Options for Self-Employed Borrowers

🔥 Pro Tip: Make your topic relevant and valuable to your audience.

How to Promote Your Webinar Effectively

Use a multi-channel approach to get the word out:

📧 Email Invitations: Reach out to your existing clients and prospects.

📱 Social Media Posts: Share teasers and countdowns on platforms like Facebook and Instagram.

🌐 Website Banners: Add a visible announcement on your homepage.

🤝 Referral Networks: Ask real estate partners to share with their audiences.

💡 Studies show that emails account for 57% of webinar registrations, so don’t skip this step.

Hosting a Successful Webinar

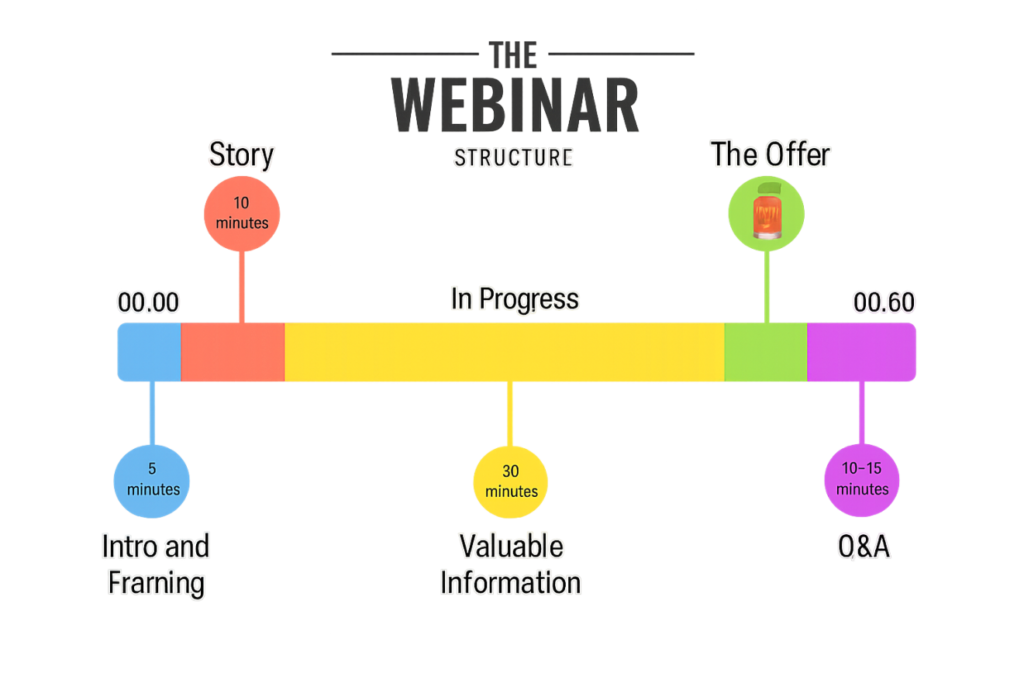

👋 Start Strong with an Engaging Introduction

The first few minutes set the tone for your entire webinar. Start by introducing yourself and sharing why you’re passionate about helping people through the mortgage process. Give a quick overview of what attendees can expect to learn and add a relatable story or client experience to create an instant connection with your audience.

📝 Deliver Clear, Actionable Content

Keep your presentation simple, focused, and packed with value. Break down complex mortgage concepts into easy language, and use real-life examples to make them relatable. Visuals, charts, or even a short client success story can help hold attention and make your key points memorable.

🤝 Encourage Interaction

Webinars aren’t meant to be one-way lectures. Keep your audience engaged by asking thoughtful questions, running live polls to gather opinions, and inviting attendees to share their concerns. Wrap up with an interactive Q&A session to address specific client needs and build even more trust.

Turning Attendees into Leads

Hosting a successful webinar is just the first step. The real magic happens when you turn those interested viewers into actual mortgage clients. Here’s how to make the transition seamless:

📥 Capture Lead Information

Before your webinar even begins, require attendees to register with their name and email address. This simple step not only helps you plan for your audience size but also builds a valuable list of prospects you can nurture later. You can even include optional fields like “Are you planning to buy or refinance in the next 6 months?” to segment your leads and personalize your follow-up.

📧 Follow-Up Like a Pro

Your job isn’t over when the webinar ends. The first 24 hours after your session are critical for keeping the momentum alive:

✅ Send a thank-you email to attendees showing appreciation for their time.

✅ Include a recording of the webinar so they can rewatch or share it with others.

✅ Offer a free consultation, downloadable mortgage guide, or a checklist as an incentive to take the next step.

Ready to Attract More Leads?

Launch your high-performing mortgage website fast no contracts, no hassle.

Frequently Asked Questions

What makes webinars effective for mortgage lead generation?

Webinars let you educate and engage prospects in a personal way, building trust and making them more likely to choose you.

What features should I look for in a mortgage website?

Mobile responsiveness, CRM integration, mortgage calculators, secure hosting, and customizable layouts.

How long should a mortgage webinar be?

Keep it between 30–60 minutes to maintain audience attention.

What topics are best for mortgage webinars?

Focus on client pain points like first-time homebuying, refinancing, or improving credit scores

Do I need technical skills to host a webinar?

Not necessarily. Many platforms offer simple, user-friendly setups.

How soon should I follow up with attendees?

Within 24 hours is ideal for maximum engagement.

What if only a few people attend?

Quality matters more than quantity. Even small webinars can lead to valuable relationships.

Conclusion

Webinars aren’t just another marketing tool—they’re a bridge between your expertise and your clients’ needs. By offering value through education, you build trust, establish authority, and attract high-quality leads who are already warmed up to work with you.

So why wait? Start planning your first webinar today and position your mortgage business for success in a digital-first world.

Book a Strategy Call

Launch your high-performing mortgage website fast no contracts, no hassle.