Imagine this: A first-time homebuyer, excited yet nervous, finally decides to research mortgage options. They find your site through Google, click, and within 8 seconds, they’re gone. Why? Because your site was slow, hard to read on mobile, or didn’t give them a clear next step.

It’s not that they didn’t want a loan. It’s that your website, your digital storefront wasn’t ready to earn their trust. And trust is everything in the mortgage business.

The truth is, even the most skilled loan officers and brokers lose deals every day because their websites unknowingly push people away. But here’s the good news: avoiding common mortgage broker website mistakes is easier than you think, and once fixed, your site becomes a 24/7 lead-generating partner.

Key Takeaways

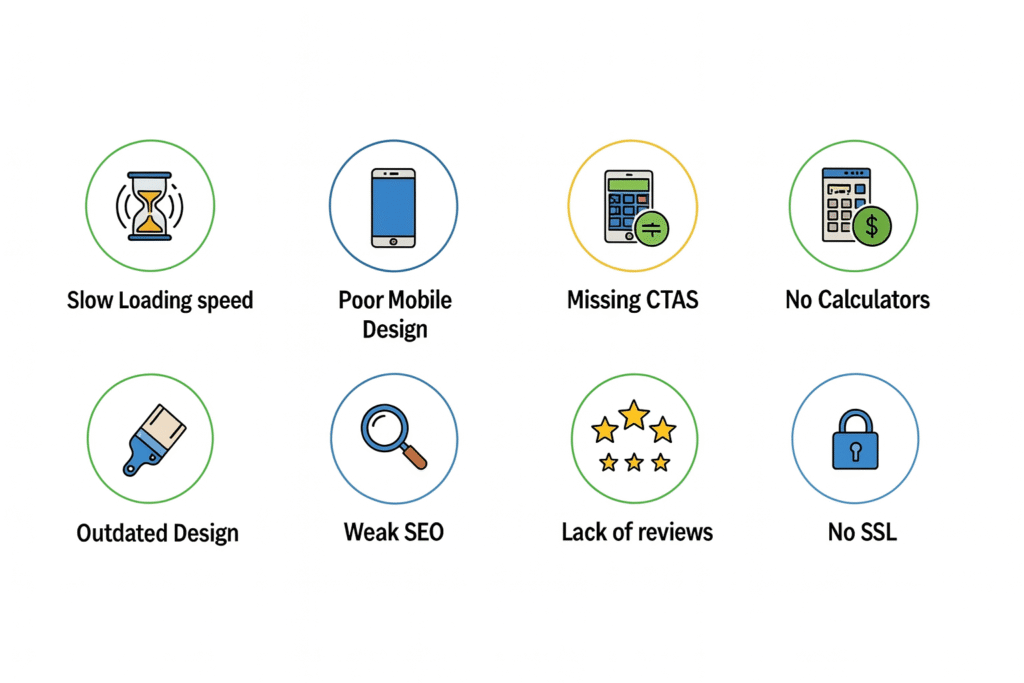

Outdated or poorly designed websites instantly reduce borrower trust.

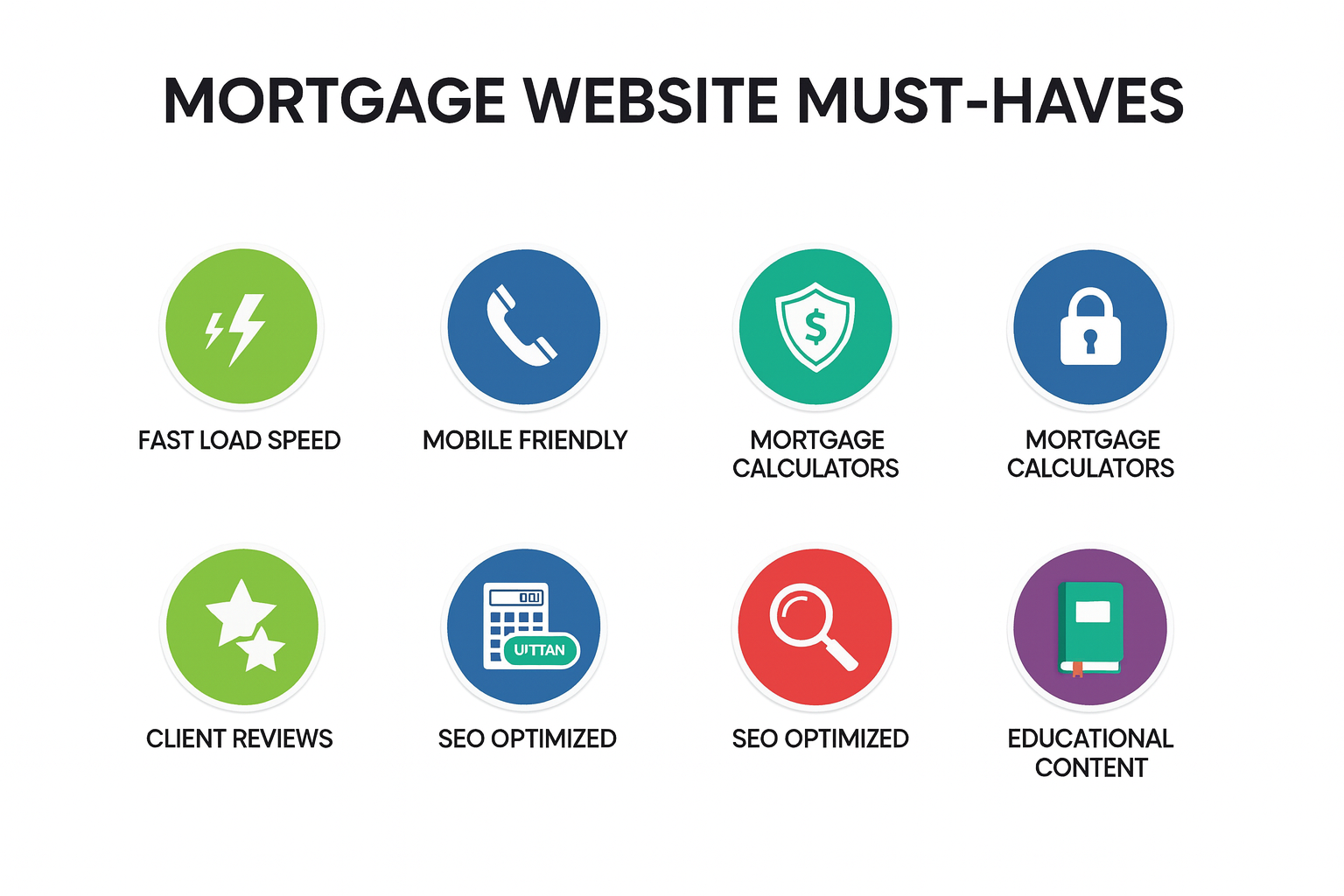

Speed, mobile-friendliness, and user experience are now non-negotiable.

Missing CTAs, calculators, and educational content cost you leads daily.

SEO and credibility signals (reviews, security, content) drive more traffic.

Fixing just a few Mortgage Broker Website Mistakes can transform your pipeline.

Why Your Website Is the Heart of Your Business

Mistake 1: Poor Mobile Experience

Borrowers are busier than ever. According to the National Association of Realtors, 63% of homebuyers start their mortgage research on a mobile device. If your site looks broken on a phone, requires endless pinching and zooming, or loads a desktop layout on a small screen, you’ve already lost them.

💡 Example: A young couple shopping for their first mortgage on an iPhone lands on your site. They can’t find the loan application form because the text is too small and the menu won’t collapse. Instead of fighting with it, they bounce to the next broker.

Fix:

- Choose a mobile-first design platform (like GetMortgageWebsite.com) that automatically adapts to all devices.

- Test your site on multiple phones and tablets.

- Keep forms short and mobile-friendly.

Build Trust Online

Explore tools, calculators, and homebuyer content at GetMortgageWebsite.com.

Mistake 2: Slow Loading Speed

Patience is thin online. Every extra second your site takes to load reduces conversions by 7% (Google data). A slow site makes borrowers question your professionalism.

💡 Example: A borrower clicks your link from Google but stares at a blank loading page for 6 seconds. By second 4, they’re already hitting the back button.

Fix:

Compress images.

Invest in fast, secure hosting.

Regularly check speed using Google PageSpeed Insights.

Mistake 3: Weak or Missing CTAs

Think of your website as a roadmap. If there are no clear directions, visitors wander off. A shocking number of mortgage sites lack clear “Apply Now” or “Schedule a Call” buttons.

Fix:

Add CTAs above the fold (the first section people see).

Repeat them at the end of blog posts and service pages.

Use action verbs: Get Pre-Approved Today, Schedule a Free Consultation.

Mistake 4: No Mortgage Tools

Modern borrowers want interactivity. Mortgage calculators, affordability checkers, and refinance estimators they’re not “extras”; they’re expectations.

💡 Stat: Websites with calculators keep users engaged 2–3x longer than those without.

Fix:

Add at least 2–3 calculators (purchase, refinance, FHA/VA).

Offer downloadable PDFs or comparison charts.

Highlight “Try Our Free Calculator” on your homepage.

Mistake 5: No Content Strategy

A website without content is like a house with no furniture—empty and uninviting. Content is how you educate, attract, and rank in search engines.

💡 Stat: Websites with calculators keep users engaged 2–3x longer than those without.

Fix:

- Blog weekly about home buying tips, loan programs, and mortgage trends.

- Answer common borrower questions (e.g., “Top Digital Marketing Tips”).

- Repurpose blog posts into social media updates and email campaigns.

Mistake 6: No Social Proof

Borrowers don’t just want to hear from you—they want to hear from people like them. Reviews, testimonials, and case studies are critical.

Fix:

- Showcase 5-star Google Reviews directly on your homepage.

- Add video testimonials for extra impact.

- Display borrower success stories in a blog or “Client Stories” section.

Mistake 7: Security Oversights

Borrowers share sensitive data. If your site doesn’t look secure, they won’t risk filling out forms. SSL certificate is most important .

Fix:

Install SSL (so your URL shows HTTPS).

Highlight “Secure Form” or “Protected by SSL” near applications.

Run security audits twice a year.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

What are the top Mortgage Broker Website Mistakes in 2025?

Outdated design, slow speed, missing CTAs, poor SEO, and no calculators.

How much does it cost to fix these mistakes?

Many fixes (like adding CTAs or SSL) are low-cost. Redesigns vary but are an investment in lead generation.

Do I need a blog for SEO?

Yes, consistent content is one of the fastest ways to rank and build authority.

How often should I refresh my website?

Every 2–3 years, or sooner if your site looks dated.

What’s the best hosting option for mortgage websites?

Choose hosting with SSL, backups, and strong uptime (specialized providers are ideal).

Does it support marketing?

Yes, with built-in email, SMS, and drip campaign tools.

Where can I get a mortgage website designed for leads?

GetMortgageWebsite.com specializes in professional, lead-ready mortgage sites.

Can I edit my site without a developer?

Yes—modern platforms allow simple edits and updates.

Conclusion

Skip the Tech Headaches

We handle the website. You focus on loans.

🔒 Secure, backed up, and mortgage calculators