Let’s be honest, scrolling Facebook feels like walking through a digital flea market. Everyone’s trying to sell something. If you’re a loan officer constantly posting “Apply Now!” or “Refinance Today!” ads, you may be missing the mark.

In 2025, your audience is smarter and more selective than ever. They crave value, trust, and real connection. And that’s exactly where the Facebook Strategy Loan Officers Need comes in: stop selling in every ad and start serving instead.

This article will walk you through a more human, effective way to use Facebook to generate mortgage leads without looking like every other sales-hungry lender in their feed.

Key Takeaways

People buy from brands they trust, not from ads that shout.

Facebook’s algorithm rewards engagement, not pushy sales tactics.

Storytelling, education, and community-building outperform hard sells.

The Facebook strategy loan officers need is a value first, brand-building approach.

You’ll learn how to craft posts that connect, educate, and convert without being salesy.

Why Selling in Every Facebook Ad Fails in 2025

In 2025, consumers are smarter than ever. Their digital behavior is shaped by platforms filled with content that entertains, educates, or inspires.

So, when a Facebook ad simply yells “Buy Now,” it’s the equivalent of a pop-up on a peaceful walk. It interrupts. It annoys. And most importantly it gets ignored.

Let’s break it down:

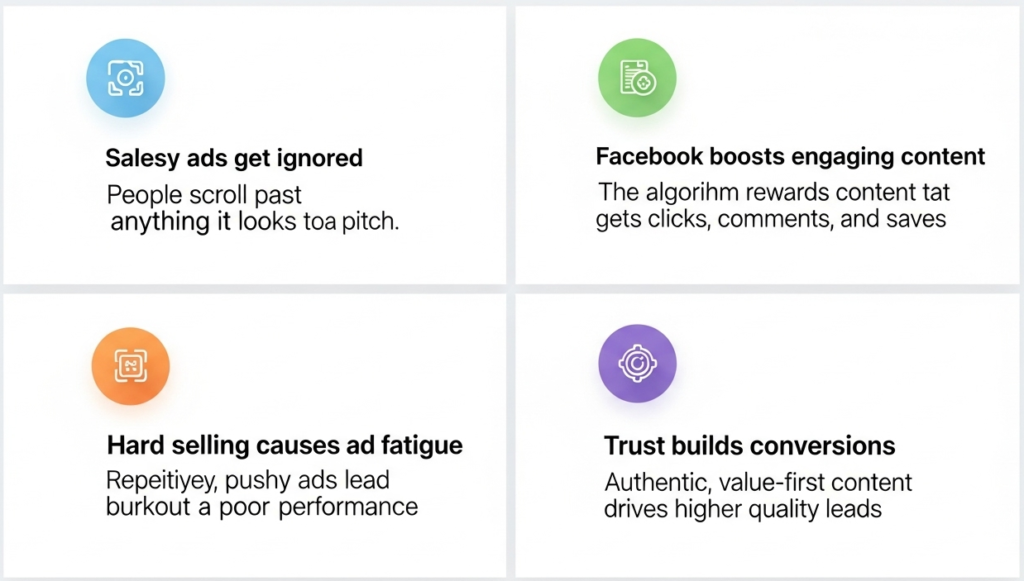

Banner Blindness Is Real

Facebook users have become skilled at mentally filtering out anything that looks like a generic advertisement. When you post another “Lowest Rates Ever!” ad, it blends into the noise.

Engagement Drives Reach

Facebook’s algorithm prioritizes content that generates conversation likes, comments, shares. Salesy posts? They don’t start conversations. They stop them.

The Trust Factor

Mortgage decisions are personal. Deeply personal. People want to work with someone they trust. A timeline filled with pushy ads creates distance, not connection.

🔎 According to Edelman’s Trust Barometer, 81% of people say trust is a deciding factor in their buying decisions even more than price.

What Is the Facebook Strategy Loan Officers Need?

It’s a shift from transactional marketing to transformational marketing.

This strategy focuses on building value, not pushing product. Think of your Facebook presence like a digital dinner party. Would you go around handing everyone your rate sheet? Or would you connect, share stories, and earn their trust?

This value-first approach hinges on three pillars:

Before creating a strategy to use reviews for lead generation, you need to assess where you currently stand.

Educate: Become a trusted advisor by sharing useful, relevant insights.

Engage: Build relationships through storytelling, personal updates, and authenticity.

Empower: Make followers feel confident and informed not pressured.

Ready to Attract More Mortgage Leads?

See how a mobile-first mortgage website CRM can transform your business

Educate Before You Pitch

People come to Facebook to connect and learn not to get sold to. You can still generate business but by leading with value.

Here are some educational post ideas that build authority without selling:

“What’s the difference between FHA and Conventional loans?”

“How credit scores impact your interest rate in 2025”

💡 Tip: Break complex topics into short, digestible nuggets. Use clear language. Avoid jargon.

The more people learn from you, the more likely they are to trust you with their biggest purchase decision.

Share Human Stories That Resonate

People remember stories more than statistics.

Did you recently help a newlywed couple buy their first home? Share it.

Was there a veteran you worked with who almost gave up before you found a solution? Post that.

When you tell true, emotional, human-centered stories, you give your audience something to feel. And emotions drive action.

Here’s a formula to follow:

Situation → Struggle → Solution → Success

📌 Example:

“Last month, I worked with a single mom who was turned down by two lenders. She had a steady income but a complex financial history. After working through her documents carefully, we found a solution and she closed on her dream home just last week. Her smile said it all.”

Be Present, Not Just Promotional

If every time someone sees your name it’s tied to a rate offer or “click here” button, they tune out. Instead, show up in ways that feel real.

Some ideas:

- Share a photo of your workspace or team

- Post a “day in the life” of a loan officer

- Celebrate your clients’ wins

- Talk about industry trends in plain English

- Address common questions you get from clients.

It’s okay to be professional and personal at the same time. People do business with people not logos.

How to Write Facebook Posts That Convert Without Selling

- Hook: Start with a question or bold statement

“Is your credit score the only thing stopping you from buying a home?” - Value: Provide a useful insight or resource

“There are actually multiple programs for buyers with credit below 640.” - Relatability: Share a personal note or client story

“I recently helped a teacher with a 615 score qualify for her first home.” - Call to Action: Use a soft ask

“Curious where you stand? Message me and I’ll run some numbers no pressure.”

Focus on Consistency, Not Perfection

You don’t need to post every day. But you do need to post consistently.

Aim for 3 ,4 quality posts per week. Make them a mix of:

💬 Education

👥 Client stories

📸 Behind-the-scenes

🎥 Short videos or reels

🧠 Quick tips and stats

⚠️ Avoid the trap of thinking you have to be perfect. Authenticity beats polish every time.

Launch Your Mortgage Website Fast

Showcase reviews, capture leads, and grow your business all in one place.

Frequently Asked Questions

What makes this Facebook strategy different from traditional ads?

It focuses on connection and value, rather than selling and shouting. It builds long-term trust with your audience.

How do I build trust through my Facebook posts?

By educating, sharing personal stories, and being transparent about the mortgage process.

Can I show all my reviews in one place?

Yes but it should be no more than 20% of your total content. The other 80% should provide value.

Do reviews help with SEO?

3–4 times per week is ideal. Consistency matters more than frequency.

Should I use emojis and visuals?

Yes! They make your posts more scannable and engaging just don’t overdo it.

How long before I see results?

It can take a few weeks, but the leads you get will be warmer, higher quality, and more likely to convert.

Will this actually get me leads?

Yes when people trust you, they’ll reach out. This strategy nurtures inbound leads over time.

Conclusion

If you’re tired of shouting into the void on Facebook, it’s time to pause, pivot, and try a new approach.

The Facebook Strategy Loan Officers Need isn’t about abandoning sales. It’s about leading with service. It’s about educating before pitching. It’s about being a real person behind the professional title.

Start creating content that informs, inspires, and invites conversation.

Be the guide, not the pusher.

Serve first. The sales will follow.

Take Control of Your Online Reputation

Get a website built to impress and convert.